Sunil Mittal: Time is Running Out For Him

Sunil Mittal single-handedly built Indian telecom. Now he must save it, starting with Bharti Airtel

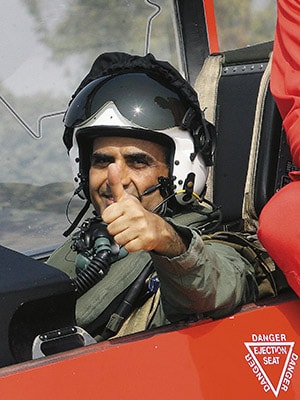

Name: Sunil Mittal

Age: 55

Profile: Chairman & managing director, Bharti Enterprises

Rank in the Rich List: 12

Net Worth: $5.9 billion

The Big Hairy Challenge Faced in the Last One Year Bereft of management attention, attempts to diversify seem to have failed. Even in telecom, Airtel’s business model is now a commodity and its leading incumbent status, a liability. Meanwhile, in Africa, there is still no silver lining.

The Way Forward From being a beneficiary of regulation, Mittal has turned into an adversary. The last few years have seen him adopting a martyr complex too often, something you don’t from a market leader. Can he fix his Achilles’ Heel—the lack of a pragmatic and forward-looking regulatory strategy? Along with this, he will also need to transition Bharti Airtel from the commoditised and diminishing voice telephony market, to data services.

The year was 2005 and Sunil Bharti Mittal, then 48, founder, chairman and group CEO of Bharti Enterprises was the undisputed king of the Indian telecom jungle.

“Between 2000 and 2005, the formative period of this sector, his perspective was superior. What seemed like recklessness to others was an opportunity to him. When the sector was shell-shocked, he took the first-mover advantage. He put out investments and resources by diluting equity to raise money when most operators were looking inwards. He saw with greater clarity what others didn’t,” says Sanjeev Aga, former MD of Idea Cellular.

Mittal had single-handedly invented the outsourced ‘minutes factory’ business model that allowed low-cost mobile telephony to flourish in India. “There is no doubt he came up with a great business model by telling his partners, ‘I will produce the minutes; you supply me with the machines for doing that; but I’ll only pay you if I sell the minutes,’” says BK Syngal, principal with Dua Consulting, and a four-decade veteran of Indian telecom.

It was from that position of unassailability that in May 2005 Mittal had rhetorically answered Ratan Tata, chairman of the Tata Group, who had voluntarily offered to pay Rs 1,500 crore for third generation (3G) mobile spectrum across all of India. “There is the Prime Minister’s Relief Fund... If someone wants to donate money, he can do it there,” Mittal had told the media.

Back then, many were surprised that a person as sharp and astute as Mittal could make a statement as callous.

Seven years of hindsight later, Mittal’s statement still comes across as a stunningly short-sighted misstep from a person known for his long-term vision.

Because in December 2007, Bharti Airtel would go on to offer Rs 2,650 crore—nearly 80 percent more than what Tata had—for pan-India 2G spectrum. That price has, in 2012, risen to Rs 14,000 crore at the minimum—the reserve price set by the government for the upcoming auction of spectrum.

Meanwhile, Airtel’s business model has by now been replicated ad infinitum by the competition, to the extent that it is now merely table stakes in the Indian mobile telephony market. Two of Airtel’s biggest competitors, Vodafone and Idea, have not just closed the gap with it but have even been beating it quarter after quarter in many circles.

Idea, once a relative minnow to Airtel, has nearly doubled its market share from 9.5 percent to 17 percent during the last four years, even as Airtel’s has fallen from 24.3 percent to 20.7 percent.

“A lot of the competition has come up in the last two to three years, and obviously the No. 1 player has taken the hit,” says Sachin Gupta, head of Asian Telecoms Research at Nomura.

The last four years have also seen Airtel buffeted by a series of challenging scenarios, including hyper-competition and malicious regulation, and commoditisation of voice telephony that has progressively cost it profit margins and market share.

“The industry has become largely a plain vanilla operation centred around volumes and prices, involving very little innovation,” says Mahesh Uppal, director of consulting firm, Com First and a veteran telecom policy expert.

