Emami Ltd: Mover & shaker

FMCG major Emami Ltd has taken its products deep into the hinterland by roping in Bollywood stars as brand ambassadors, and has grown through domestic and foreign acquisitions. Consequently, it remains a market leader in niche products

In business, sir, one has no friends, only correspondents,” wrote Alexander Dumas in The Count of Monte Cristo. Yet, it is this seemingly immutable law of business that Radhe Shyam Agarwal and Radhe Shyam Goenka, founders of Indian FMCG major Emami Limited, have defied. They have been childhood friends and then business partners for over 40 years. Initially opting for corporate careers, in the early 1970s, Agarwal joined the Aditya Birla Group and Goenka the KK Birla Group—cushy jobs they abandoned to embark on an entrepreneurial journey. The two have also faced the ups and downs of entrepreneurship together as business partners since 1974, when they set up Kemco Chemicals (a partnership firm which later morphed into Emami Ltd), an ayurvedic medicine and cosmetics manufacturing unit, in Kolkata.

Four decades later, this penchant for innovation and differentiation continues to be at the core of Emami’s business. In fact, today it is not just about product differentiation, but disruption as well. “Disrupt or die,” is the business mantra of Agarwal, executive chairman of the

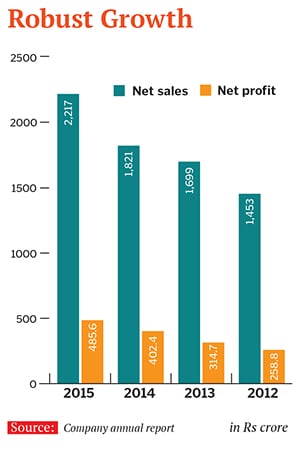

Rs 2,217-crore consumer goods company.

Inventing a new wheel

In the early 2000s, Emami displayed its ability to disrupt the market when it created a new product category—men’s fairness creams. Launched in 2004, Fair and Handsome gave Emami the first-mover advantage in capturing a dominant share in the Indian men’s fairness products market and stay ahead of deep-pocketed foreign competitors such as Hindustan Unilever (HUL) and L’Oreal.

Emami roped in Mumbai-based Situations Advertising to work on their account. In a survey that was conducted by Situations Advertising and market research firm AC Nielsen ORG-MARG it was found that almost 20 percent of fairness cream users, at that time, were men. Just that men did not openly acknowledge using women's fairness creams. Emami went ahead with the plan and Fair and Handsome was born. Today, the product enjoys a market share of 59.1 percent, way ahead of India’s largest FMCG company HUL’s Fair and Lovely Max Fairness for men, which has a 25 percent market share.

“We faced our first competition from HUL only in 2007 when they launched Fair and Lovely Men. But we have managed to maintain our market leadership,” says Mohan Goenka, son of Radhe Shyam Goenka and director, Emami Ltd. With sales of more than Rs 300 crore, Fair and Handsome contributes around 14 percent to Emami’s overall turnover. Global majors such as Germany’s Beiersdorf AG and L’Oreal have launched a slew of men’s skin care products. But most of them had missed the bus when it came to men’s fairness creams. “Even global giants like HUL could not envision a category like this. When HUL is in a particular market, it is usually the brand leader, but in the men’s fairness product category, Emami is perched well on top,” says veteran adman Alyque Padamsee, who has been advising Emami’s advertising team for 15 years.

Emami’s niche category play has helped all its major brands acquire dominant market share, says Amnish Aggarwal, senior vice president of research at brokerage firm Prabhudas Lilladher. “Four of its key brands—Navratna Oil, Boro Plus, Fair and Handsome and Zandu—together contribute about 70 percent of Emami’s topline,” he adds. For FY15, Navratna Oil had a market share of 67.4 percent in the cool oil category and Boro Plus accounted for 76.3 percent of all antiseptic creams sold in India. Emami’s pain relief portfolio—Mentho Plus Balm, Fast Relief and Zandu Balm—garnered a 60.9 percent market share in 2014-15.

