Liquidity risks or valuations: What's boiling in mid and smallcap stocks?

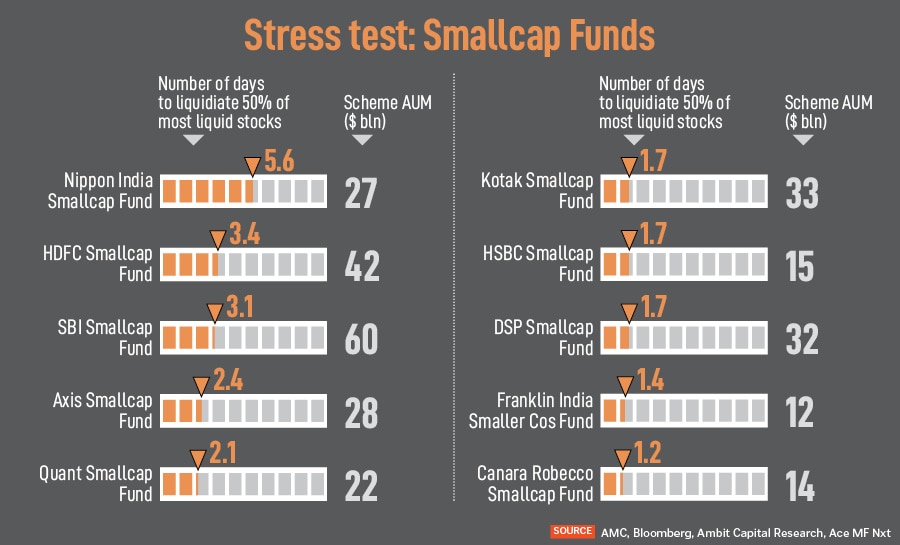

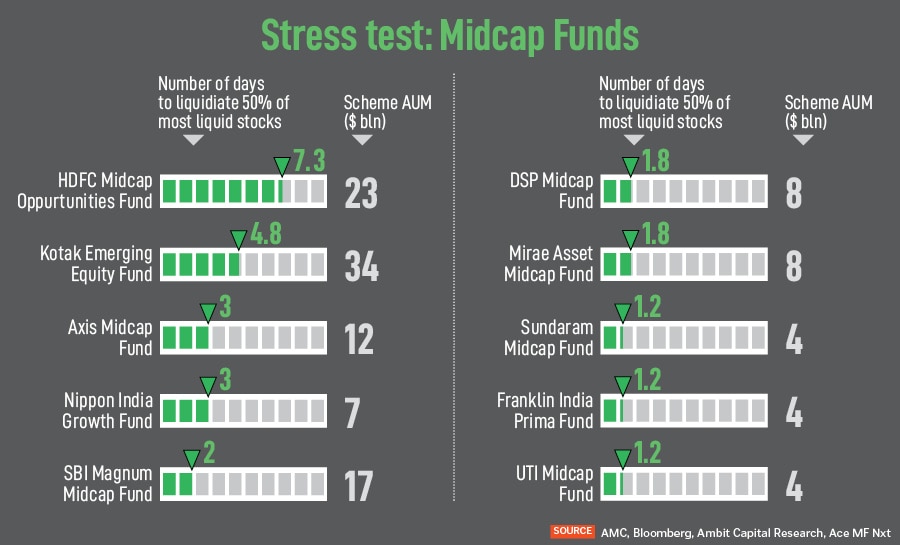

The bull run in mid and smallcap stocks made valuations expensive, trigging a liquidity risk concern. But has a deeper cut in mid and smallcap stocks been avoided by the stress tests in mutual fund schemes?

Despite the corrections in these stocks, analysts find valuations in mid and smallcap stocks to be still expensive and therefore, risky.

Image: Shailesh Andrade / Reuters

Despite the corrections in these stocks, analysts find valuations in mid and smallcap stocks to be still expensive and therefore, risky.

Image: Shailesh Andrade / Reuters

For investors in smaller stocks in equity markets, it is usually ‘make hay while the sun shines’. The confetti rain lasts until a crisis blows up the party. A fast-paced bull run in mid and smallcaps attracts more investors, thus gulping more liquidity and heating up valuations to a point that it creates a bubble. But if it is a bubble, it will burst, which gradually sparks off a massive selling spree in these stocks.

This is exactly what is brewing in mid and smallcaps in the last few months, ringing in similarities of what panned out in 2018. However, this time markets regulator, the Securities and Exchange Board of India (Sebi), intervened before the euphoria turned into a catastrophe. The possibility of a deeper cut in mid and smallcap stocks appear to have been avoided, at least for now, with Sebi’s nudge and mutual fund schemes stress testing their exposure in mid and smallcaps.

The Nifty Midcap 100 index and the Nifty Smallcap 100 index are down 5 percent and 10 percent, respectively, in the past one month. However, both Nifty Midcap and Nifty Smallcap are still higher by 5 percent and 58 percent, respectively, in the past one year. In fact, about 61 percent of midcap and 63 percent of smallcap stocks have given more than 30 percent returns in the past year even as the bulk of the midcap and smallcap stocks have given negative returns in the past one month, shows a Kotak Institutional Equities analysis.

Despite the corrections in these stocks, analysts find valuations in mid and smallcap stocks to be still expensive and therefore, risky.

“Most mid and smallcap stocks are still trading at full-to-lofty valuations and well above their fundamental value despite the sharp correction in recent weeks. We are not sure if the correction marks a reversal of the market to fundamentals and numbers from sentiment and narratives. If it is the former, many low-quality stocks may still have a long way to fall,” says Sanjeev Prasad, co-head, Kotak Institutional Equities.