Remaking the Factory

In the last 10 years, Sunil Mittal gave the global telecoms industry two game-changing ideas—the outsourced operating model, and the ‘minutes factory’ model. But with great success comes great expectations. The world now expects him to come up with a new game changing idea, perhaps something that can democratise data services for tens of millions of customers across Asia and Africa.

Ironically the biggest impediment to that at Airtel is its own success. Managers who have grown through its ranks have mostly seen 20 to 30 percent growth year after year, and vendors falling over each other to deliver innovation. Very few have a firsthand perspective on handling a recession; even fewer have any international experience that can be applied in India.

And then there is the politics. “It is an incestuous world of politics within Bharti. There are silos between managers’ turfs everywhere as a result of which innovation gets stifled. Within vendors, very few people want to work on their account,” says a senior executive with IBM, Bharti Airtel’s biggest outsourcing partner, who did not want to be identified.

Years of working under an ‘everything-is-outsourced’ construct has managers waiting for their vendor partners to deliver disruptive innovation instead of leading from the front themselves.

To counter that, Mittal put Airtel through a nearly two-year-long restructuring, letting go of hundreds of people, including board-level executives like Atul Bindal who was regarded as one of its sharpest executives by people within the industry. The results are still a way off, judging from either the dropped calls or absence of any meaningful data strategy. At least three consultants who have worked with Airtel say the only way it can bring about disruptive innovation is to bring in talent from outside.

Mittal, always a hands-on entrepreneur, has, as a result, become even more operationally involved with Airtel. Besides being part of circle-level reviews, he is also learnt to be conducting fairly granular reviews with various Airtel executives every few months.

The Bharti Group, through their spokesperson Raza Khan, declined to participate in this story or to provide responses to a detailed set of questions sent by Forbes India.

A Fledgling Multinational

More than two years after spending $10.7 billion to expand into Africa through its acquisition of Zain Telecom, the results are still mixed for Airtel. “Airtel has directly or indirectly disrupted many markets in Africa, in most cases through price competition,” says Dobek Pater, a director with telecoms research firm Africa Analysis.

But its competitors have countered by dropping prices, at times pre-emptively, like Etisalat in Nigeria. Airtel also had its hands tied in many countries because of a 12 to 18 month handicap, a period before the takeover, during which Zain stopped investing altogether. As a result, MTN, the biggest operator in Africa (Airtel is No. 2), ended up gaining market share from it on an aggregate basis.

Its famed business model too hasn’t transposed all that well into Africa. “Airtel’s ‘factory model’ hasn’t really worked in Africa. Firstly, unlike India, which is under one jurisdiction and a market with mostly one set of regulations, Africa is different countries. Secondly, the population of 16 countries is about a third of the Indian market, making economies of scale much smaller,” says Pater.

“Unlike other industries, in telecom the cell-site is your factory, and your market is limited by the distance travelled by the airwaves. So a telecom company is more like a ‘multi-local’ company than a ‘multi-national’ one. Which is why it doesn’t lend itself to globalisation easily,” says Aga.

“Airtel underestimated the complexity of Africa, thinking it was essentially a ‘multi-circle’ play like India. For instance, when they started centralising services across countries, they ran into issues around double taxation, and other issues they’d never thought of,” says a senior industry expert with a management consulting firm who requested anonymity.

The absence of high-capacity backbone bandwidth and the lack of centralised data centres have, in turn, kept the cost of ‘minutes’ still high. This has put its outsourcing relationships with IBM and Huawei under stress; as sources say, the vendors are telling Airtel that current deal terms are unviable in the absence of centralised backhaul and data centres.

Bharti is now gearing up for the long run. It is refocussing towards enterprises, data services and 3G on one hand, and on the other building a pan-African backhaul network that can aggregate and carry traffic across multiple countries it operates in.

“Africa is a high-risk bet that will pay off in the long run. But for cash to be generated, cash needs to be invested. Today, Bharti is spending somewhere close to $1 billion on capital investments in Africa, which many of us think may not be enough, given the depth of the network that needs to be created,” says Nomura’s Gupta.