Ad power

It is not just the first-mover advantage that has worked in favour of Emami. Its aggressive advertising and promotional push, backed by celebrity endorsements, provided an additional momentum. “We never gave our rivals enough room to grow,” says Mohan Goenka, who focuses on brands such as Zandu, Fast Relief, Mentho Plus Balm and Fair and Handsome. Emami is one of the first few domestic FMCG players to realise the potential of celebrity brand ambassadors, especially in a price-sensitive market with a large rural base. However, roping in Bollywood stars Shah Rukh Khan and Hrithik Roshan—who were initially sceptical about a men’s fairness product—to endorse Fair and Handsome wasn’t an easy task. They were convinced only after being apprised of the huge global market for men’s fairness products and the demand for such products in India. “After we got Shah Rukh Khan on board in 2007, our brand penetrated the rural market because of his star power. In 2006-07, sales from Fair and Handsome cream were Rs 25-27 crore, which nearly quadrupled to Rs 100 crore in 2008-09,” says Mohan Goenka. Last year, the company signed up Hrithik Roshan as the brand ambassador for its Fair and Handsome face wash.

Emami’s advertising strategy is complemented by its strong distribution network: It directly reaches more than 6.5 lakh retail outlets across the country. With 1,800 sales people, Emami has 2,000 direct distributors and about 7,000 indirect distributors to tap into the rural markets, which accounts for 52 percent of sales, compared to HUL’s 45 percent, notes an Edelweiss report dated May 2015.

Last year, Emami appointed global consulting major McKinsey & Company to help revamp its sales and distribution mechanism and make it more agile. The company says that over the last two years it has invested about Rs 12 crore in ramping up its IT infrastructure and plans to do “much more” over the next two years. Emami has also opted to have its own warehouses in five strategic locations, whereas most FMCG players opt for third-party warehouses. This helps Emami show assets, which have capital appreciation, on its books.

Rewarding shareholders

The synergy between innovation, marketing and distribution has translated into enviable growth for the company. In the last five years, Emami has grown at a compound annual growth rate (CAGR) of 17 percent, compared to the Indian FMCG sector’s 12 to 15 percent growth in the same period. In the past decade, the company’s market capitalisation has grown more than 20 times: From Rs 948 crore on March 31, 2005 to Rs 22,820 crore as of March 31, 2015. In 2014-15, Emami reported a 20.8 percent year-on-year jump in net profit at Rs 486 crore, while revenue was up 21.8 percent to Rs 2,217 crore.

Emami has also enhanced value for its shareholders. The company (then under the avatar of Himani Limited) listed on the bourses through a public issue in 1979-80, which helped it raise around Rs 16 lakh. An investor who had subscribed to the maiden issue with Rs 1,000 for 100 shares would now own 84,000 shares worth more Rs 8.4 crore. (The company has done two rights issues, in 1983-84 and 1987-88, and undertaken two stock splits, in 1987-88 and 2010-11, apart from two bonus issues in 2004 and 2013.)

Emami has performed despite the fact that FMCG is a crowded sector dominated by global players, where companies clone rivals’ products in no time. The company’s inclination towards ayurveda and a herbal-based product line have made it stand out in the crowd. Emami regularly surveys the market to measure the feasibility of every product idea that is developed internally, says Harsha Vardhan Agarwal, son of Radhe Shyam Agarwal, and director, Emami Ltd. The company also has a 30,000-square feet R&D centre in Kolkata, which looks into product innovation including processing, analytics, perfumery science, quality assurance and packaging. Emami allots around two percent of its overall sales to R&D.

Growth path

Emami has the leeway to invest in R&D and enjoy greater freedom of operations—despite the volatile spending patterns in the FMCG sector—due to its healthy balance sheet and a strong annual cash flow. The company’s cash reserves of Rs 800 crore (as of March 31, 2015,) has also made it hungry for acquisitions. “Over the years, Emami has managed to get the right fit in terms of its acquisitions: Be it Zandu or more recently Kesh King. Zandu has made strong contributions to Emami’s overall business, while Kesh King’s niche herbal positioning is a good fit for the company’s ayurvedic portfolio,” says Aggarwal of Prabhudas Lilladher.

