Max India to split into three separate listed companies

Success in the life insurance business has led them to demerge the business into three clusters

Max India Ltd, the business conglomerate with interest in insurance and healthcare has announced today its corporate restructuring plan. According to the release, its board has approved a split of the company through a demerger into three separate listed companies.

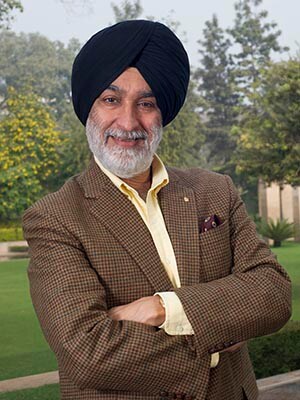

The restructuring will give investors, access to the different businesses and provide sharper focus to each business. The decision to restructure the business was taken 15 months ago, said Analjit Singh, Chairman of Max India Group. “The success in our life insurance business has led us to believe the time is right to demerge the business into three clusters,” Singh told reporters at a press conference held after the board meeting in New Delhi.

When the demerger is completed, Max India will be renamed Max Financial Services Ltd and will focus on the group's flagship life insurance business through its 72.1 percent shareholding in Max Life. The insurance business is a joint venture between Max India and Mitsui Sumitomo Insurance Co. Ltd. The second vertical will be Max India which will look at the health and related businesses including Max Healthcare, Max Bupa Health Insurance and Antara Senior Living, which makes premium senior living homes.

The third business will house investment activity in the group's manufacturing subsidiary Max Specialty Films and will be called Max Ventures and Industries Ltd. Max Ventures will look at a new business because the environment was conducive for it. “In the last 12-13 years we have said no to new businesses but with the Prime Minister Narendra Modi's focus on “Make in India”, we feel the time is right to revisit the wider world of business opportunities in India,” said Singh.

The demerger will result in ‘surrogate listing of the life insurance business,’ said Singh while adding that the leadership of all the businesses will remain the same. Max also announced its decision to sell its clinical research business to a Canadian contract research firm, JSS Medical Research Inc. for $1.5 million.

“There are just too many risks and regulatory issues in this business,” Singh added. The demerger is expected to be completed within 6-9 months after which Max could look at a public listing of some of its companies. “There has been a lull in IPO's in India. But, I think 2015 will see some action,” he concluded.