Media Agencies Are On The Ropes

Marketing clients are beginning to raise uncomfortable questions about both performance and practices. And media agencies are clearly feeling the heat

Reckitt Benckiser owns some of India’s best selling cleaning brands like Harpic, Colin and Dettol. In June this year, it mixed all of them together in one big metaphorical bottle and emptied it on top of MPG, its media agency. Reckitt thought its new blockbuster, all-purpose cleaner — putting up its media account for review just seven months after awarding it to MPG — would help eliminate all the grime, grease and hodge-podge in its media buying operations, one of the largest in India at an estimated $40 million per year. At over 12 percent of its sales, that was one of its largest expenses and there was pressure to either reduce it or get more results from it.

Illustration: Sameer Pawar

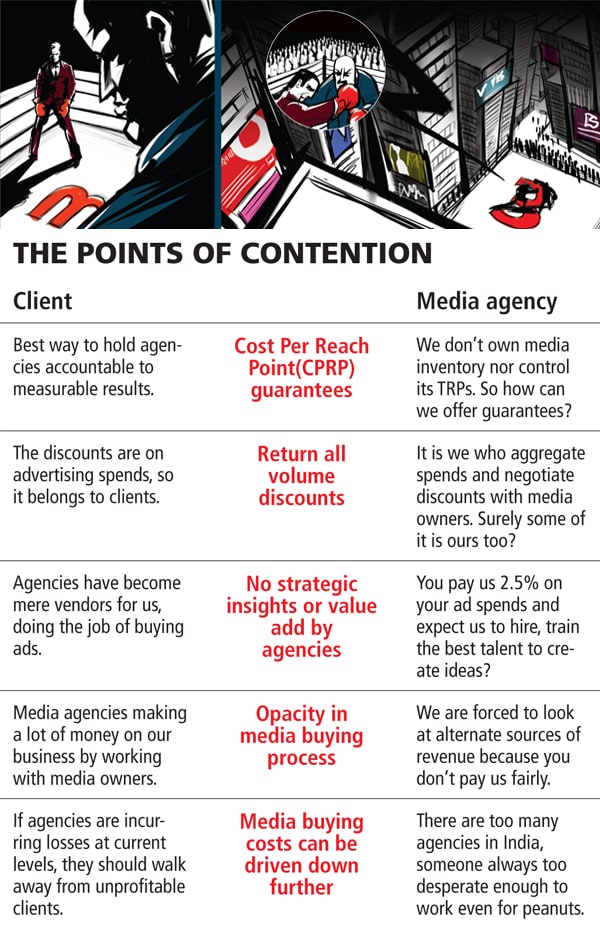

In the normal course, this event would not have made much news because advertisers keep evaluating, benchmarking and changing their media agencies every few years. But this wasn’t normal course, because Reckitt had expected bidders to meet three significant conditions: Any agency that wanted to pitch would need to pay Reckitt $10,000 for the privilege of doing so; the winner would need to guarantee a certain level of Cost Per Reach Point, or CPRP, an advertising metric that computes the average cost of reaching one percent of an advertisers target TV audience; finally the winner would also need to pay back 2.5 percent of the overall spend back to Reckitt itself by negotiating that discount from media owners.

The Advertising Agencies Association of India (AAAI), a nationwide nodal body representing advertising and media agencies, promptly forbade all its members from bidding because it saw the conditions as harmful for agencies.

But that hasn’t stopped local incumbent MPG (part of the Havas Group) and international incumbent ZenithOptimedia (part of the Publicis Group) from bidding. Reports on trade sites like exchange4media.com talk of other agencies too that are bidding for Reckitt’s business, but so far there is no official word.

The battle lines are drawn. “This is a response to the environment. Agencies cannot demonstrate the value they bring. Hence, clients are discounting them on cost,” says Meenakshi Madhvani, founder and head of media audit company Spatial Access. Media agency heads don’t quite agree. “This is a very short term approach and I don’t see how anyone can build a business on such terms. But because there are too many agencies trying to build scale now, everyone wants a piece of the action,” says Ashutosh Srivastava, the Asia-Pacific head, media agency Mindshare.

