India could become world's third largest cinema market by 2021

The entertainment and media industry in India is expected to grow at a CAGR of 10.6 percent to Rs 290000 crore by 2021

India’s entertainment and media industry is expected to grow steadily over the next four years, even as the global growth rate slows down, finds a PwC study released on Wednesday.

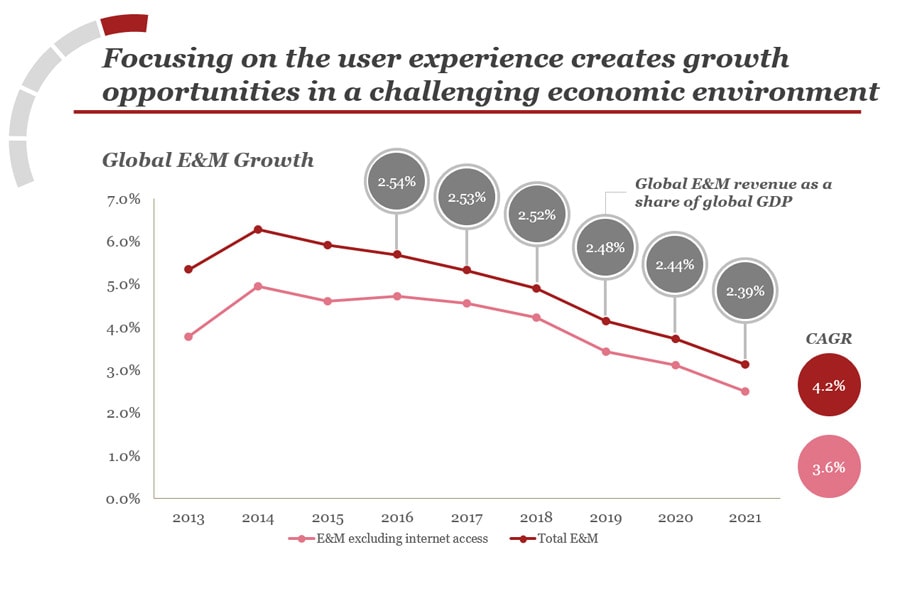

With a compound annual growth rate (CAGR) of 10.6 percent between 2017-2021, the Indian entertainment and media industry is expected to exceed Rs 290000 crore by the end of this period. On the other hand, the global growth outlook has been lowered from a CAGR of 4.4 percent in 2016 to 4.2 percent in 2017. The global market is growing from $1.8 trillion in 2016, to $2.2 trillion in 2021. Also, the growth rate of the E&M industry will be slower than the growth rate of global GDP.

The slowdown is primarily because ‘in many of the largest markets, and hence in the industry as a whole, E&M businesses are reaching or have reached a point of saturation,’ states the study, titled PwC’s Global Entertainment and Media Outlook for 2017-2021.

