Of superheroes and the threat of a global recession

Central bank governors have channeled their powers to protect economies through the pandemic. But will they be able to deal with the fresh challenges posed by the Russia crisis and inflation?

Will the superheroes be able to come to the rescue and avert the impending gloom?

Illustration: Chaitanya Dinesh Surpur

Will the superheroes be able to come to the rescue and avert the impending gloom?

Illustration: Chaitanya Dinesh Surpur

If the unimagined magnitude and devastating harm created by the Covid pandemic were a sci-fi film, then central bank governors would be among the superheroes. After all, much like Captain America or Wonder Woman, hadn’t they channeled untold financial ammunition to protect the global economy from an alien virus that had the world topsy-turvy in deep distress?

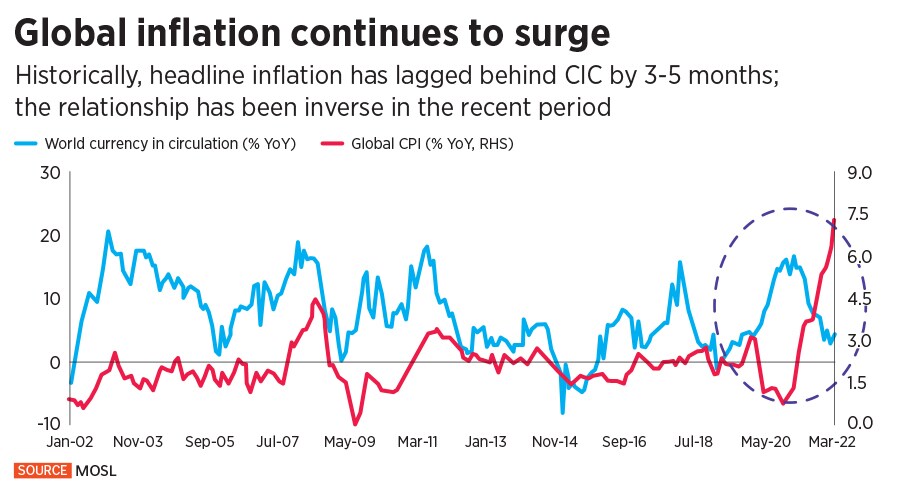

One may even have hoped this sci-fi movie would have a happy ending after the alien virus’s unrelenting onslaughts on life and livelihood over the past two years. But, exhausted, central bank governors now find themselves staring at a familiar, partly self-created, but powerful new enemy: Inflation.

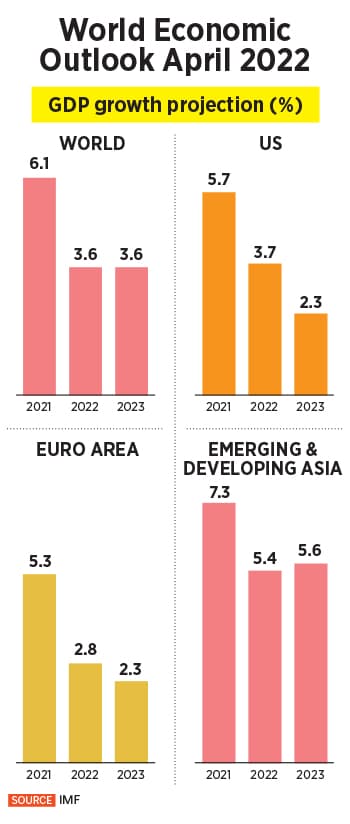

Unfortunately, these superheroes do not have sophisticated bullet-stopping armours and hi-tech mechanisms to dodge or instantly heal from the fierce attack of the new enemy that has strengthened and soared to multi-decadal highs. Now, the world precariously finds itself on the brink of a recession.

Can the superheroes come to the rescue and avert the impending gloom?

Worldwide, food and fuel prices have been inching upwards, stoking a cost-of-living crisis. In turn, central banks have spurred into action to rein in

Worldwide, food and fuel prices have been inching upwards, stoking a cost-of-living crisis. In turn, central banks have spurred into action to rein in