“The core of this problem is that mutual respect, accountability and trust between clients and agencies are all much lower today compared to five, ten years ago,” says Ravi Kiran, the South Asia head of media agency Starcom MediaVest.

But secretly — over espressos in cafes, mugs of draught beer in bars and cigarettes outside their offices — everybody is talking about how the Reckitt pitch could open a Pandora’s Box for media agencies.

Race to the Bottom

Here’s a funny thing: Of the three clauses in the Reckitt bid document the one that is causing the greatest consternation among agencies is the first, or having to pay Reckitt first to be able to bid for its business. But what Reckitt is doing, essentially putting up a monetary barrier so only those genuinely interested in working with it come through the gate, isn’t either novel or unfair. Besides, the amount being asked for is chump change for any of the large agencies, especially when you consider what the Reckitt business might be worth. So when agency executives keep harping about the $10,000 pay-to-play clause as the main reason why the Reckitt bid is evil, it’s fair to wonder: Have they fallen for a red herring or are they creating one?

Instead it’s the other two clauses — CPRP guarantees and returning of volume discounts — that should be scaring the living daylights out of them. Taken together, both represent an attempt by Reckitt to see how far it can push agencies on cost before everyone throws up their hands.

“The question is how much is enough or how little is too little? The band clients pay us today is between 2.5-3.5 percent; five years ago, it was around 4 percent. Everything else remaining constant that means I am earning 33 percent less. And which of our costs have gone down? Salaries, research costs, rentals, execution costs have all gone up. Only laptop costs have gone down!” says Kiran.

Judging from the Reckitt’s bid document though, clients don’t seem to share Kiran’s concern. In fact, they quite clearly want to reduce agency fees even further.

“I have zero sympathy for agencies who say they aren’t remunerated adequately. Then they simply shouldn’t bid. What Reckitt is doing is trying to establish a simple supply and demand equilibrium. It’s a negotiation till it settles to both parties satisfaction,” says the marketing head of a large multinational consumer goods company, on condition of anonymity. But the problem is both sides are now locked into an adversarial zero-sum relationship where gains for one are nothing but losses for the other, a race to the bottom.

At a recent trade conference in Delhi, Rahul Welde, Unilever’s VP of media for Asia, Africa, Turkey and Middle East, set the cat among the pigeons when he described media as a commodity that could just as well be handled by the procurement department. And almost on cue, a host of leading clients are either calling for media reviews to play off one agency against another or explicitly demanding lower rates from their incumbents.

On their part, agencies seem to be falling straight into the trap. “The kind of fees clients are paying agencies — between 2-2.5 percent — is ridiculous. But many agencies accept even lower fees because they can make 3-4 percent from other places,” says Madhvani.

Illustration: Sameer Pawar

And the question that still remains is: If Reckitt’s terms are unprofitable to agencies, why are they bidding?

