Perfect Match: Why brands love the Indian Premier League

As IPL gets bigger in scale and viewership, marketing tie-ups with the tournament are fetching greater visibility and returns for brands across sectors

Photo - Samuel Rajkumar / Sportzpics for BCCI

Photo - Samuel Rajkumar / Sportzpics for BCCI

There was a time menstrual hygiene startup Niine struggled to extract payment from stockists for nearly 40 days. The brand was nascent, barely visible and was expected to wither away in the face of competition from multinational behemoths like Procter & Gamble (P&G) and Johnson & Johnson (J&J). Not anymore. “Now, all our distributors know what Niine is, markets that didn’t give us shelf space earlier are calling us to place orders, and stockists are paying up within 15 days,” says Sharat Khemka, founder of Niine.

Khemka’s magic wand has been an association with the Indian Premier League (IPL) franchise Rajasthan Royals as its principal sponsor. In September 2020, the three-year-old company tied up with the then-Steve Smith-led team for a logo placement on the back of the jersey. Despite the team ending up at the bottom of the table, Khemka’s business has only gone north since. Following the two-month-long tournament, played in the United Arab Emirates last year due to the Covid surge in India, Niine gained a 3 percent pan-India market share, and upwards of 9 percent in the western state. In its first three years of operations, the company raked in Rs14 crore per month in sanitary napkin sales, while following two months of the IPL, the number shot up to Rs20 crore. “Our competitors like P&G and J&J have now started taking us seriously. There is no better property than IPL to improve a brand’s image,” adds Khemka.

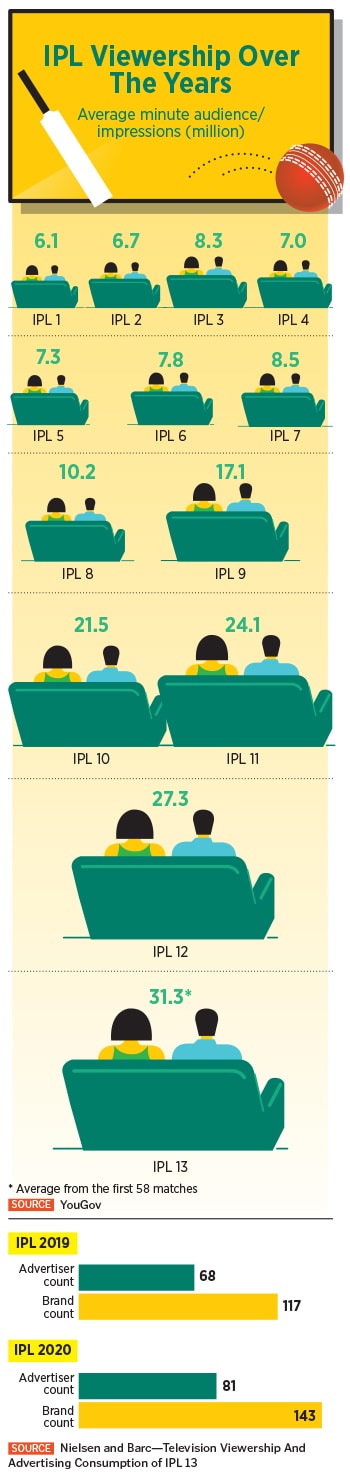

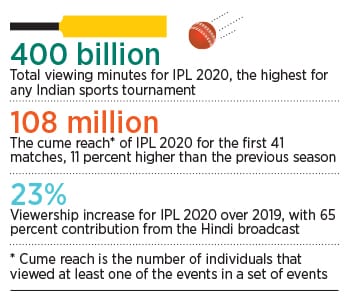

Be it sponsorships (with teams as well as the league) or on-air tie-ups, an IPL association is moving the marketing needle for brands, bringing an uptick in brand awareness among consumers. With 400 billion viewing minutes during its last edition—the largest viewership for an Indian sports tournament—at a time the country was under a house arrest due to the pandemic, it has brought about a visibility windfall for its advertising partners.

2020 title sponsors Dream11, the fantasy league platform which bagged the rights for Rs 222 crore after Vivo stepped away for a year, crossed 100 million in registered users during the tournament. The company that conceptualised six ad films starring MS Dhoni, Rohit Sharma, Rishabh Pant, Hardik Pandya, Shikhar Dhawan and Jasprit Bumrah championing gully cricket, and nine 10-second films goading fans to pick their fantasy teams, experienced a 44.4 percent surge in traffic during the final match as against the 2019 one. “As online fantasy sports is entirely based on live sporting events, it was a good opportunity for us to be visible at different fan touchpoints. Pitch report, toss, giving the ‘Dream11 GameChanger of the Match’ to the cricketer with the most fantasy sports points and so on were some richly organic moments where fans connected and interacted with our brand,” says Vikrant Mudaliar, chief marketing officer, Dream Sports & Dream11. Mudaliar added that they served more than 80 million requests per minute during the tournament.

