Dream11 turned fantasy (gaming) into reality. Now it's eyeing a diversified sports tech future

Dream Sports started off as a fantasy sports platform, and is now expanding across verticals like sports merchandising and experiential tourism. Will it help the company overcome regulatory hurdles the sector is battling?

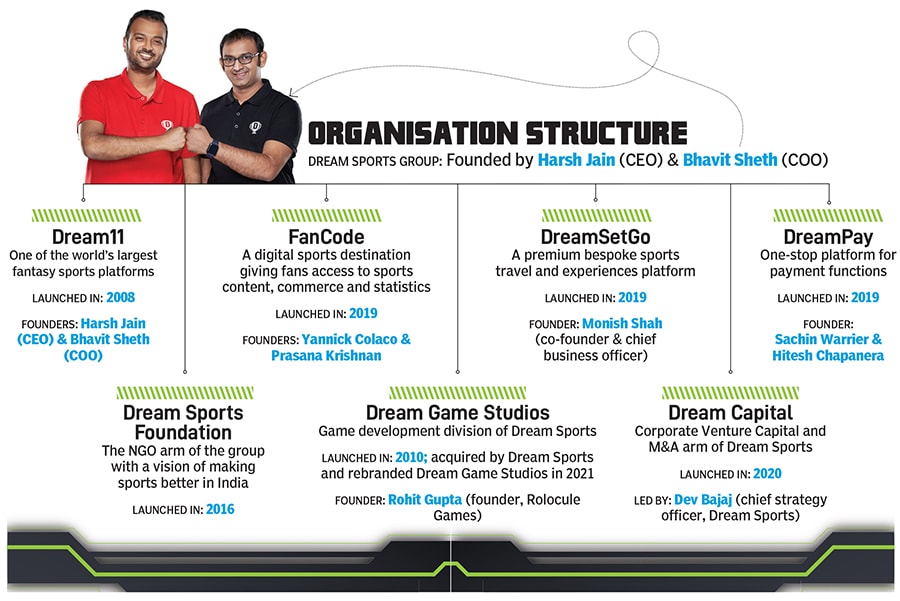

Harsh Jain (right) Cofounder and CEO, Dream11 and Dream Sports and Bhavit Sheth, Cofounder and COO, Dream11 and Dream Sports

Image: Mexy Xavier

Harsh Jain (right) Cofounder and CEO, Dream11 and Dream Sports and Bhavit Sheth, Cofounder and COO, Dream11 and Dream Sports

