Missing IPOs in a stock rally: When will markets get their mojo back?

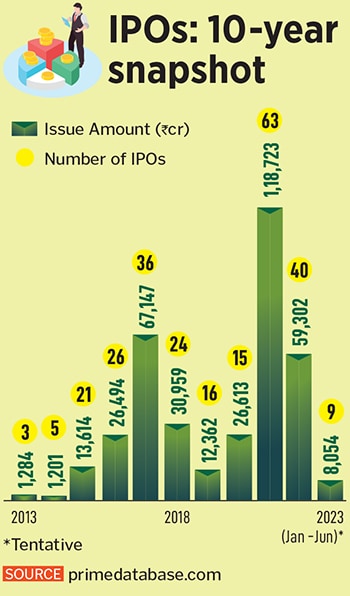

In the last six months, there were only nine IPOs that collectively raised Rs 8,053.64 crore, even when markets are at record highs. Last year, despite markets slipping nearly 9 percent, there were 16 IPOs in the same period. What explains the divergence?

The trend of a drop in the listing of stocks is not taking place in India alone, and is a global phenomenon, as investors are grappling with challenges of macro-economic uncertainties.

Image: Shutterstock

The trend of a drop in the listing of stocks is not taking place in India alone, and is a global phenomenon, as investors are grappling with challenges of macro-economic uncertainties.

Image: Shutterstock

As companies waiting to go public chase liquidity and stock returns, Indian primary markets seem to still be in the slow lane, even when indices are hitting meteoric highs. Does it indicate a lack of confidence or is it simply a valuation conundrum? Well, the trend of a drop in the listing of stocks is not taking place in India alone, and is a global phenomenon, as investors are grappling with challenges of macro-economic uncertainties.

“First of all, the initial public offering [IPO] market is driven by many factors, including macro-economic trends, investor sentiment and business outlook,” explains Raja Lahiri, partner, Grant Thornton Bharat. Global macro trends continue to be challenging, with growth slowing along with continued evolution and tech disruptions. While Indian macro continues to be robust, with strong domestic demand, Indian companies will also have to deal with slowing growth and recessionary trends in global markets, he adds.

Buoyed by liquidity mostly through institutional investors, Indian markets are roaring with gains, hitting record highs in June. Both the benchmark indices, Sensex and Nifty, had hit record highs previously last December, while they have gained nearly 10 percent from the period starting end of March 2023. Typically, companies opt to raise funds in stock markets through IPO listings when the overall secondary market is rising, and investor confidence is exuberant. However, the dry spell in primary markets seems to be lasting a little longer this time.

For instance, in January to June so far, there have been only nine IPOs, which collectively raised Rs 8,053.64 crore, shows a Forbes India analysis of data provided by Prime Database. In contrast, there were 16 IPOs in first six months of last year, which raised Rs 40,310.61 crore. However, overall stock markets were on a decline in that period, with the Sensex falling nearly 9 percent in January-to-June 2022.

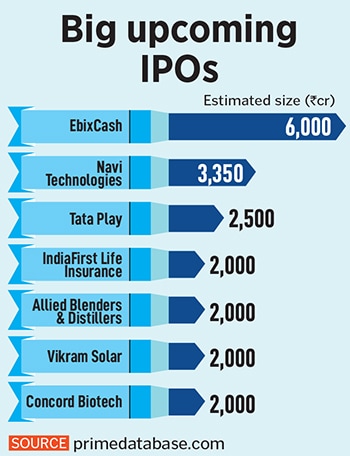

“I don't think the IPO market has dried up at all. Just as in the previous year's last three quarters, there have been select IPOs. And we expect there will be more of the same going forward,” says Venkatraghavan S, managing director, Investment Banking, Equirus. He feels it is not that promoters’ confidence is lagging in fund-raising through the IPO route, it is just a matter of time.

“I don't think the IPO market has dried up at all. Just as in the previous year's last three quarters, there have been select IPOs. And we expect there will be more of the same going forward,” says Venkatraghavan S, managing director, Investment Banking, Equirus. He feels it is not that promoters’ confidence is lagging in fund-raising through the IPO route, it is just a matter of time.

Experts say investors have also grown more vigilant of IPO-bound companies and look for more compelling, convincing and sustainable strategies beyond profitability. “There is sufficient dry powder and investor interest in the market and that’s demonstrated by the strong growth of the Sensex over the last quarter. However, there is investor caution and increased due diligence regarding the quality of companies, especially around business models, profitability etc, and hence the IPO market in 2023 has been slow. This is also in line with global IPO trends, which are witnessing slowdowns as well,” Lahiri adds.

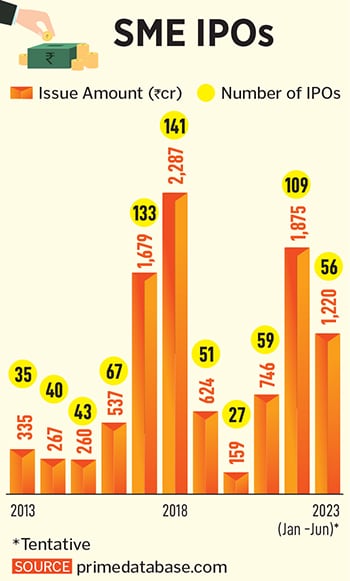

Experts say investors have also grown more vigilant of IPO-bound companies and look for more compelling, convincing and sustainable strategies beyond profitability. “There is sufficient dry powder and investor interest in the market and that’s demonstrated by the strong growth of the Sensex over the last quarter. However, there is investor caution and increased due diligence regarding the quality of companies, especially around business models, profitability etc, and hence the IPO market in 2023 has been slow. This is also in line with global IPO trends, which are witnessing slowdowns as well,” Lahiri adds. There has been brisk fund-raising via SME IPOs in the January-to-June period, even as the main board IPO segment has been slowing down. Since the beginning of January, there were 56 listings in the SME IPO segment, which have collectively raised Rs 1,219.99 crore, according to Prime Database.

There has been brisk fund-raising via SME IPOs in the January-to-June period, even as the main board IPO segment has been slowing down. Since the beginning of January, there were 56 listings in the SME IPO segment, which have collectively raised Rs 1,219.99 crore, according to Prime Database.