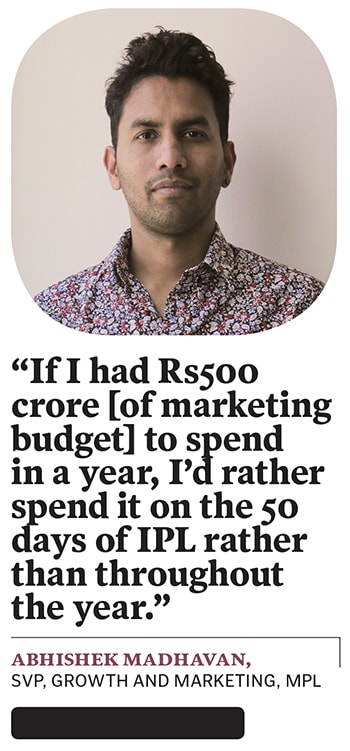

Mobile esports platform MPL not only advertised during the IPL but also sponsored a couple of teams (Kolkata Knight Riders or KKR and Royal Challengers Bangalore or RCB) and signed on RCB captain Virat Kohli as its brand ambassador. “Approximately 30 to 40 percent of our marketing budget was allocated for the IPL. In terms of advertising, we had four to five slots during every match throughout the season,” says Abhishek Madhavan, SVP, growth and marketing, MPL. The returns? MPL’s user base grew 10x through the entire year and between 1.5 and 2 times during the tournament. “We started the year around 40 million users and ended around 70 million, most of the traction came during the IPL,” says Madhavan, who is looking to double his IPL ad spends this year. “If I had Rs500 crore to spend in a year, I’d rather spend it on the 50 days of IPL rather than throughout the year because the amount of viewership it’s able to generate is huge for anyone looking to build a brand.”

Mobile esports platform MPL not only advertised during the IPL but also sponsored a couple of teams (Kolkata Knight Riders or KKR and Royal Challengers Bangalore or RCB) and signed on RCB captain Virat Kohli as its brand ambassador. “Approximately 30 to 40 percent of our marketing budget was allocated for the IPL. In terms of advertising, we had four to five slots during every match throughout the season,” says Abhishek Madhavan, SVP, growth and marketing, MPL. The returns? MPL’s user base grew 10x through the entire year and between 1.5 and 2 times during the tournament. “We started the year around 40 million users and ended around 70 million, most of the traction came during the IPL,” says Madhavan, who is looking to double his IPL ad spends this year. “If I had Rs500 crore to spend in a year, I’d rather spend it on the 50 days of IPL rather than throughout the year because the amount of viewership it’s able to generate is huge for anyone looking to build a brand.”

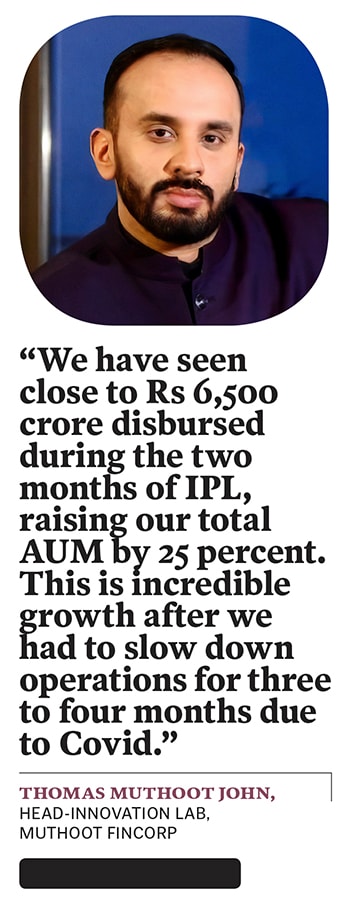

The association brought Muthoot Fincorp a 54 percent spike in brand awareness from its pre-IPL days. “We logged about 140 million digital impressions and received close to 20 lakh inquiries at our branches and call centres during and post-IPL,” says Thomas Muthoot John, head-innovation lab. “We have seen close to Rs 6500 crore disbursed during the two months of IPL, raising our total AUM by 25 percent. This is incredible growth after we had to slow down operations for three to four months due to Covid.”

The association brought Muthoot Fincorp a 54 percent spike in brand awareness from its pre-IPL days. “We logged about 140 million digital impressions and received close to 20 lakh inquiries at our branches and call centres during and post-IPL,” says Thomas Muthoot John, head-innovation lab. “We have seen close to Rs 6500 crore disbursed during the two months of IPL, raising our total AUM by 25 percent. This is incredible growth after we had to slow down operations for three to four months due to Covid.”