Russian roulette: The F&O trading trap

Playing the risky game of high probability does not necessarily make a winner. The exponential spurt in retail F&O traders is concerning, but also surprising as to what makes the risky bet attractive if traders lose money most of the time. Or is it just a trap?

The market regulator is concerned by the exponential surge of retail traders in the F&O segment, which is considered risky and often loss-making.

Image: Shutterstock

The market regulator is concerned by the exponential surge of retail traders in the F&O segment, which is considered risky and often loss-making.

Image: Shutterstock

Picture being part of a Russian roulette. A bullet is placed in a revolver, the cylinder is spun, someone pulls the trigger, and you are in the line of firing. What are the chances of being killed? Well, the probability of dying is one in six in that random but lethal game of luck. This game of probability is almost exactly what pans out in futures and options (F&O) trading, also referred to as derivatives. High risks and low or no returns have made the equity F&O segment for retail or individual traders a heady cocktail.

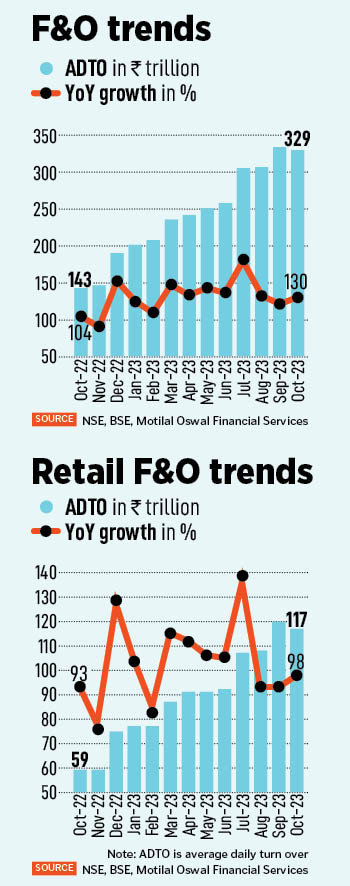

Surprisingly, despite steep losses in equity F&O, the number of retail or individual traders in the segment is ballooning. Derivative trading has stripped cash market volumes with a phenomenal rise in the number of active derivatives traders. In October, the total average daily turnover (ADTO) in the F&O segment was Rs 329 trillion, surging 130 percent from same month last year, at Rs 143 trillion, shows analysis by Motilal Oswal Financial Services, based on data from NSE and BSE. This year so far, ADTO in the F&O segment was the highest in September, at Rs 334 trillion, up 121 percent year-on-year (y-o-y).

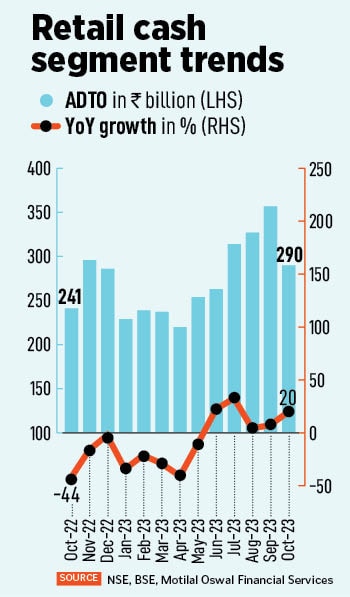

However, the market regulator is concerned by the exponential surge of retail traders in the F&O segment, which is considered risky and often loss-making. In October, retail ADTO in the F&O segment was Rs 117 trillion, rising 98 percent y-o-y, whereas retail ADTO in the cash market was only Rs 290 billion, up merely 20 percent y-o-y. Though retail ADTO in the cash market segment was Rs 357 billion in September, it is comparatively small to the Rs 120 trillion in the F&O segment.