Thus far, Emami has made six acquisitions across the personal and healthcare space. In 1978, it acquired the century-old but ailing Himani Limited, which had a strong brand equity in eastern India. In 1984, the flagship brand Boro Plus antiseptic cream was launched from the stable of Himani, which was merged with Emami in 1998.

In 2008, Emami acquired a 73 percent stake in Zandu Pharmaceutical Works for Rs 730 crore. In 2011, it acquired a 90.6 percent stake in Pharma Derm SAE Company, a small Egyptian FMCG company, through an indirect subsidiary Emami Overseas FZE. In its quest for growth, Emami has made three acquisitions in the past year. In 2014, it entered into an agreement with Mumbai-based Royal Hygiene Care Private Limited to acquire She Comfort, a brand of sanitary napkins, marking its foray into the female hygiene sector. This January Emami also acquired Australia-based Fravin Pty Limited, along with its three subsidiaries, through its arm Emami International FZE.

Last month, too, in one of the largest deals in the Indian FMCG industry in recent times, Emami acquired Kesh King’s hair and scalp-care business for Rs 1,651 crore from Himachal Pradesh-based SBS Biotech Private Limited. The valuation of the deal was more than five times Kesh King’s annual sales (in FY15, it had reported revenues of Rs 300 crore).

Emami’s disposition towards innovation also extends to the way it raises funds for its acquisitions, says NH Bhansali, CEO (finance, strategy and business development) and CFO of the company. “When we acquired Zandu, everyone in the market felt that we bought it at a high valuation. The deal happened during the global downturn. Banks were not giving any loans. In such a scenario, we acquired the company for Rs 730 crore, whereas Emami’s market capitalisation was Rs 1,300 crore,” he says. The company funded the acquisition through multiple channels such as borrowing at high interest rates and a qualified institutional placement that took place six months after the acquisition. “But, within two years, we became a debt-free company,” says Bhansali.

Emami has also been steadily expanding its footprint overseas. Currently, it is present in 63 countries. McKinsey is guiding the company in developing its international strategy, which will now focus on Russia, Middle East and Africa with its four power brands—Fair and Handsome, Boro Plus, Navratna Oil and Zandu. “We are looking at Africa in a big way and it would be mostly through inorganic growth,” says Radhe Shyam Goenka’s nephew Prashant Goenka, 41, director, Emami Ltd.

Emami positions products according to the needs of a particular country. “We never change the core of any brand, but we localise it depending on the market. For example, Navratna Oil is a cool therapeutic oil in India, but in the Middle East we market it as an anti-hair fall and anti-dandruff product,” says Prashant Goenka, who looks after Emami’s international business, which contributes about 15 percent to its overall topline.

Keeping It In the Family

Four decades after Agarwal and Goenka founded the business, Emami remains a family-owned enterprise. The promoters held a 72.74 percent stake as of March 2015. There is a family council—including family members engaged in the business—with well-drafted governing rules. Ram Krishna Agrawal, former managing partner at audit firm SR Batliboi & Company, acts as an advisor to the council. All major decisions are taken at council meetings. Each member of the second generation of the Agarwals and Goenkas involved in the business has a defined responsibility. “It is important to have a structure and process in place when families are involved in the business. It brings in discipline. Nobody is entitled to withdraw money from the company for their independent businesses or for any personal purpose,” says Radhe Shyam Goenka, who still keeps a strict tab on finance.

However, the partners have had their share of adversities. In December 2011, they faced a major crisis when a fire at AMRI Hospital (which Emami group then co-owned with the SK Todi-led Shrachi Group) in Kolkata’s Dhakuria neighbourhood claimed 92 lives. The tragedy resulted in a criminal trial against some members of the Agarwal and Goenka families. The case is sub-judice.

Despite this setback, due to which the two families did not attend office for six months, analysts feel Emami ran on its own steam. “The business continued to do well and that shows the inherent resilient strength of the company,” says a Bengaluru-based analyst who didn’t want to be named.

This resilience against all odds can be traced to the six-decade-long friendship of the co-founders, who met for the first time while studying at Shree Maheswari Vidyalaya in Kolkata. As Radhe Shyam Agarwal tells the next generation, “Look at the details. And always strive for the best.” And he seems to have heeded his own advice, given the trajectory of Emami’s growth.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)