India-Canada row: Multibillion-dollar trade pact put on hold, but investors breathe easy

Deep-pocketed investors seem to have shrugged off the ongoing diplomatic spat between the two countries, but a proposed treaty to boost bilateral trade is off the table for now

India's Prime Minister Narendra Modi (R) and his Canada counterpart Justin Trudeau shake hands during a bilateral meeting after the G20 Summit in New Delhi on September 10, 2023. Image: PIB / AFP

India's Prime Minister Narendra Modi (R) and his Canada counterpart Justin Trudeau shake hands during a bilateral meeting after the G20 Summit in New Delhi on September 10, 2023. Image: PIB / AFP

The diplomatic spat between India and Canada over the alleged killing of a leader of a separatist group has strained relations between the two nations and put a trade pact on shaky ground. Tension further escalated when, in a tit-for-tat move, New Delhi expelled a Canadian diplomat after Ottawa asked an Indian official to leave. The ongoing row casts a potential shadow on the progress of trade and investments between the sparring countries, but it hasn’t spooked long-term investors or dented their confidence.

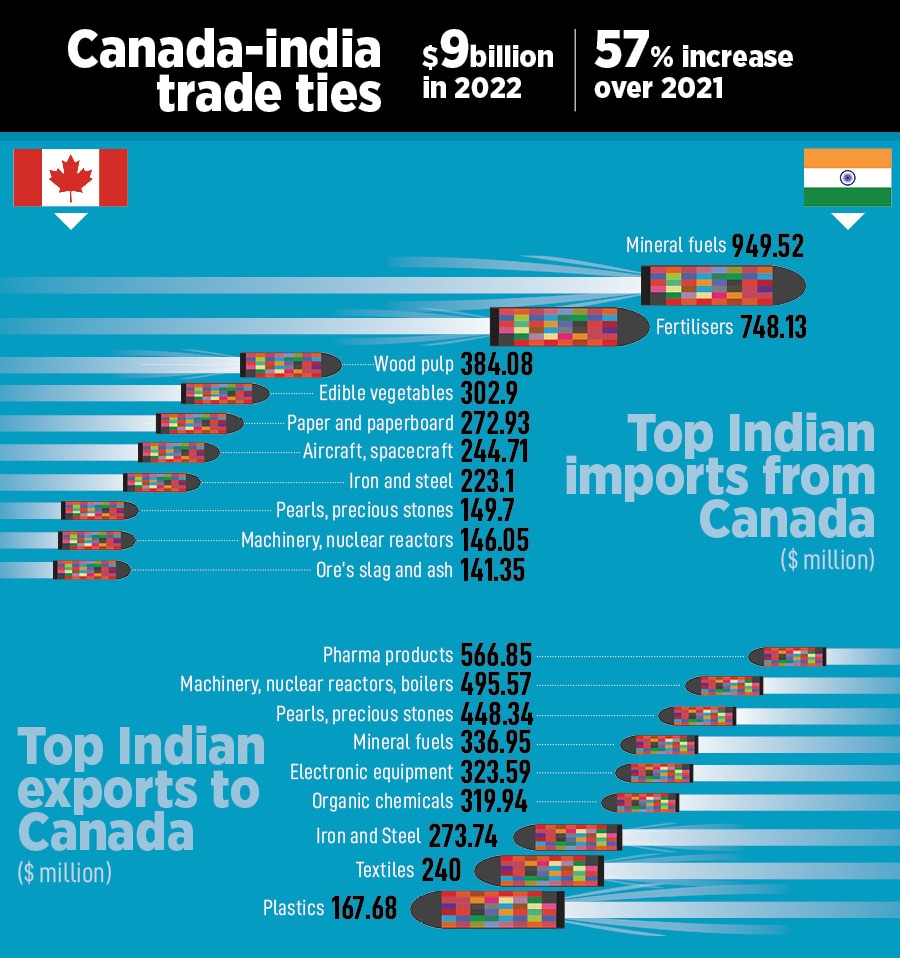

According to the government of Canada, bilateral trade between the two countries touched $9 billion last year. This is a rise of nearly 57 percent over the previous year. This is 0.7 percent of India’s total global trade. The proposed India-Canada Comprehensive Economic Partnership Agreement (CEPA) aimed to boost trade by as much as $6.5 billion in the coming years, but negotiations came to a screeching halt this month. Now, some companies and traders are wary of supply snags if the situation takes a turn for the worse. For example, the bulk of India’s imports from Canada includes fertilisers and fossil fuels, such as coal and coke, pegged at about $1.7 billion (see table). In recent years, Canada has also become India’s largest supplier of red lentils or masoor dal with imports to the tune of $370 million in FY23.

According to the government of Canada, bilateral trade between the two countries touched $9 billion last year. This is a rise of nearly 57 percent over the previous year. This is 0.7 percent of India’s total global trade. The proposed India-Canada Comprehensive Economic Partnership Agreement (CEPA) aimed to boost trade by as much as $6.5 billion in the coming years, but negotiations came to a screeching halt this month. Now, some companies and traders are wary of supply snags if the situation takes a turn for the worse. For example, the bulk of India’s imports from Canada includes fertilisers and fossil fuels, such as coal and coke, pegged at about $1.7 billion (see table). In recent years, Canada has also become India’s largest supplier of red lentils or masoor dal with imports to the tune of $370 million in FY23.

Also read: India bond Inclusion in JP Morgan index may trigger $20-40 billion flow. Is it enough?

After urea and phosphate, potash is the third most-used fertiliser in India, and reportedly, Canada-based Canpotex is one of the main suppliers of potash, a key fertiliser ingredient. Three domestic companies—Coromandel International, Chambal Fertilisers and Indian Potash—majorly depend on an MoU signed with Canpotex in September 2022 for the annual import of around 1.5 million tonnes for three years. However, in an interaction with Reuters, PS Gahlaut, managing director, Indian Potash, said, "We don't expect any impact on our potash imports from Canada. Canpotex's deals with Indian companies are commercial contracts. So far, it is business as usual for us."

Canada relies on India for a big chunk of its pharmaceutical exports. As per UN Comtrade data, Canada buys pharma products worth over $566 million from India. Other major exports include machinery, boilers and nuclear reactors to the tune of $495 million. Iron, steel and textiles are also among India’s top exports to Canada (see table). Although the negative sentiment hasn’t had an impact on trade, the industry is watching the developments closely.

Canada relies on India for a big chunk of its pharmaceutical exports. As per UN Comtrade data, Canada buys pharma products worth over $566 million from India. Other major exports include machinery, boilers and nuclear reactors to the tune of $495 million. Iron, steel and textiles are also among India’s top exports to Canada (see table). Although the negative sentiment hasn’t had an impact on trade, the industry is watching the developments closely.