Alembic Pharma: Shaking Things Up

With a legacy of over 100 years, Alembic Pharma's fourth generation Pranav and Shaunak Amin are running the show with an innovation-led approach

(From left) Chirayu Amin is chairman while son Pranav Amin is managing director, international business at Alembic Pharmaceuticals Limited; Image: Mexy Xavier

(From left) Chirayu Amin is chairman while son Pranav Amin is managing director, international business at Alembic Pharmaceuticals Limited; Image: Mexy Xavier

Vadodara, Gujarat. Alembic City, home to the Alembic Group, is a lush mini city spread across 200 acres. The Group has a rich history dating back more than 110 years, with this campus at the centre of all its innovations. Back then, this ‘city’ had practically everything on-campus, from a school to a bakery, and the focus was to be self-reliant. Over the years, much like their business, the many generations of Amins have preserved and reinvented a lot of the campus. For instance, what was once a distillery, is now a space for various events.

A company with a glorious past of nation-building through focusing on manufacturing indigenously and led by technocrat-innovators—rather than growth-obsessed leaders—suddenly found itself in the midst of a fresh bunch of competitors who emerged post-economic liberalisation.

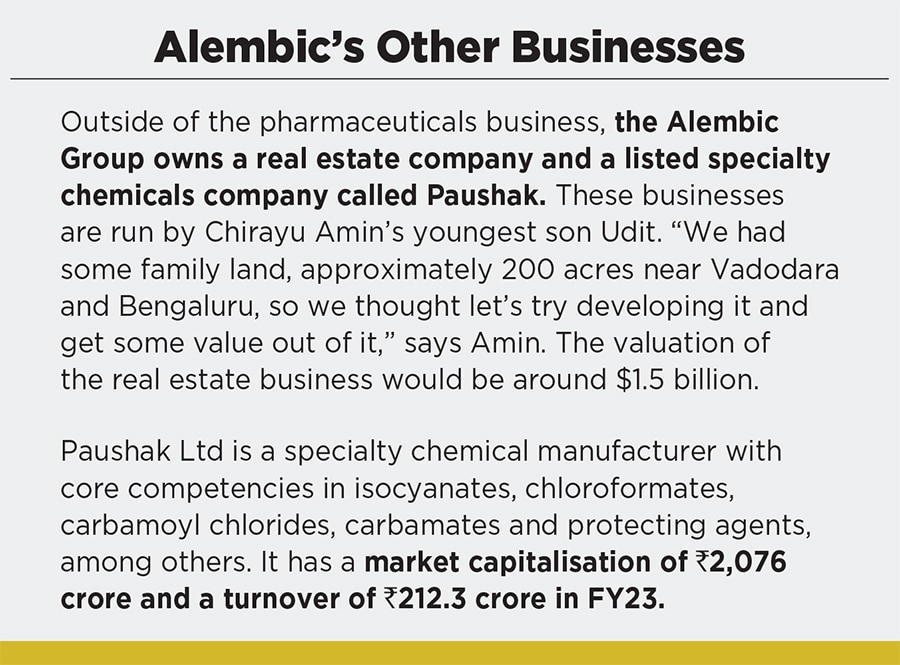

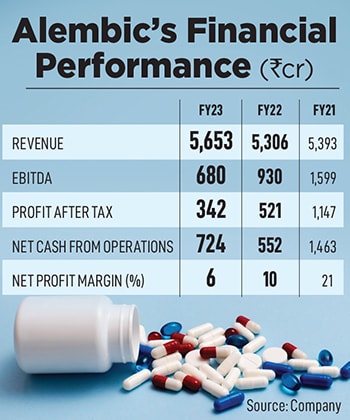

The Alembic Group started off by manufacturing alcohol in 1907 under the name Alembic Chemical Works. Later, when Ramanbhai B Amin—son of one of the founders BD Amin—joined the business, he expanded Alembic further. Amin’s mindset was ‘what can we bring that India doesn’t have?’ That’s what led to the manufacturing of antibiotics such as penicillin, cough syrups like Glycodin, bulk manufacturing of vitamin B12, and much more. As Alembic grew, the technocrat’s focus was on trying to be indigenous and building everything in-house. For instance, glass bottles for the cough syrups were being imported which made Amin think: Why not manufacture the bottles in-house? This led to Alembic Glass Industries in 1943. Eventually, the Amins diversified into engineering, fabricator units, agri-businesses and a lot more.