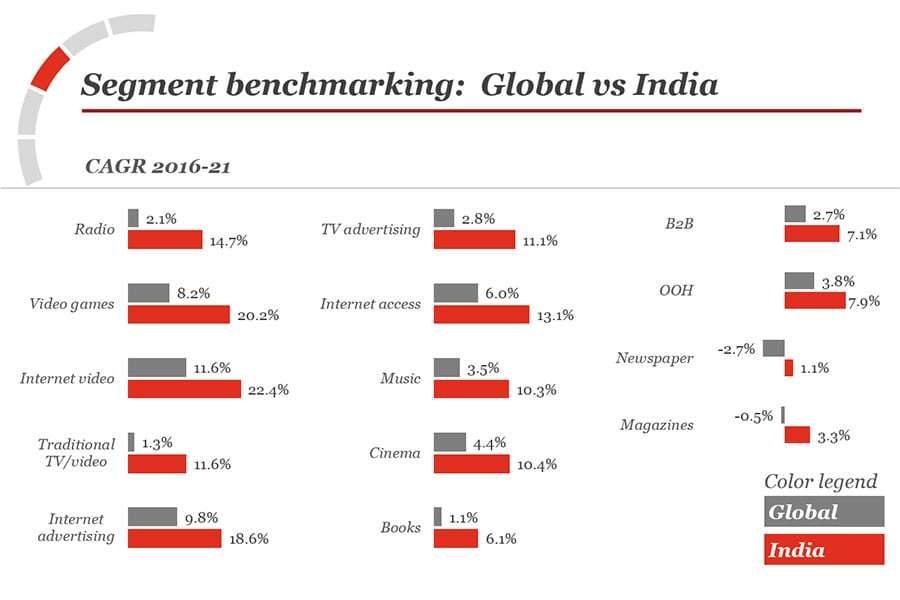

While the newspaper industry has been de-growing globally, India bucks the trend with a positive growth rate of 1.1 percent CAGR during 2017-2021, which translates to an increase from Rs 23,161 crore in 2016 to Rs 24,447 crore in 2021. The overall publishing industry is expected to grow to Rs 44,391 crore from the current Rs 38601 crore, a CAGR of 3.1 percent. Book publishing is projected to grow at 6.1 percent CAGR over 2017-2021 whereas Magazines are expected to grow at a CAGR of 3.3 percent for the same period.

Interestingly, for the first time, newspaper subscription revenues globally have surpassed advertising revenues – as advertisers stopped spending on the medium, and also because the newspapers have started to monetize their digital platforms.

Cinema has always been a favourite form of entertainment in India, and soon, despite fewer screens and low admission prices, India is projected to be the third largest Cinema market in the world by 2021 with a double digit CAGR of 10.4 percent over the Outlook period. Box office revenue will rise from Rs 10,957 crore in 2016 to Rs 18,047 crore in 2021, and admissions (footfalls) will rise from an estimated 200 crore in 2016 to 230 crore in 2021 (at a CAGR of 2.4 percent). The growth will also be aided by the rise in Ticket prices at a CAGR of 7.9 percent in the same period. The report states that India is one of the few major cinema markets in which 100 percent digitisation of screens has not yet been achieved – and it is not expected to occur over the forecast period.

When asked about the growth of OTT players and whether it will have an impact on the cinema industry, as it has had in the western markets, D’Souza says that digital disruption in India is still some time away primarily because of inadequate telecom infrastructure and because non-linear mediums have still not hit the right pricing strategy to compete with a linear player.

Television, which is among the largest contributors to the revenues for the E&M industry, will see its subscription revenues grow from Rs 52,755 crore in 2016 to Rs 90,713 crore in 2021 at a CAGR of 11.6 percent. TV advertising will continue to hold the larger share of the pie from Rs 21,874 crore in 2016 to Rs 37,315 crore in 2021, even though Internet advertising is expected to growth a much faster rate of 18.6 percent as opposed to TV advertising at 11.1 percent from 2017-2021.

Television, which is among the largest contributors to the revenues for the E&M industry, will see its subscription revenues grow from Rs 52,755 crore in 2016 to Rs 90,713 crore in 2021 at a CAGR of 11.6 percent. TV advertising will continue to hold the larger share of the pie from Rs 21,874 crore in 2016 to Rs 37,315 crore in 2021, even though Internet advertising is expected to growth a much faster rate of 18.6 percent as opposed to TV advertising at 11.1 percent from 2017-2021.Though subscriber numbers are still growing, explosive growth levels of the recent past will not be replicated in the future. The cable market is approaching a saturation point but will still account for over 55% of the total pay-TV market in 2021. In terms of advertising, TV will continue to hold the larger share of the pie from Rs 21,874 Cr in 2016 to Rs 37,315 Cr in 2021, even though Internet advertising is expected to growth a much faster rate of 18.6% as opposed to TV advertising at 11.1% from 2017-2021.

Within Internet advertising, mobile Internet advertising only comprises 27.6 percent of total online spending, marking a clear gap between Indians with mobile access and brands reaching out to the mobile audience. India’s internet video segment has produced revenues of Rs 560 crore in 2016 and will grow at 22.4 percent CAGR to reach Rs 1540 crore in 2021. Transactional video-on-demand will account for over 61 percent of total Internet video revenues in 2021, with many households not wanting to commit to the regular payments of subscription video-on-demand.

Globally, a majority of the industry segments show a decline in projected growth rates. Only two segments, newspapers and magazines, are declining in absolute terms. However, segments such as TV advertising, B2B content, and cinema, will also shrink as a share of the global economy between now and 2021. And while Internet video and Internet advertising are growing, it is not sufficiently large to overcome the stagnation in other areas. D’Souza adds that globally, the millennials, as of today, have lesser disposable income than the previous generation. At the same time, they have been brought up on a diet of free content, and it is difficult to get them to pay.

“Whereas one may be tempted to conclude that India’s growth in this sector is divergent from the world’s, it will do well for Indian players to keep their eyes on changing landscape globally and prepare for its eventual impact on the Indian market,” concludes D’Souza.

X