Image: Mexy Xavier

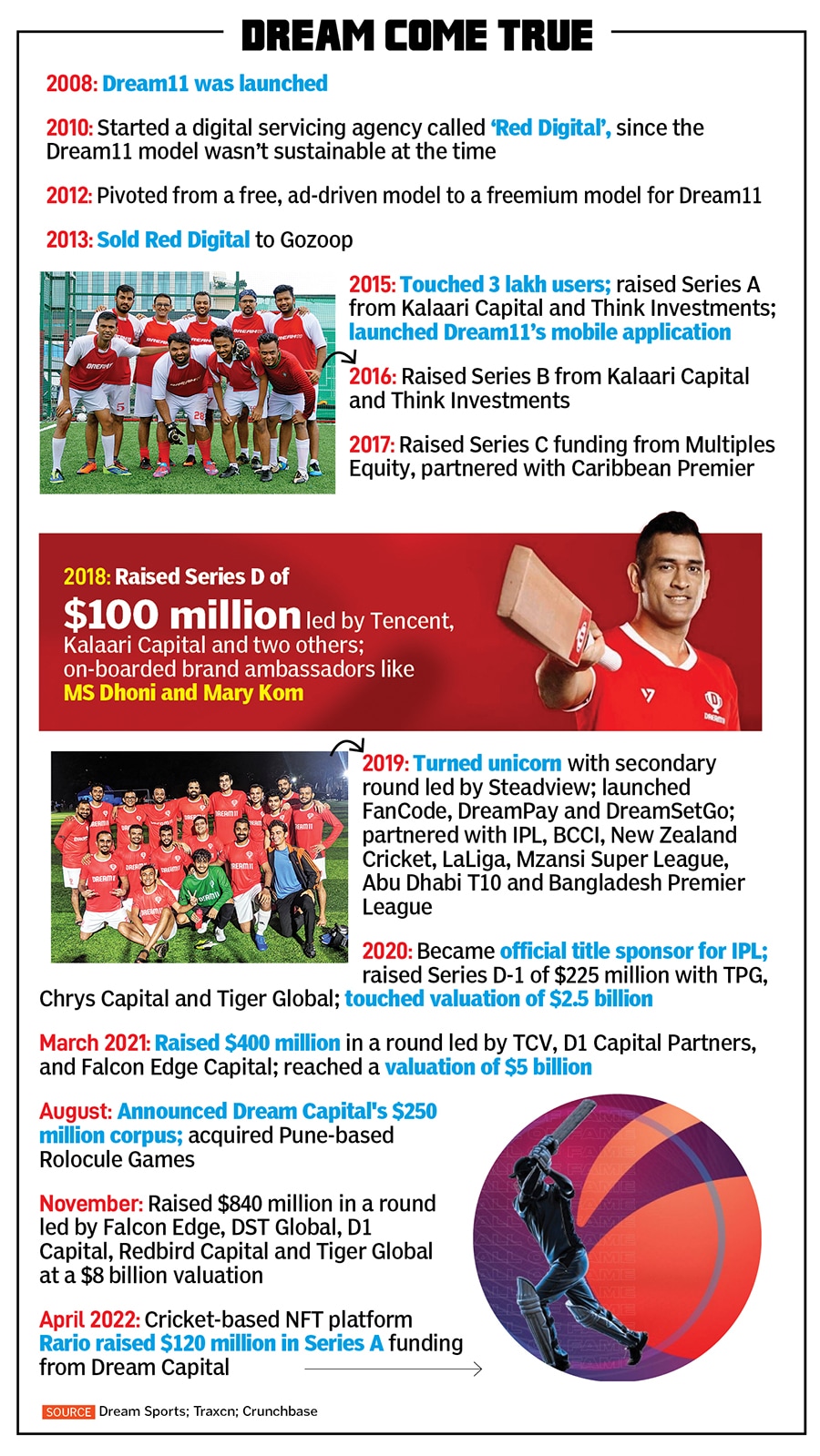

Since the 90s, fantasy football has been a rage in the UK. Tabloids like The Sun have run such competitions for years, asking readers to fill in their picks and send across clippings; the newspaper would then announce winners every week. With the advent of the internet in the early 2000s, the game moved online, and a 16-year-old sports buff from Mumbai, who was schooling in London in 2001, was hooked.

Harsh Jain later moved to the US for his undergraduate degree from the University of Pennsylvania, and then returned to India in 2007 to join his family business, Jai Corp. But even as he moved continents, his love for fantasy football remained his constant companion.

In 2008, when the Indian Premier League (IPL) was launched, Jain set out to look for fantasy cricket platforms. He found nothing—the concept was alien to the country even though it loved the game as much as the UK loved football. It was also around the same time that Jain was getting the entrepreneurial itch. “I always wanted to do something on the lines of my three biggest passions—sports, gaming and technology,” he says.

During a casual chat with school friends, the engineering graduate pitched the idea of bringing it all together—creating a fantasy cricket platform. “Let’s launch it ourselves [I thought] if no one else is doing it... even if it’s only for us. If we make a good version, maybe a 100 million other Indians might like it,” he said.

A month later, he finally made up his mind—he was going to go on with it. “Bhavit [Sheth] was the only one to join me. We just jumped in, eyes shut or wide open, however you want to say it,” says Jain. The 22 year olds met a bunch of gaming gurus and, Jain says, “all of them told us it was the worst idea in the world”. Sheth adds, “…they were absolutely right.”

Kola was convinced, and seven years after starting the business, Dream11 had its Series A. Soon after Kalaari Capital came on board, they started getting several other investors. “VCs have FOMO (fear of missing out)... it’s the biggest driving factor in the industry,” jokes Jain.

Kola was convinced, and seven years after starting the business, Dream11 had its Series A. Soon after Kalaari Capital came on board, they started getting several other investors. “VCs have FOMO (fear of missing out)... it’s the biggest driving factor in the industry,” jokes Jain. Jain, however, thinks otherwise. “The Supreme Court has called it a ‘game of skill’... this is not a discussion matter anymore. Fantasy sports in our format—the single full-match format—is legal and is not gambling, betting or wagering. It is a game of skill and a genuine business. We’ve been taken to the Supreme Court three times, and we have a three-out-of-three success rate,” he says.

Jain, however, thinks otherwise. “The Supreme Court has called it a ‘game of skill’... this is not a discussion matter anymore. Fantasy sports in our format—the single full-match format—is legal and is not gambling, betting or wagering. It is a game of skill and a genuine business. We’ve been taken to the Supreme Court three times, and we have a three-out-of-three success rate,” he says.