50-paise-a-minute Calling

The 50-paise-a-minute scheme could be the catalyst for the telecom industry to head for consolidation

With telecom companies coming out with new calling plans every other day, Vodafone and Reliance’s 50-paise-a-minute scheme for both local and STD calls might have been shrugged off by many as just another scheme. But the move is likely to prove to be a game changer for the telecom industry. Especially now that Airtel and Tata Indicom also seem to have jumped into the pricing game.

Saurine Doshi, telecom business head and managing director of consulting firm A.T. Kearney, feels that the new call costs will be profitable to only the top three players — Airtel, Vodafone and Reliance — in the short run. He says, “This is, perhaps, the first sign that the larger players are aiming to consolidate the market.”

Globally, mature markets have three or four players who share the market among themselves. In India, thanks to a policy that kept changing over time, there are eight to 10 players in each circle.

Some of these players, who were awarded licences last year, are yet to launch services because of lack of spectrum availability. Doshi feels if the pricing pressure continues and revenues contract, some of these new players may want to merge or exit the business.

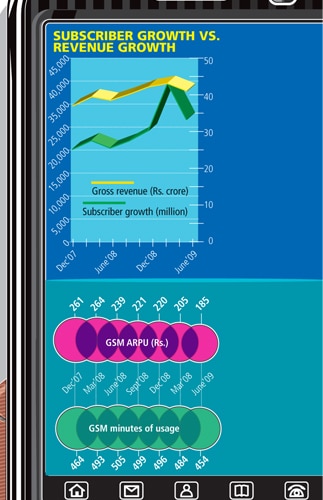

There are a couple of facts that support this argument. For starters, according to the telecom regulator TRAI, in the April-June 2009 quarter, the industry’s gross revenue fell by 3.3 percent over the previous quarter. This is only the second time in recent history that the sequential quarter revenues have fallen for the industry. The fall comes even as the players added 35 million new subscribers during the same period.

“This quarter is an inflection point because the growth in subscribers has not compensated for the reduction in ARPU (average revenue per subscriber) and MoU (minutes of usage), as the case used to be earlier. Operators now need to closely examine the value brought in by the incremental customer and contrast this with the revenue lost from the existing customer base due to aggressive pricing” says Rajesh Patnaik of consulting firm PRTM.

There is also a belief that the new 50 paise rate is the rock bottom rate that a company can offer to make calls. Today, mobile firms have to pay 20 paise as termination charges if a call emanating from their network ends up in another player’s network.

Since large players are bound to have more calls landing in their networks, a small or a new player’s outgo will be more than what it makes from incoming calls.

Further, there is a belief that the industry will be further divided into “have and have nots” when the few 3G and Wi-Fi licences are allotted in the coming months in 2010. If these licences are cornered by the large and more cash rich players, analysts feel that smaller companies will be left with a smaller pie of the market to contend with.

A senior executive in Tata Teleservices who did not wish to be named says, “Since the churn in the industry is still high, if growth in telecom revenues continue to remain, the next stage will be for stronger players to drive the new ones out of market.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)