Rise of the Coal Bill

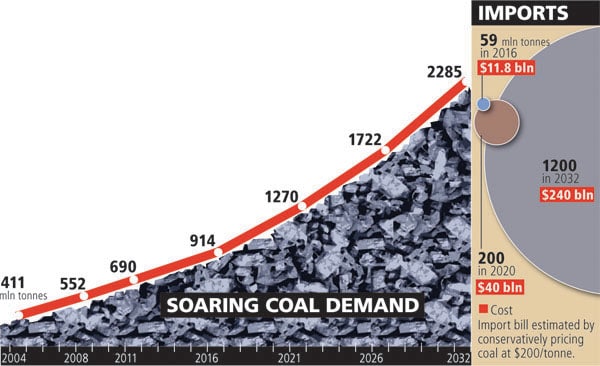

Over the next seven years, 50 percent of India's coal will come from foreign lands. A look at the implications of a $40 billion coal bill

Where Will We Get It From?

The 2 00 to 300 million tonnes that the country will need, can be imported from Indonesia, Africa and Australia. Essar Group recently did a $600 million buyout of US-based Trinity Coal. Tata Steel and Riversdale Mining are investing $270 million to develop the Benga Coal project in Mozambique. JSW Steel Ltd has said it may spend $500 million to buy coal mines overseas. Reliance Power has acquired coal mines in Indonesia and Tata Power and Adani Power will import coal from there. Coal and Oil group imports coal from many countries.

00 to 300 million tonnes that the country will need, can be imported from Indonesia, Africa and Australia. Essar Group recently did a $600 million buyout of US-based Trinity Coal. Tata Steel and Riversdale Mining are investing $270 million to develop the Benga Coal project in Mozambique. JSW Steel Ltd has said it may spend $500 million to buy coal mines overseas. Reliance Power has acquired coal mines in Indonesia and Tata Power and Adani Power will import coal from there. Coal and Oil group imports coal from many countries.

How Will We Transport It?

India simply does not have enough port linkages and dedicated freight corridors (DFCs) from the ports to the power plants. The only DFC that is currently being implemented will cater to the needs of west and north-west India. The railways also do not allow private parties to run their own railway linkages from port to plant. This could push up the price of coal delivered to plants far away from the coast, and could also compel them to opt for larger inventories of coal. The railway earns almost 45 percent of its income through coal freight, and supplies it through its merry-go-round (MGR) routings.

INDIA’S POTENTIALLY HUGE COAL IMPORT BILL

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

Much of the coal supplied by CIL is at notified prices which are half the market prices. CIL allows 10 percent of its coal to be sold with the reserve price fixed at 80 percent above the notified price. So the entire energy sector is split into two parts — one that is market driven, and the other, politically driven. Coal prices are decided by the government, at prices way below market-prices. With 70 percent of the coal coming through market pricing — through imports — the country will face a situation where some players can claim bumper profits just because they have got coal at these discounted prices.

Much of the coal supplied by CIL is at notified prices which are half the market prices. CIL allows 10 percent of its coal to be sold with the reserve price fixed at 80 percent above the notified price. So the entire energy sector is split into two parts — one that is market driven, and the other, politically driven. Coal prices are decided by the government, at prices way below market-prices. With 70 percent of the coal coming through market pricing — through imports — the country will face a situation where some players can claim bumper profits just because they have got coal at these discounted prices.