“Airtel has realised that voice has become commoditised and that it hasn’t been able to deliver profits because of price wars. But irrespective of its losses over the past couple of years it is still the No. 2 player and very well positioned to take advantage of economies of scale and opportunities,” says Pater.

His Achilles ’ Heel?

While telecom regulators in India have had a long history of mischief, during the last four years Airtel, along with Vodafone and Idea, have found themselves in the crosshairs of regulators. “It’s like they’ll need to write a cheque to the government to just keep standing still,” says Gupta.

Frustrated, Mittal even made a statement in May this year saying, “This has been the most destructive period of regulatory environment I have seen in 16 years.”

But fact is, regulations are fast becoming Mittal’s biggest weakness. His regulatory affairs team under Narendra Gupta and Jyoti Pawar have been unable to either set the agenda for future regulation or counter the rising attacks on Airtel’s business fundamentals from regulators.

“Airtel and other operators are shooting themselves in the foot by fighting self-destructive wars. Writing letters against one another may help you for a while, the net result is that nothing is moving. Instead they should think constructively and positively,” says Syngal.

Some industry experts believe Mittal is largely responsible for the current state of the industry. Despite being the undisputed market leader, he spent a great amount of time lobbying for spectrum to be allotted based on the number of voice subscribers an operator had. While it may have helped Airtel in the short term, it discouraged the entire industry from getting more data subscribers.

“On hindsight, it appears that the preparation that was required for 3G never happened. If some amount of awareness existed around non-voice or GPRS [the earliest form of data transfer on GSM networks] services, it would have helped 3G too. But the focus of the GSM incumbents was to expand the SIM base, reflecting a lack of strategic thinking,” says Uppal.

Even when presented with a chance to take a transparent and efficient call on spectrum allocation, like Ratan Tata did as early as 2005, Mittal surprisingly adopted a petulant and short-term approach.

“The opposition that many GSM incumbents had to spectrum auctions in the time frame before the 3G auctions was more tactical than strategic. Their opposition allowed A Raja to take decisions based on administrative procedures rather than market mechanisms,” says Uppal.

“Frankly speaking, Sunil Mittal has never seemed to get the regulatory piece right. From WLL to CDMA to dual-technology to spectrum auctions, Airtel has, by and large, ended up on the receiving end. Someone else takes up an aggressive stance and Bharti ends up reacting. It’s almost as if the others look farther ahead to what’s going on and take advantage of it,” says Kunal Bajaj, erstwhile India head of telecom strategy firm Analysys Mason.

Even in Africa, some experts say, Airtel underestimated the regulatory complexity of operating in too many countries. After letting go of some of the sub-par regulatory staff that came with its Zain acquisition, it transferred some people from India, very few of whom have any first-hand understanding of the markets.

The Conglomerate Experiment

“As Bharti enters its next phase of growth, we have a new vision to make it India’s finest conglomerate by 2020,” said Mittal in November 2008, as his company launched its new brand identity and corporate vision. Apart from telecom, the “future growth engines” would be retail, financial services, and agriculture.

But four years on, it can safely be said that the group’s conglomerate dreams are dead.

Bharti-Axa, its insurance joint-venture with global insurance major Axa, is scrounging at the bottom of life and general insurance league tables in India. Late last year, it even tried selling its share in the venture to upcoming arch rival Reliance Industries, only for the talks to collapse in November.

Yet in 2006, when it was launched, many industry observers were wary of the combination of Axa's insight into insurance and Bharti's aggression in the Indian consumer market.

Its retail joint-venture with Walmart is managed and controlled almost entirely by Walmart, regardless of its equal shareholding. Operationally, the business hasn’t made any major disruptions in the overall retail landscape.

Multiple challenges in his core business—telecom—have also forced Mittal to tone down his conglomerate ambitions. To generate cash he’s already sold mobile value-added services provider Comviva to Tech Mahindra and skill development company Centum Learning to Everonn Education.

“Is Vodafone getting into farming and fresh vegetables? Instead, stay focussed and become a world class player,” says Syngal.

“I don’t see why you should attempt excessive diversification in today’s age. Trying to become a Tata or a Birla, which are over a hundred-year-old groups, is impossible. In fact, as capitalism evolves in India, the concept of a ‘promoter’ will disappear over time just like it did from the Western markets. The concept of a promoter group is a relic from the 1950s industrial licensing,” says Aga.

