Vodafone Idea FPO: Is Rs 18,000 crore enough to save a wreckage?

Will the FPO improve the fortunes of VI only in the short-term? Shrinking market share and high debt may make revival challenging, despite network expansion

The fundraising plan, if successful, will allow VI to ramp up its network capex and narrow the gap with peers on 4G coverage and 5G rollouts

Image: Ashish Vaishnav/SOPA Images/LightRocket via Getty Images

The fundraising plan, if successful, will allow VI to ramp up its network capex and narrow the gap with peers on 4G coverage and 5G rollouts

Image: Ashish Vaishnav/SOPA Images/LightRocket via Getty Images

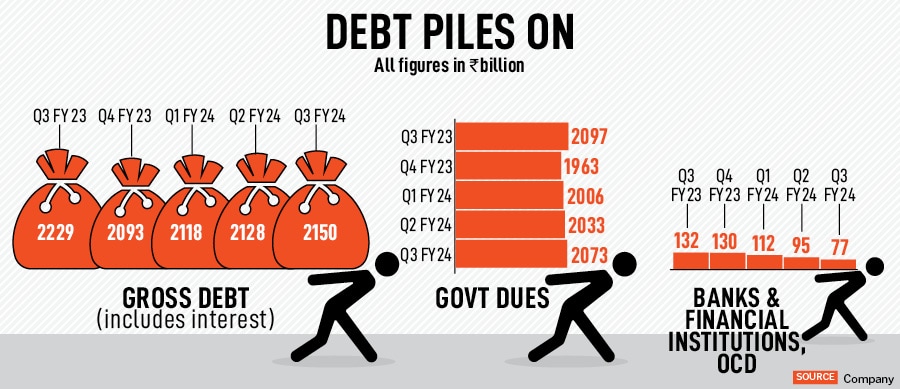

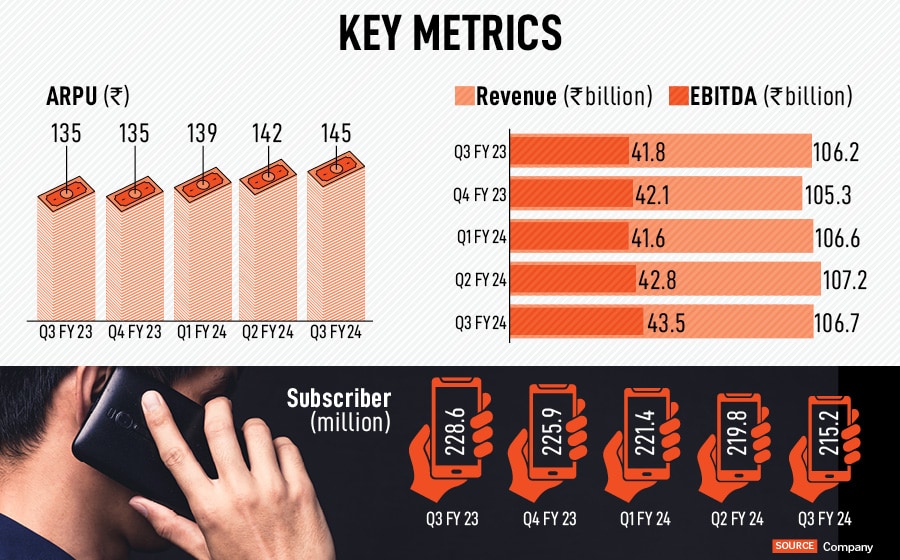

With Vodafone Idea (VI) gradually losing grip of the market, as debt liability piles up, the most essential life saviour is cash, and a lot of cash. But is Rs 18,000 crore enough to revive a cash-strapped VI? Perhaps not. The amount may significantly improve VI’s cash flow position, but it will not be able to save it from facing a cash shortfall.

VI is planning to raise Rs 18,000 crore through a follow-on-offer (FPO). India’s largest FPO will open for subscription from April 18. The sale, which will close on April 22, has set a price band of Rs 10-Rs 11 apiece. At the upper band, the issue is offered at percent discount to the closing price of Rs 13.16 on Monday.

Post issue, Rs 18,000 crore works out to be about 25 percent of the total market cap at Rs 11 per share. Though the stock has seen some momentum in the last few days, based on the revival plan, but overall it has been shaky.

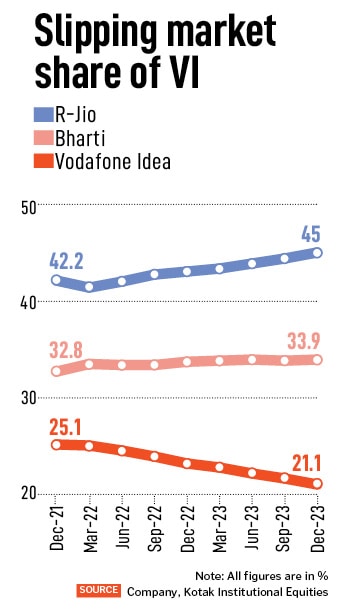

“The FPO may improve VI’s fortune in the short-term, but long-term revival is still contingent on the government,” say Aditya Bansal and Anil Sharma, analysts, Kotak Institutional Equities. They explain that the fundraising plan is a step in the right direction, but it is much delayed. However, the FPO should help in bridging the network coverage gap and improve competitiveness versus peers to some extent.

The fundraising plan, if successful, will allow VI to ramp up its network capex and narrow the gap with peers on 4G coverage and 5G rollouts, but challenges remain. As VI has been battling issues on all fronts, a mere fundraising will not be enough to protect the telco from uncertainties, especially in a business led by two giant rivals Bharti Airtel and Reliance Jio.

The fundraising plan, if successful, will allow VI to ramp up its network capex and narrow the gap with peers on 4G coverage and 5G rollouts, but challenges remain. As VI has been battling issues on all fronts, a mere fundraising will not be enough to protect the telco from uncertainties, especially in a business led by two giant rivals Bharti Airtel and Reliance Jio.