Buoyed by strong IPO response, ideaForge Technology eyes scalable and profitable growth

The unmanned aircraft systems manufacturer saw its issue subscribed 50.3 times in three days; the company plans to use the capital to expand globally and invest in R&D

(L-R) Rahul Singh, VP - Engineering and Whole Time Director; Ankit Mehta, CEO, Ashish Bhat, VP - R&D and Vipul Joshi, CFO; Photo courtesy: ideaForge

(L-R) Rahul Singh, VP - Engineering and Whole Time Director; Ankit Mehta, CEO, Ashish Bhat, VP - R&D and Vipul Joshi, CFO; Photo courtesy: ideaForge

ideaForge Technology has been witnessing a strong response from investors for its Rs567-crore initial public offering (IPO) since the issue opened for subscription on June 26. The issue subscribed 50.3 times by the afternoon of June 28. The unmanned aircraft systems (UAS) manufacturer has announced to sell its shares in the price range of Rs638-672 per share.

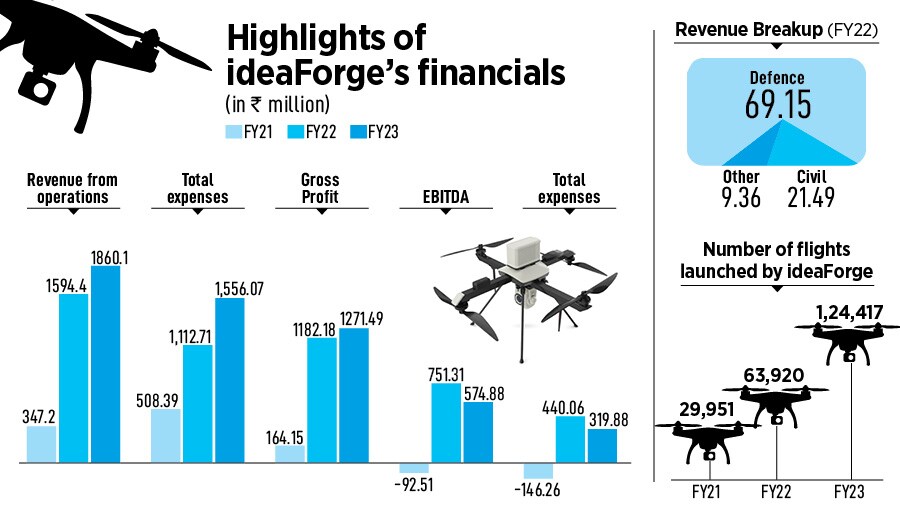

In 2005, three IIT-Bombay students—Ankit Mehta, Rahul Singh and Ashish Bhat—started experimenting with aerial robotics. Eventually, the trio came together to incorporate ideaForge Technology in 2007. Today, it is one of the largest UAS manufacturers in the country. From FY21 to FY23, the company’s revenue jumped from Rs347.18 million to Rs1,860.07 million.

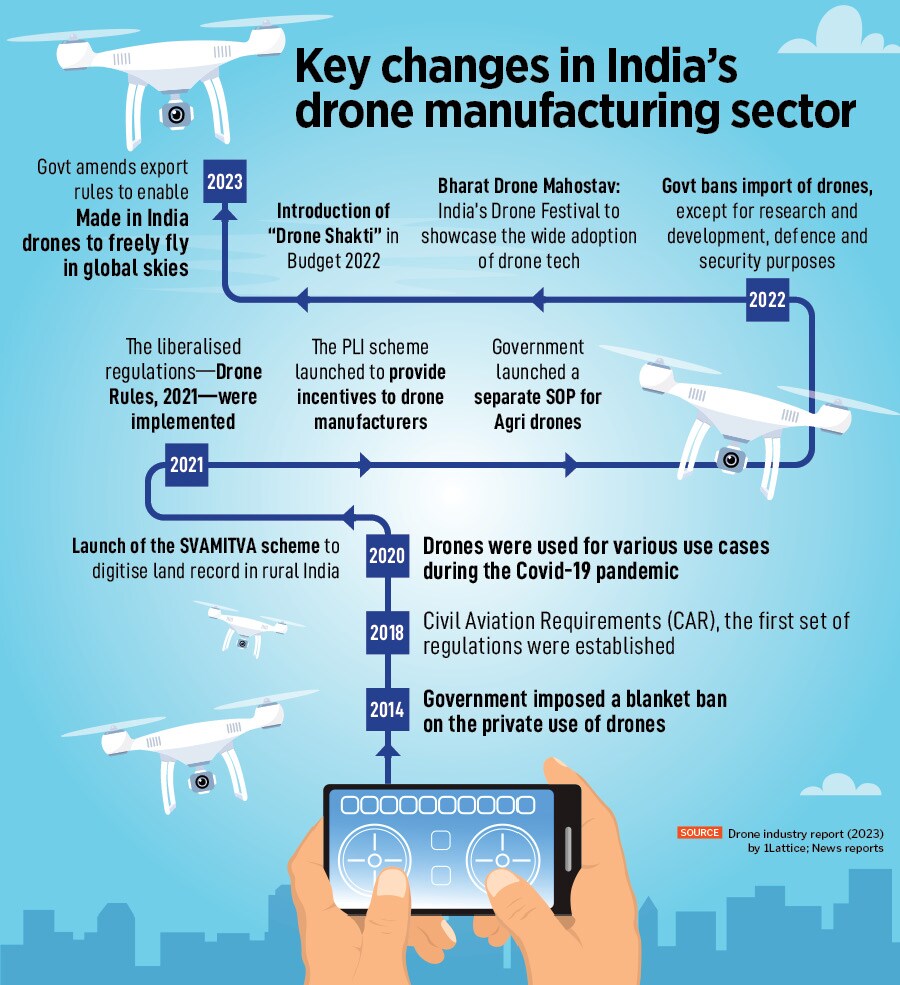

Mehta, co-founder and CEO of ideaForge, credits this growth to policy changes for the sector. The company sells drones in two main categories—Mapping and Surveying (Civil) and Security and Surveillance (Defence). A majority of its revenue was from defence: Close to 69 percent in FY23. But civil is a fast-growing category that experts reckon will help garner higher growth and revenue for the company. ideaForge’s clients include all Indian defence forces, central armed police forces, many state police forces, several government departments and large private enterprises.

The drone-maker has a 50 percent market share in the Indian UAS market. With plans to expand globally, and continue R&D, ideaForge felt the need to raise more capital. "We felt that an IPO was a better option compared to private capital," Mehta tells Forbes India during a telephonic interview. ideaForge has reserved 75 percent shares for qualified institutional buyers (QIB), 15 percent for high net-worth individuals (HNI) and 10 percent for retail investors. According to the red herring prospectus (RHP), Rs40 crore is expected to be used for product development, Rs135 crore in working capital and Rs50 crore as debt repayment.

Celesta Capital first invested in ideaForge in 2016 because they saw a clear alignment of demand for drone technology in India’s defence and enterprise markets, and a significant gap in the market to meet this need. With the defence market, particularly, ‘Make in India’ drones started getting a big push. “Given the perceived risks associated with imported drones, we recognised the urgent need for domestically manufactured ones, which could help to quickly position ideaForge as a key player in the market with the advanced capabilities they were developing,” explains Gani Subramaniam, senior partner at Celesta Capital.