Meet the accidental venture capitalist fuelling India's D2C boom

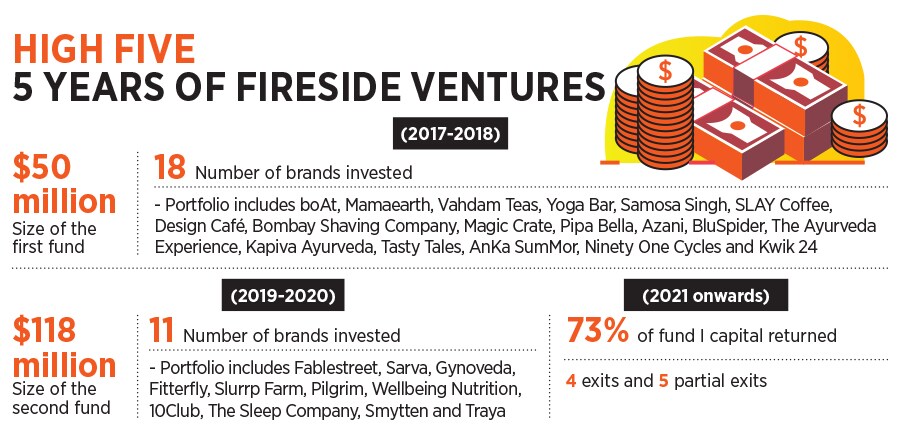

Kanwaljit Singh has been relentlessly stoking the direct-to-consumer fire in India. Can his Fireside Ventures stay fired up?

Image: Hemant Mishra for Forbes India Kanwaljit Singh, founder & managing partner, Fireside Ventures

Kanwaljit Singh, founder & managing partner, Fireside Ventures

Bengaluru, October, 2014.

There were quite a few suitors aggressively wooing PC Musthafa. And why not? Nine years after turning entrepreneur in 2005—when he co-founded iD Fresh Food with his cousins Shamsudeen TK, Abdul Nazer, Jafar TK and Noushad TA—Musthafa had finally relented to ‘marry’. In 2014, the ready-to-cook fresh food brand, more known for idly and dosa batter, had reached a decent scale of operations and was reportedly clocking Rs7 crore monthly sales across eight cities. For Musthafa, it was the right time to start a new innings.

There was a problem, though. The ‘bride-to-be’ was much older than Mustafa. But the age did not matter to him. “I was ‘marrying’ one of the best marketing minds in the world,” recalls the IIM Bangalore alum. There was another small problem. “The ‘bride’ had a beard”, laughs Musthafa. He soon got to know of a third problem: The ‘bride’ was planning to call it quits.

The news was broken by Kanwaljit Singh, co-founder and senior managing director of Helion Venture Partners. Just a few hours ahead of signing the term sheet for iD’s maiden institutional funding by Helion, Singh took Musthafa out for lunch. “I am leaving Helion,” he said. Musthafa was shocked. “You can’t do this,” he gasped, still reeling under the shock. Among all the investment proposals, Helion’s offer was at the bottom of the heap. “It was the least valued offer,” he recalls. The only reason Musthafa went ahead with the ‘marriage’ was Singh, who was now quitting.

The meeting started at The Oberoi in Gurugram. While Varun did his best to hide his nerves, Ghazal, who had earlier founded Dietexpert, a startup customising diet plans, talked passionately about the products that the yet-to-be-born venture would make. After 30 minutes came a two-word reply. “Theek hai (okay),” said Singh. “I am in.”

The meeting started at The Oberoi in Gurugram. While Varun did his best to hide his nerves, Ghazal, who had earlier founded Dietexpert, a startup customising diet plans, talked passionately about the products that the yet-to-be-born venture would make. After 30 minutes came a two-word reply. “Theek hai (okay),” said Singh. “I am in.” What also changed was the way Singh moulded Fireside. Though instinctive bets still formed the core, investments got more structured and methodical. The founders now pitching to an institutional investor like Fireside, explains Singh, need to play in a large market that can be disrupted.

What also changed was the way Singh moulded Fireside. Though instinctive bets still formed the core, investments got more structured and methodical. The founders now pitching to an institutional investor like Fireside, explains Singh, need to play in a large market that can be disrupted.