How The Good Glamm Group is building a content-to-commerce behemoth

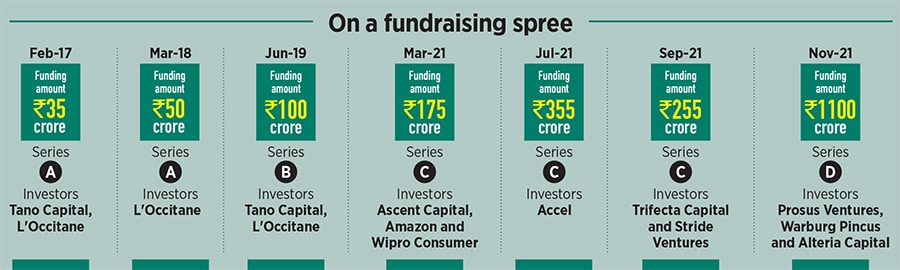

The conglomerate has acquired 11 companies and raised $250 million over the last year. Now with its move into the international market, a revamped organisation structure and a potential deal with Raymond's consumer care portfolio, can it sustain in the long run?

(from Left) Naiyya Saggi, Co-Founder, Good Glamm Group; founder & CEO, BabyChakra; Darpan Sanghvi, founder & group CEO, Good Glamm Group; founder & CEO, MyGlamm and Priyanka Gill, co-Founder, Good Glamm Group, founder & CEO, POPxo & Plixxo

(from Left) Naiyya Saggi, Co-Founder, Good Glamm Group; founder & CEO, BabyChakra; Darpan Sanghvi, founder & group CEO, Good Glamm Group; founder & CEO, MyGlamm and Priyanka Gill, co-Founder, Good Glamm Group, founder & CEO, POPxo & Plixxo

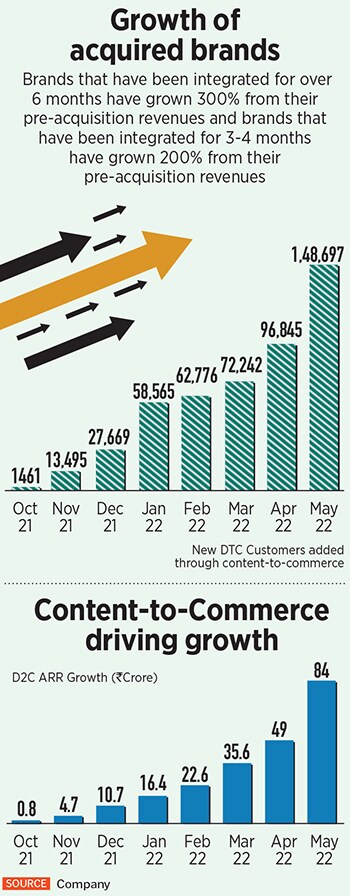

Over the last year, The Good Glamm Group has been on an acquisition spree with 11 acquisitions. On July 6, the content-to-commerce conglomerate announced the launch of its international division and overall group structure to build revenue synergies from all its acquisitions.

The group has now been divided into three core segments—Good Brands Co, comprising all its DTC beauty and personal care brands; Good Media Co, which will look at all its digital media brands and influencer platform Good Creator Co. “We are consolidating the overall structure of the group to reflect our content-creator-commerce strategy. The core functions are being integrated between companies in each division which has led to efficiencies and removes duplication,” says Priyanka Gill, co-Founder, The Good Glamm Group.

Each of these verticals have their own metrics and very different objectives—but are interconnected in their way of functioning. Good Brands Co is the revenue driver, with a focus on acquiring more customers and generating revenue in a cost-effective way; Good Media Co will focus on digital reach and engagement and Good Creator Co will help influencers make money, of which the company takes a commission.

The second major announcement of setting up an international division for Good Brands Co—which will be led by Asad Raza Khan, global commercial officer—was always part of the core team’s long-term vision. “The international division gives Good Brands Co an opportunity for global growth. We aspire to build our brands across offline channels, e-marketplaces, and DTC via leveraging the growth and digital marketing capabilities of the group already in place,” says Khan.

The group is also in talks with the Raymond Group for an acquisition of its consumer care portfolio—Park Avenue and Kamasutra, stated a source with information on this deal. If this deal closes, it will be The Good Glamm Group’s entry into the grooming and sexual wellness segment. The deal has been in talks for a while, it is being renegotiated, and as per the current market situation Good Glamm is looking at a deal size of Rs 2,000 crore for the acquisition.

As the group grew, the strategy for the business, Gill says, “was increasing our top of the funnel user

As the group grew, the strategy for the business, Gill says, “was increasing our top of the funnel user  “On the brand’s growth, we were already present at 5,000 stores and, by the end of this year, we will be present at 25,000 stores. Our DTC website is already 3X of what we were pre-acquisition and that continues to grow at a very fast pace,” says Malika Sadani, founder and CEO, The Moms Co, which was acquired by the Group in October 2021.

“On the brand’s growth, we were already present at 5,000 stores and, by the end of this year, we will be present at 25,000 stores. Our DTC website is already 3X of what we were pre-acquisition and that continues to grow at a very fast pace,” says Malika Sadani, founder and CEO, The Moms Co, which was acquired by the Group in October 2021.