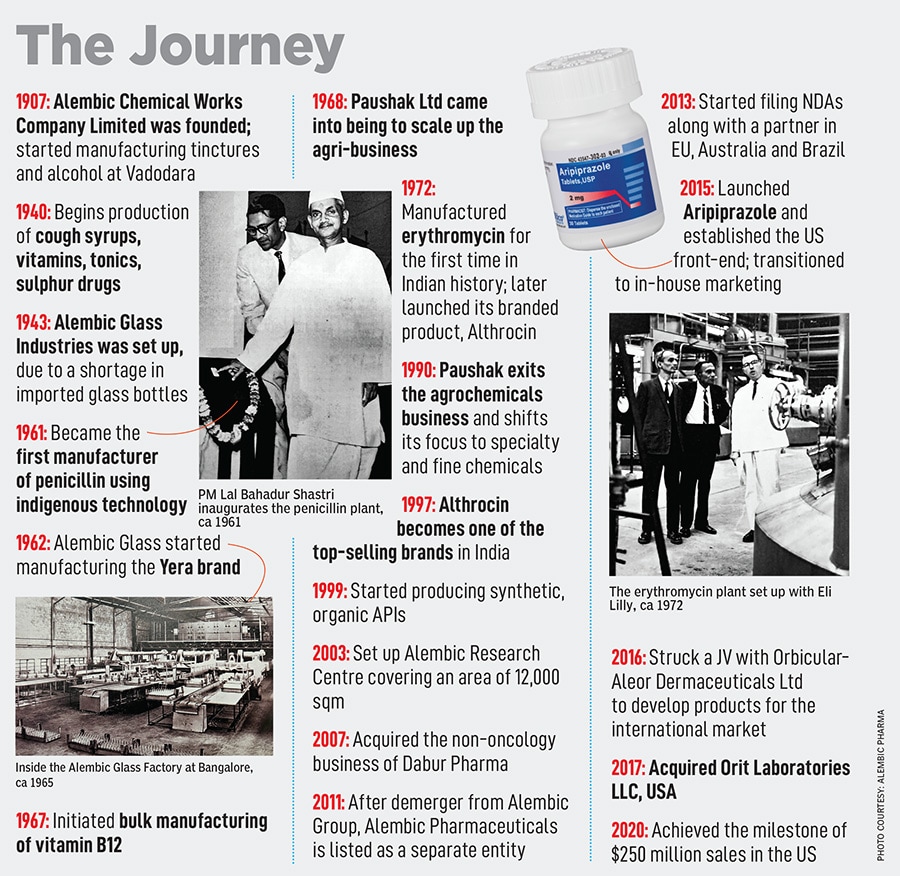

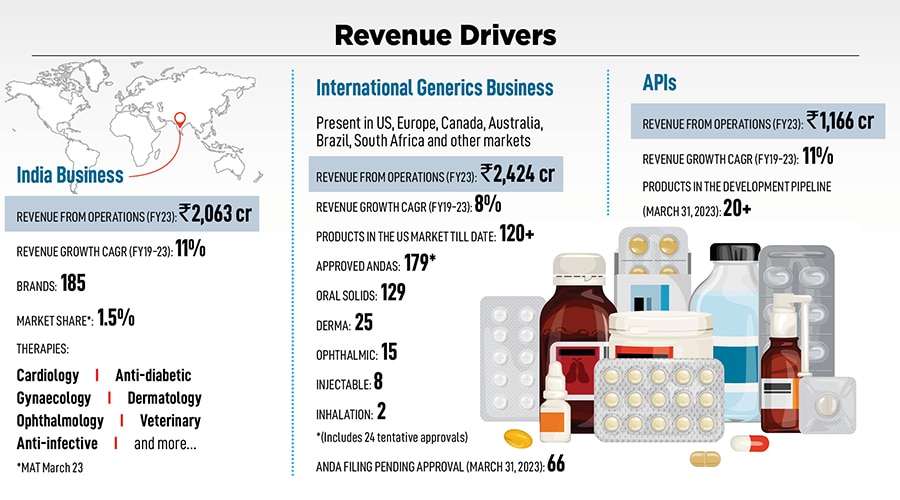

Today, Alembic’s pharma division remains at the core, and the fourth generation—Pranav and Shaunak Amin—drive the business. Despite being late in refreshing their Indian and international product portfolios, the siblings have grown Alembic Pharma into a formidable Rs 5,653 crore business, with a market capitalisation of Rs 15,036 crore.

Early opportunities

Over the years, a lot of these verticals were shut, but the pharma business remained strong. “At the time, the domestic market was our main focus and we were trying to produce molecules under the patent laws of that time. Our fight was with the multinationals mainly, but now they are pretty insignificant; the Indian industry gave them a good run for their money,” says Chirayu Amin (77), chairman and CEO.

With a Rs 3,570-crore international business, Pranav has been a stickler for compliance. But why do Indian companies get pulled up often by the US FDA? “High attrition at the grassroots is one main reason. When the manufacturing team keeps changing it gets challenging. Attrition is often at 30 to 40 percent, so we’re trying to control it,” says Pranav. Alembic holds regular workshops with team members across levels—from senior team members to the grassroots—to ensure all regulations are followed. “Even the FDA has been increasing its benchmarks over the years. Every time a peer is pulled up by the US FDA we study what went wrong to understand what we can do better and stay ahead of the game,” he adds. This obsession over compliance measures probably has the company better placed as opposed to many of their rivals, who might’ve grown faster but at the cost of quality and inviting the regulator’s rap.

With a Rs 3,570-crore international business, Pranav has been a stickler for compliance. But why do Indian companies get pulled up often by the US FDA? “High attrition at the grassroots is one main reason. When the manufacturing team keeps changing it gets challenging. Attrition is often at 30 to 40 percent, so we’re trying to control it,” says Pranav. Alembic holds regular workshops with team members across levels—from senior team members to the grassroots—to ensure all regulations are followed. “Even the FDA has been increasing its benchmarks over the years. Every time a peer is pulled up by the US FDA we study what went wrong to understand what we can do better and stay ahead of the game,” he adds. This obsession over compliance measures probably has the company better placed as opposed to many of their rivals, who might’ve grown faster but at the cost of quality and inviting the regulator’s rap.