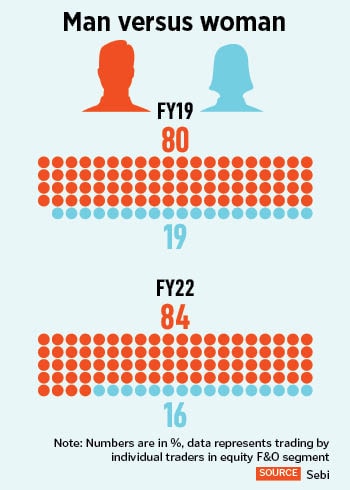

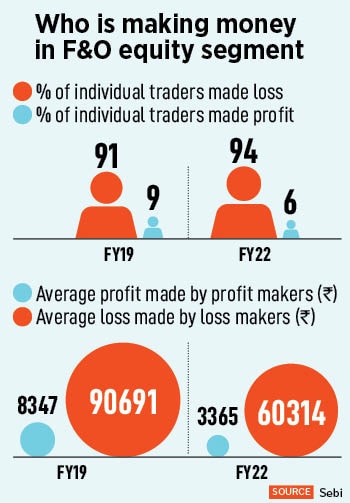

According to a study by the Securities and Exchange Board of India (Sebi), the total number of unique individual traders who traded in the equity F&O segment was 45.2 lakh in FY22, growing from 7.1 lakh in FY19. This is a significant increase of more than 500 percent in FY22 as compared to FY19.

Shorter durations indicate that the options market is shifting from hedging to speculation. The Collins Dictionary defines derivatives as contracts, such as options or futures contracts, whose value is contingent on the value of the underlying securities or commodities. Originally designed as a tool for hedging risk, derivatives are now a tool for taking risk.

Shorter durations indicate that the options market is shifting from hedging to speculation. The Collins Dictionary defines derivatives as contracts, such as options or futures contracts, whose value is contingent on the value of the underlying securities or commodities. Originally designed as a tool for hedging risk, derivatives are now a tool for taking risk.  Also, trading platforms and online brokers like Zerodha and Upstox have helped grow the market, where tools for simulation on F&O strategies is provided to retail investors who never had the chance earlier to dabble in such stuff, which was the exclusive space for institutional players.

Also, trading platforms and online brokers like Zerodha and Upstox have helped grow the market, where tools for simulation on F&O strategies is provided to retail investors who never had the chance earlier to dabble in such stuff, which was the exclusive space for institutional players.  For groups of active traders, on average, loss makers registered net trading loss close to Rs 50,000 in FY22 while average loss of a loss maker was over 15 times the average profit by a profit maker in the same year, shows the Sebi study. The percentage of loss makers was marginally lower at 83 percent for non-active individual traders in FY22, compared to 76 percent in FY19.

For groups of active traders, on average, loss makers registered net trading loss close to Rs 50,000 in FY22 while average loss of a loss maker was over 15 times the average profit by a profit maker in the same year, shows the Sebi study. The percentage of loss makers was marginally lower at 83 percent for non-active individual traders in FY22, compared to 76 percent in FY19. Buch sounded cautious that there is a 90 percent chance of investors losing money in the F&O segment, “but we also know, and the data shows us, that if you take a long-term view of the market, and if you invest with a long-term perspective, you will rarely go wrong”.

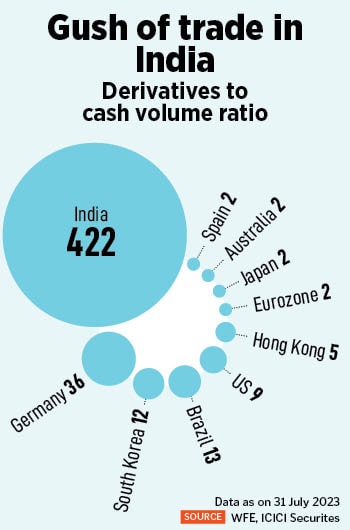

Buch sounded cautious that there is a 90 percent chance of investors losing money in the F&O segment, “but we also know, and the data shows us, that if you take a long-term view of the market, and if you invest with a long-term perspective, you will rarely go wrong”. The growth of the derivatives market is not unique to India. In most markets today derivatives volumes outstrip cash market volumes. In the US, derivatives account for 70 percent of traded volumes, compared to 99.6 percent currently for the Indian markets. A key reason for attractiveness of the product is the embedded leverage, where only a fraction of the notional value is needed to transact, which ends up magnifying the potential gains (as well as losses) for the participant.

The growth of the derivatives market is not unique to India. In most markets today derivatives volumes outstrip cash market volumes. In the US, derivatives account for 70 percent of traded volumes, compared to 99.6 percent currently for the Indian markets. A key reason for attractiveness of the product is the embedded leverage, where only a fraction of the notional value is needed to transact, which ends up magnifying the potential gains (as well as losses) for the participant.