Pension Plans for the Unorganised Sector

Gautam Bhardwaj has undertaken a tough task: To make sure unorganised India can retire on a pension

Gautam Bhardwaj, 45, used to be an impulsive, hot-headed young man. He dropped out of college because “studies felt boring”. He got a copywriting job with ad agency Trikaya Grey in the 1980s, but quit after a tiff with his boss. He acted in a TV soap Fauji but quit that too. Why? “I was upset being sidelined by this unknown guy called Shah Rukh (Khan),” he laughs. He got married at 24 and found himself without a job and no college degree.

That was in a previous lifetime. Today Bhardwaj talks about retirement and pensions, not for himself though. He wants the poor, unorganised working class in India to have a shot at leading a comfortable life after the age of 60. It’s a remarkable goal given that retiring would be the last thing on their minds as they struggle to make ends meet on a daily basis.

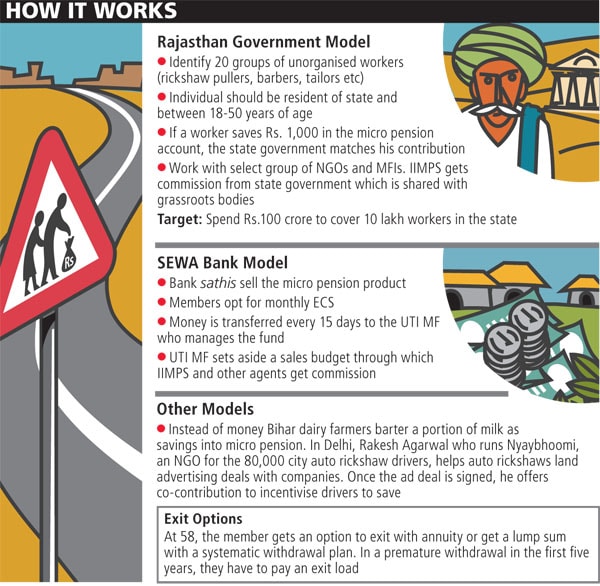

Yet, in the last four years over 200,000 workers from the unorganised sector have signed up to his ambitious micro pension scheme. Hard selling, a grassroots level reach and low transaction costs are responsible for his success so far. His outfit, Invest India Micro Pension Sevices, is present in nine states.

He has created a strong ecosystem. State governments, international organisations like Asian Development Bank and KfW Bank, co-operatives and NGOs are partnering him.

Challenges are abundant. The most difficult one is getting agents to sell the idea as commissions are small. Premature withdrawal and closure is also a serious problem. But Bhardwaj is optimistic he will succeed. This idea has been on his mind since a decade.

The Idea Takes Seed

In 2000, Bhardwaj began work on the OASIS (old age social and income security project) report for the government. As a consultant, Bhardwaj helped out with the implementation logistics of the New Pension Scheme (NPS).

While working on OASIS Bhardwaj met U.K. Sinha, a joint secretary in the finance ministry overseeing pension sector reforms. Sinha was equally passionate about pension for poor. But they were unable to take it further. In 2006 Sinha took over as MD at UTI AMC. UTI AMC was ready to manage a micro pension fund. The Self Employed Woman’s Association Bank (SEWA) with 12 lakh members was on the lookout for a pension product and Bhardwaj was ready to connect the dots. The micro pension experiment had begun.