One important tool groups like the Tatas and Birlas have used to manage their conglomerates is to have a management cadre that is groomed over time and rotated across various group companies. Doing so allows for best-practices and learnings to spread across disparate and often unconnected businesses. It also gives greater career opportunities for senior leaders within the same group.

Yet, in spite of his conglomerate vision, Mittal always kept his best leaders within the telecom business. Even when he deputed senior management to newer ventures, they seem to have been unaccompanied by the group’s attention or backing. As a result, many of the managers who went from Airtel to Bharti Retail, ended up quitting within a year or two, including CEO Vinod Sawhny. Even within telecom, the exit of capable and long-term senior leaders like Atul Bindal at a time when the group is short of strategic talent, raises questions.

Most of the joint ventures that have succeeded in India are those where the Indian partner adds something unique to the equation. The falling apart of Mittal’s conglomerate ambitions would, at some level, also dent his sheen as a prospective partner for future endeavours. One wonders if Axa would agree with his famous statement that no partner had ever lost money while working with Bharti.

There are signs of change even in Airtel’s relationship with Singtel, the largest shareholder in the company with over 32 percent stake. For years Singtel was seen as the passive and quiet investor, happy to take a backseat while Airtel decided what to do.

In fact, the managers at Airtel considered Singtel quite “infra dig”, according to a senior person who’s consulted with them over the years. “The feeling among Airtel senior management was always that they knew what they’re doing, and that Singtel being a mature market operator had no clue about India. Hence, it was impossible to convince them for any kind of joint initiatives or programmes with Singtel, be it app store strategies, training programmes or joint vendor negotiations: All those things Singtel does with most of its other investee companies, but not with Airtel,” he says.

Another person who’s interacted closely with Singtel’s senior management says those days might be nearing their end. “While it’s true that in the past Singtel didn’t want to interfere in the day-to-day business of Airtel, today things are different. While they do see a well-run business in Airtel, they also see Vodafone doing an equally good job. I feel that the phase of Singtel giving Airtel a free run and being on-board on all decisions is either over or slowly getting over. They would want more information on the way things are being run,” he says.

An industry watcher likens present-day Sunil Mittal to Naguib Sawiris, the chairman of Egyptian telecom operator Orascom, whose favourite strategy aid was said to be a world map—for identifying countries with high populations and low mobile penetrations to enter.

That sort of a strategy is unlikely to be sustainable, especially in Africa, where Airtel faces entrenched competitors in most countries. For instance, to compete with MTN, Mittal will not just need to create a good telecom network, but also build an equally impressive ecosystem of value-added services.

Fighting all these battles will cost money too. “According to our calculations, the industry will need an additional Rs 3.15 lakh crore of financing by 2015,” says Mohammad Chowdhury, head of PwC’s telecoms practice in India. It stands to reason that Airtel, being the industry leader, must shoulder the largest share of that.

The debt on Airtel’s balance sheet is 2.6 times its EBITDA (earnings before interest, taxes, depreciation, and amortisation), when the average around the region is 1.1 times the EBITDA. Once that ratio crosses 3, bankers will start evaluating Airtel’s risk profile with a much more critical eye. Though he cannot avoid more debt altogether, Mittal is trying to reduce its impact by raising funds by selling off group companies (Comviva, Centum) and lining up IPOs (Bharti Infratel and, possibly, Indus Towers).

Vsevolod Rozanov, CEO of mobile operator MTS India, says the industry’s tough times will continue for another 12 to 18 months, during which he expects a significant slowdown in spending. “In times of uncertainty, no one goes overboard on funding or spending. The only thing that can improve things is consolidation. We currently have nine players plus one more confirmed, RIL, waiting to enter. That is still too much. This market can support a maximum of four, plus the public-sector BSNL,” he says.

It must be mentioned, though, that even with all these dire calculations, Airtel, Vodafone, and Idea are likely to be the survivors when the smoke clears a few years later. And while these three may somehow be able to afford the price of renewed and fresh spectrum, competitors like Reliance Communications, Tata Docomo and Uninor will find it nearly impossible.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)