Vijay Mallya arrested by UK authorities, but it's not a victory for creditors yet

While his arrest may be a small victory in the Modi government's efforts in tackling big-ticket defaulters, a lot more needs to done

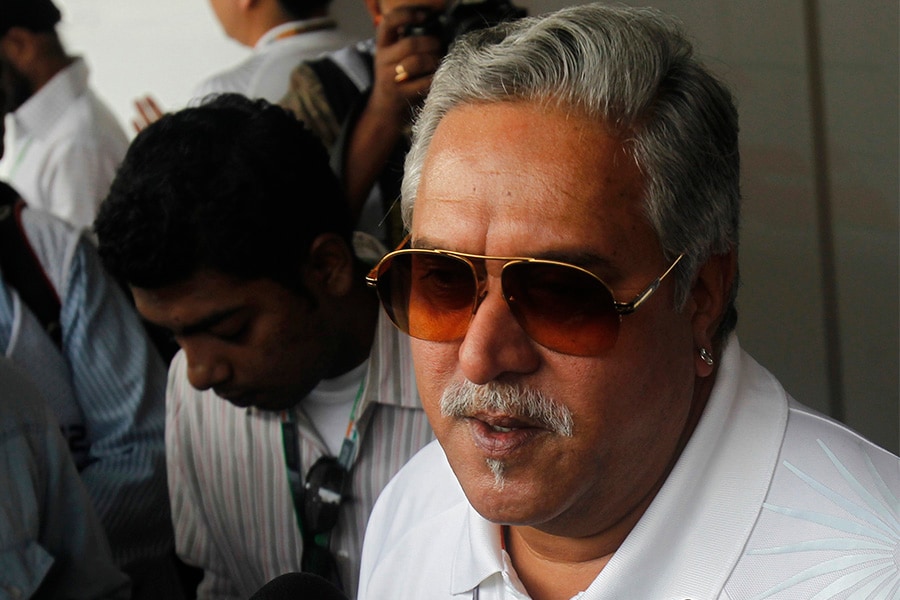

Vijay Mallya

Vijay Mallya

Image: Reuters/Ahmad Masood

Various news channels, including CNN News18 that is part of the Network18 Group which publishes Forbes India, reported on Tuesday afternoon that beleaguered industrialist Vijay Mallya, who has been residing in London since March last year, was arrested by the local authorities in London.

However, he was soon granted bail.

The development follows the Indian government’s request to the UK to extradite Mallya, who is facing numerous non-bailable arrest warrants issued by various high courts in India. Mallya, however, made light of the development by tweeting: "Usual Indian media hype. Extradition hearing in Court started today as expected."

While Mallya’s arrest could be counted as a small victory by the Modi-led government in trying to punish those absconding from the law, whether the liquour baron would actually be extradited from London is the billion-dollar question.

Mallya owes a 17-member banking consortium led by the State Bank of India over a billion dollars in debt. Then there are his dues to a host of non-secured creditors and salary payments to his erstwhile employees of the now-defunct Kingfisher Airlines.

Given the complexities involved in an extradition request to the UK, until and unless Mallya is on a flight back to India and faces trial by the Indian courts, can it be said that the government’s efforts in nabbing him have paid off.

“It’s a tough road ahead,” says a senior Mumbai-based lawyer on condition of anonymity. “It’s (Mallya’s arrest) certainly a step in the right direction. Is it a victory for the creditors? No, that will occur only when all assets are seized and liquidated.”

Ramesh Vaidyanathan, managing partner, Advaya Legal, says, "Mallya’s arrest is definitely one step forward, but one among many to be traversed before getting anywhere close to his extradition. The good part is that a prima facie case has been made out in the extradition request made by the government of India earlier this year and a district judge in the UK has found merit in this request. This was possible largely due to the emphasis in the request on the cheating and money laundering aspects of the CBI charge sheet in the IDBI Bank loan sanction issue. A pure civil wrong of loan default of the borrower or the guarantor would not have entitled an extradition request to the UK authorities.”

By trying to net Mallya in the UK, the Modi government is sending out a strong signal to big-ticket defaulters. But there are many who believe that Mallya is just a small fish in a big pond of defaulters. Says a stock market analyst: “There are companies who owe banks in excess of Rs 20,000 crore and no one knows who the promoters of these companies are.”