Skeletons and Monkeys

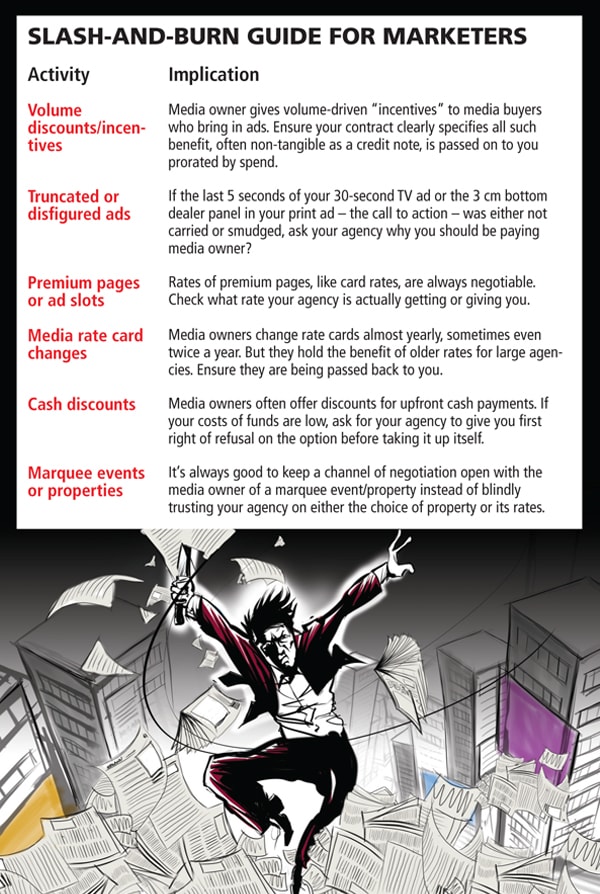

There is a skeleton in the agency basement nobody wants to talk about. Known by various names — volume discounts, commissions, incentives or rebates — it is actually an incentive (the less charitable use the word “kickback”) given by media owners to agencies for funneling all their client spends to their channels. The quantum of the discounts, ranging from 0.5 percent to as high as 6 percent, is negotiated annually depending on how much additional business agencies can bring. The larger the agency, the more volume discounts it can demand.

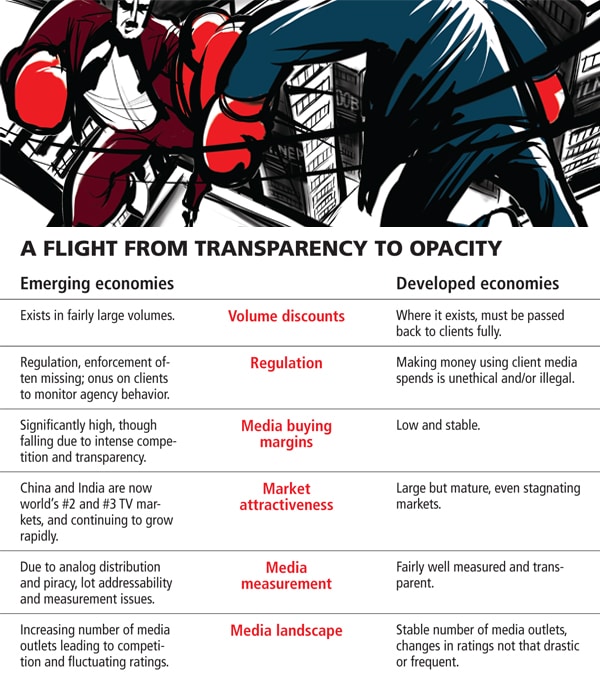

But here’s the thing — it would be illegal in most developed markets for agencies to keep any of this money. Fifteen of the largest media agencies in Europe are currently under investigation for retaining client volume discounts for themselves. In the US, most large media agencies have paid tens to hundreds of millions of dollars back to their clients to settle allegations of volume discount fraud.

Legality apart, there is a serious conflict of interest when media owners pay agencies to choose their channels.

“You can call it volume discounts or cutbacks, but if agencies earn money through this route then they might push wrong deals or channels for clients. This should not be an earning model for them,” says Harsh Agarwal, one of the directors with personal care products maker Emami and the person in charge of its media buying. Some agency executives’ counter that these discounts are possible because of their effort in aggregating spends across multiple clients and using them to negotiate hard with media owners.

“The jury has been out on this argument for 100 years now. But the fact is no one can go up on a stage in front of clients and defend this argument, because there is no argument. The whole premise of volume discounts is based on incremental volume for media owners, so it puts agency’s interests above that of clients,” says Kiran. In India, the practice isn’t yet illegal, unless explicitly part of a contract between the agency and the client. Most agencies have for years been following a “not asked, don’t tell” policy about volume discounts, quietly banking most of it, unless specifically asked to return it by clients. But because many clients, especially the small and medium-sized ones, did not know about the extent of volume discounts sloshing around, they never asked for them.

“This is not a subject most marketers are aware of, but they must be,” says Madhvani. “This is why India and China are so important for international media groups, because increasing transparency and declining margins in the West is pushing them to the opacity and “other sources of revenue” in the East.”

Reckitt’s solution to this issue is interesting. Instead of asking for actual volume discounts to be passed back, it has set a hard target for the amount: 2.5 percent. This means any agency that wins its business will need to work hard to negotiate at least that amount from media owners to avoid making up the shortfall from its own pockets.

