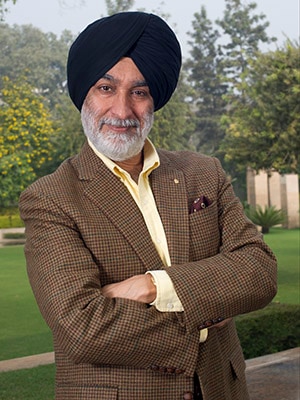

Max India demerges; Analjit Singh steps down

Max Group splits into three separately listed companies to unlock shareholder value

As part of a corporate restructuring announced in January last year, Max India has split into three listed corporate entities - Max Financial Services Ltd, Max India Ltd and Max Ventures and Industries Ltd. The demerger came into effect on January 15, 2016. As part of this scheme, Analjit Singh relinquished his post as chairman of Max Financial Services on Friday. Singh will continue as chairman of Max Ventures and Industries.

The company said that the demerger was executed with a view to unlock shareholder value and provide more distinct focus on each operating business. "The group operates diverse businesses, each of which has considerable value and growth potential. The demerger will provide investors a choice to continue to be associated with all these businesses, or in the set of businesses that suit their respective investment objectives," founder and chairman emeritus Analjit Singh said.

In the latest structure, Max Financial Services will handle the life insurance vertical. The second company, the new Max India Ltd will manage investments in health and related businesses such as Max Healthcare, Max Bupa and Antara Senior Living. The third company, Max Ventures and Industries will handle the investment in the manufacturing business, Max Speciality Films.

The company is also looking to spread its wings in newer sectors including real estate, education and technology. The group's logo has also been redesigned.

"The demerger will lead to a more specific value discovery for each vertical. Moreover, it will provide sharper management focus to each underlying business. Due to their inherent features and priorities, each of the three holding companies will be optimally positioned to guide their operating businesses on their respective growth journeys," Rahul Khosla, president, Max Group said.