"We have 30 extra years": A new way of thinking about aging

People around the world are living, working, and learning longer. Get ready to upgrade your old ideas about longevity

As careers last longer, older people can play a valuable role in designing and marketing products for their age-mates

Image: Shutterstock

As careers last longer, older people can play a valuable role in designing and marketing products for their age-mates

Image: Shutterstock

As one of three co-teachers of a Stanford Graduate School of Business course on the rapidly growing importance of older consumers and workers, Rob Chess likes to say that his colleague Laura Carstensen, the founding director of the Stanford Center on Longevity, is the expert on aging; his fellow lecturer in management, Susan Wilner Golden, has the entrepreneurial angle covered; and he represents the demographic in question. “I just got my Medicare card,” he says with a chuckle.

A serial entrepreneur who has founded and led several successful biotech companies, Chess is having a bit of fun at his own expense. But the growing cohort of older adults he belongs to — and the opportunity it represents — is no joke.

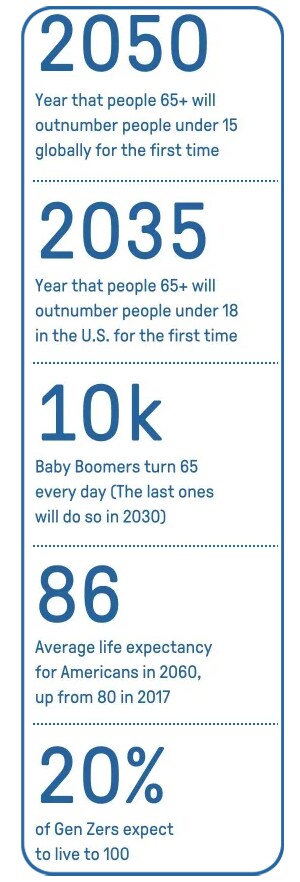

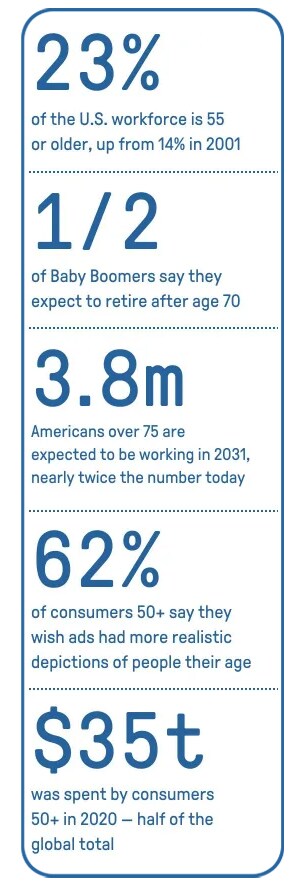

Thanks to advances in medicine and public health, people are living longer, healthier lives. The world’s population of people 60 and older is growing five times faster than the population as a whole. Global life expectancy has doubled since 1900, and experts say that children born in developed countries now have a good chance of living to 100. A “silver tsunami” is already sweeping the U.S. labor force: the Bureau of Labor Statistics projects that 36% of people ages 65–69 will remain on the job in 2024 — up significantly from the 22% who were working in 1994.

These longer-lived, longer-working individuals generate an ever-bigger slice of global GDP and control an expanding tranche of global wealth. In her recent book Stage (Not Age), Golden estimates that the “longevity economy” is worth more than $22 trillion — $8.3 trillion in the United States alone. That may be a conservative figure: AARP (the organization formerly known as the American Association of Retired Persons) estimates that people over 50 already account for half of consumer spending worldwide, or $35 trillion. (This range of figures may have to do with how “older adult” is defined: The term is variously used to refer to people over the ages of 65, 60, or — sorry, Gen Xers — 50.)

Yet the longevity market remains untapped by many businesses, which continue to ignore older consumers in favor of younger ones. “People 50 and older hold the vast majority of wealth in the country, but we’re producing products and services for people who don’t have nearly as much money to spend,” Carstensen says.

This piece originally appeared in Stanford Business Insights from Stanford Graduate School of Business. To receive business ideas and insights from Stanford GSB click here: (To sign up: https://www.gsb.stanford.edu/insights/about/emails)

Instead of segmenting older people into age brackets, Golden suggests looking at what stage of life they’re at. This may challenge many assumptions about how our lives will unfold. She argues that the linear three-stage model of “learn, earn, retire” is based on outmoded ideas about lifespan and “health span”: If you’re going to live to 80 or 90 in relatively good health, it makes no sense to assume that your formal education should end in your teens or twenties or that you should retire at 65.

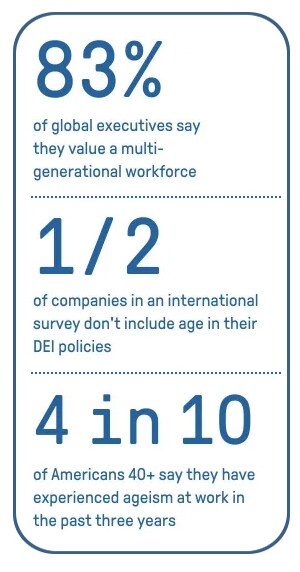

Instead of segmenting older people into age brackets, Golden suggests looking at what stage of life they’re at. This may challenge many assumptions about how our lives will unfold. She argues that the linear three-stage model of “learn, earn, retire” is based on outmoded ideas about lifespan and “health span”: If you’re going to live to 80 or 90 in relatively good health, it makes no sense to assume that your formal education should end in your teens or twenties or that you should retire at 65. That’s not to say there won’t be problems. With four or even five generations working together in close quarters, the potential for intergenerational conflict will inevitably increase. According to Carstensen, more research is needed to understand the optimal composition of mixed-age teams so that managers can create environments where age diversity improves performance rather than generating friction. “The devil is in the details,” she says.

That’s not to say there won’t be problems. With four or even five generations working together in close quarters, the potential for intergenerational conflict will inevitably increase. According to Carstensen, more research is needed to understand the optimal composition of mixed-age teams so that managers can create environments where age diversity improves performance rather than generating friction. “The devil is in the details,” she says. The federal Age Discrimination in Employment Act of 1967 protects people who are 40 or older, yet it remains difficult to enforce. A survey by AARP found that 61% of adults over age 45 had either seen or experienced age discrimination in the workplace. Nearly one-fifth of the more than 61,000 charges filed before the Equal Employment Opportunity Commission in 2021 were age-related, with research suggesting that many more cases go unreported.

The federal Age Discrimination in Employment Act of 1967 protects people who are 40 or older, yet it remains difficult to enforce. A survey by AARP found that 61% of adults over age 45 had either seen or experienced age discrimination in the workplace. Nearly one-fifth of the more than 61,000 charges filed before the Equal Employment Opportunity Commission in 2021 were age-related, with research suggesting that many more cases go unreported.