Competition set to intensify as Aditya Birla Group-owned Grasim enters paints market

With six manufacturing plants, Birla Opus set to add 40 percent to industry capacity, targets Rs 10,000 crore revenue within three years

Image: Shutterstock

Image: Shutterstock

About 100 km from New Delhi in Panipat, Haryana, the Birla Opus Paints factory is a hive of activity. The manufacturing plant, which will offer decorative painting solutions from March onwards, has commenced full-fledged production. Aditya Birla Group's flagship firm, Grasim Industries, has launched the new paint brand with an investment of Rs 10,000 crore. On February 22, during the inauguration, Kumar Mangalam Birla said the group is set to disrupt the paint industry with a 40 percent addition to industry capacity and is targeting Rs 10,000 crore revenue within three years.

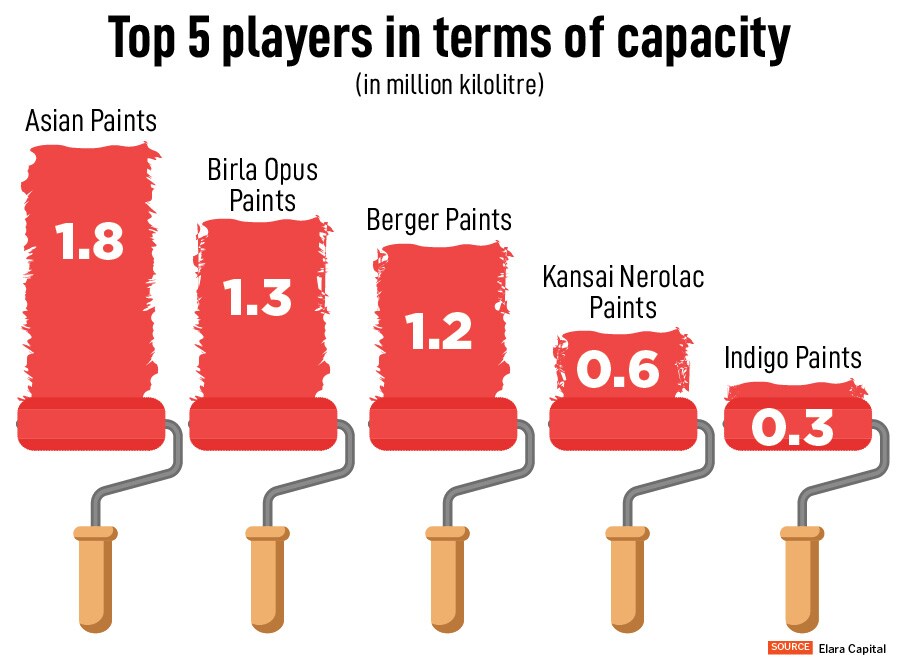

Birla Opus has six fully automated and integrated manufacturing plants with a total commercial capacity of 1,332 million litres per year. The company has currently started production at three plants in Panipat, Ludhiana in Punjab, and Cheyyar in Tamil Nadu. The other three plants—in Karnataka, Maharashtra, and West Bengal—will commence production over the course of FY25. Each of these factories has a capacity of about 200 million litres; one of the factories also has a capacity of 30 million litres of solvent. The ones that are up and running have about 630 million litres of capacity. At full capacity, Birla Opus will be become second in terms of capacity, ahead of Berger Paints.

The products will be available in Punjab, Haryana, and Tamil Nadu from mid-March and across all 1 lakh population towns in India by July. The company aims to expand its distribution to over 6,000 towns by the end of the fiscal year. Birla Opus claims this will be the fastest and widest pan-India launch by any paint brand. The brand will be offering 145 products and 1200 SKUs across water-based paints, enamel paints, wood finishes, waterproofing, and wallpapers. It has multiple category offerings, from economy, premium, and luxury to designer finishes and institutional clients. Birla Opus will also present a range of 2,300 tintable colour choices.

Rakshit Hargave, CEO, Birla Opus, said, “On the back of strong in-house R&D and extensive field validations, Birla Opus is committing to a higher product warranty than the leading players across most water-based products. Birla Opus is also setting a benchmark by offering a first-time warranty on enamels and wood finish products. As part of the inaugural offer, consumers will get an additional 10 percent volume on water-based products, and contractors will get loyalty benefits across most of our products.”