Not so interesting was its condition to force value out of media buying: CPRP guarantees. At its simplest, CPRP is the percentage of an advertiser’s target audience his ad reached divided by the cost of running it. CPRP guarantees represent a commitment by media owners that a bouquet of their channels will deliver a certain number of TRP ratings over a period for advertisers, failing which free ads would be given to make good the difference.

“Guaranteeing CPRPs could possibly mean refunding $10 million when your fee is only $100K. What kind of a business model is this? Besides, some clients are asking us to act like principals when we really acting as agents on their behalf. At the same time, they are ‘telling’ us not to own media inventory. That sounds illogical, to be asked to act like principals without being allowed to manage your own risk,” says Ashutosh Srivastava.

“Though CPRP is the right metric to judge a media agency, it is also very dynamic and may not be in the control of the agency. Asking them to guarantee CPRP is like asking your financial advisor to promise you exact returns, he can only give you a range. It would therefore be prudent to put a CPRP range instead in your contract,” says Vivek Sharma, the chief marketing officer for Philips India.

However untenable it may be, agencies may have queered the pitch by promising them to clients during a pitch. That might have made sense in the past when agencies were able to pass the monkey of guarantees to media owners’ backs. Over the last decade many channels, usually new or less popular ones, took the bait.

Sony Television, for instance, is reported to have offered attractive CPRP guarantees to Hindustan Unilever (HUL), India’s largest marketer, and its media agency Fulcrum, at various points during its existence to ensure it cornered a large part of HUL’s media spend. Some of these deals backfired as well, forcing Sony to run free HUL ads for extended periods.

Illustration: Sameer Pawar

Media owners also had no upside, if TRPs went up beyond what was promised. “Agencies looked at CPRP deals as a way of shifting the risk, not sharing it,” says Kiran. As a result, many media owners have wizened up towards CPRP guarantees over the last few years. The result: With the Reckitt bid, the monkey of CPRP guarantees has now returned to the agency’s back.

“If agencies are promising results, then holding them responsible needs to be through CPRPs. When an agency says “Hire us because we will guarantee better results than competition,” how do you capture that in the contract? They should then not promise this during the bidding stage,” says Hemant Kalbag, a Partner with consulting firm A.T. Kearney who’s working with multiple consumer goods companies on measuring media effectiveness.

A Fair and Transparent New World

Is there a way out of this downward spiral of distrust? Yes, but both sides will need to alter their business-as-usual behaviour for that. The main issue, however, is how clients will compensate their agencies in a manner that is fair without letting go of performance-linked bonuses or penalties. The answer to that, say most experts, is moving to a fee-based model.

“Most agencies have historically worked on a commission basis but many are now moving to a cost-plus model wherein clients pay them a certain margin and bonus based on actual resources deployed. Media spends then become irrelevant. Many of our clients have accomplished this very successfully,” says Kalbag.

Already, the larger clients are demanding greater visibility into the costs and structures of the agency. “Media agencies as a supplier have not been subject to the same rigour and analysis as any of my other suppliers. I could agree on a cost-plus or fixed-fee or cost-to-cost model, but the uncertainty is kickbacks from media owners to agencies,” says the same marketer quoted earlier. The excessive, even morbid fascination with CPRPs and rate negotiations also needs to be toned down. “During the last few years buying and negotiation has become so glamorous that many clients think that is all. That has commoditised the discipline and dumbed down the product with many agencies now only paying lip service to strategy and deflecting fundamental questions about how consumer behaviour is changing,” says Kiran. “CPRP is not the only parameter to judge planning or buying. The world is moving towards impact buying, content integration with brands and social media,” says Philips’ Sharma. “I think the relationship has to go beyond numbers, on to trust and long term partnerships. We have to respect ideas from media agencies and ask ourselves — if an agency buys a small property which later becomes big as a result of which you save a lot of money, how do you recognize and reward such an achievement?”

“The business of advertising was always client centric. It was that approach that made it so strong, robust and meaningful. Today it is very bottom-line oriented with only lip service for clients,” says Madhvani.

But here’s 2.5 percent of $40 million question: Cannot the two co-exist?

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)