Intuit: Innovate to Keep a Firm fresh forever

How does a mature company keep growing? For innovative Intuit, the formula is simple: Think young, experiment like crazy and let the best ideas win

It’s lunchtime at Intuit in Mountain View, California, and the company’s almost daily ritual is underway in the cafeteria: Office hours with Scott Cook. Intuit’s billionaire co-founder perches on a stool in his everyday wear of running shoes, a button-down oxford shirt, canvas jeans and a Swatch as four product managers explain their new idea, code-named Peppermint: An online marketplace like Craigslist that would allow hair salons, landscapers and dentists, or any of the 50 million small businesses that use Intuit’s QuickBooks accounting software, to connect with potential customers under the halo of being ‘Intuit-certified service providers’.

On a table between Cook and the Peppermint quartet is a giant piece of white oak tag divided into little boxes labelled with the big questions: What’s your idea? What’s your vision? What’s your leap-of-faith assumption? What’s your hypothesis? The upper rows of boxes have fluorescent pink and yellow Post-it Notes in them scribbled with answers.

There are dozens of such projects and experiments going on across the company. Cook meets monthly with 14 or 15 similar teams, meaning that most of his workday lunches are occupied by one brainstorming session or another. Right now this one isn’t going so well. Cook gently interrogates with his lips pursed and hands held out over the oak tag.

How are you going to vet the service providers?

We could use credit scores or Yelp ratings.

Okay. How would you show if there’s buyer dissatisfaction?

We could let people know by looking at how often their customers switch.

But they’ve already switched. That’s a lagging indicator.

We know people are interested in the service.

To prove the market interest, the quartet had set up a Google AdWords campaign, spending a couple of hundred bucks on a text ad that ran next to searches for dentists, hair salons and landscapers. It read: “Intuit-recommended service providers to meet your everyday needs” and linked to a dummy webpage thanking the visitor for being part of a study making QuickBooks better. They figured 10 percent of the ad click-throughs would yield a signup. It turned out 20 percent did.

That’s good, replies Cook, but what does ‘Intuit-recommended’ mean? How do we reliably vouch for them? You really have to test what you can deliver. It’s not the right test. I’m not sure I believe the results if it comes up positive.

The Peppermint quartet looks crestfallen, but they agree Cook is right. They pack up, promise to tighten their idea, do some testing with real businesses and go through some more trial and error. With a little bit of money and in a short amount of time, a new product idea at Intuit stepped toward viability.

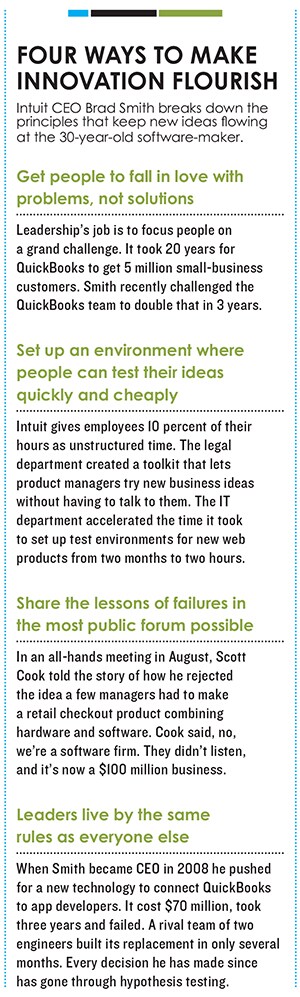

This is how things get done at the software company. In the last few years Cook and CEO Brad Smith have recast a big tech firm, with $4.1 billion in revenue and $17 billion in market valuation (similar to Yahoo’s), in the image of a startup: Fast-moving, embracing uncertainty, continually learning. And it’s worked: Intuit is making its second appearance this year on Forbes’ annual list of the world’s 100 most innovative companies, moving up 27 spots to 57. New ideas are put to test constantly. In 2006 the TurboTax group experimented with just one tweak to the website during the 100-day tax season. This season they ran hundreds of tests. Intuit tells Forbes that more than $100 million of its revenue in 2012 came from products that didn’t exist three years ago—a tenfold increase from 2010.

Plenty of companies are a religion, where people take their cues from the top. Intuit is a science lab, where anything can be tested and proven incorrect. “When you have only one test, you don’t have entrepreneurs; you have politicians. When you have lots of ideas you have entrepreneurs,” says Cook.

He’s found a kindred spirit in Smith, who became CEO in 2008. “Genius and a thousand helpers are not going to solve the problems of today or tomorrow,” says Smith, 48, who speaks quickly with a ready smile and a West Virginia twang. (He grew up in Kenova, West Virginia.) “There are very few Steve Jobses out there. We run small teams and lots of rapid experiments. No politics. No PowerPoints.”

Intuit had to adopt this fast mode. It faces a challenging growth prospect. Close to one-third of the US economy already flows through its software via payroll, invoicing and taxes. How much more can it get? The small business economy is as tepid as the economy overall. Intuit’s two biggest products, QuickBooks and TurboTax, which produce over half of its revenue, already locked up their fairly mature markets. QuickBooks has more than 90 percent retail market share for small business accounting software. TurboTax has 90 percent of consumer federal tax app sales.

The plan it is deploying in startup time is a move to the cloud and to mobile. In the past three years, Intuit has made a priority of replacing the no-growth packaged software business with faster-growing online versions of its big hits and with subscription services such as online and mobile banking software. Of Intuit’s 60 million customers, more than 45 million now use online or mobile versions of its software, up from 10 million in 2008. Seven million of those 60 million are active mobile customers.

Avoiding the physical delivery of its software has done wonders for its income statement. Return on invested capital since Smith took over the top job in 2008 has risen from 14.7 percent to 24 percent. Its shares have doubled in the past five years, while the Nasdaq is up only 20 percent. The shift to the cloud and the smartphone also gives Intuit a big opportunity to mine all that online spending and hiring data that can fuel new products and service ideas, and sell customers upgrades like payroll management and online banking.

In mobile Intuit has built 55 apps, teaching it the thorny task of making money from the phone. Its SnapTax app, which takes a picture of your W-2, charges you $24.99 to file it as your federal return. Intuit gets subscription fees from its mobile banking clients (“The other 14,995 banks in the US,” says Smith). Snap Payroll is a free app that calculates paychecks for new employees in minutes but also acts as a lead generator for the paid versions of Intuit Online Payroll. Mint’s iPad app updates your financial life every four hours and targets offers for credit cards and savings accounts.

Forbes’ innovation methodology, done in partnership with HOLT, a division of Credit Suisse, centres on investors’ confidence in a firm’s ability to come up with new revenue ideas. Intuit’s revenue is up 10 percent over the past 12 months. Smith wants to keep moving up. His goal: Add $1.5 billion in new revenue over the next three years, implying a growth rate one or two points faster than the last three years.

The year Smith took the top job, Intuit had just begun a programme of workshops called ‘Design for Delight’ which teach employees how to think more creatively through experiments and to embrace what’s called ‘deep customer empathy’. In 2008 Intuit ran one workshop. In 2009 it held 27; in the last 12 months, 700. They’re led by a cadre of 160 people who have regular day jobs but spend 10 percent of their time as so-called innovation catalysts. A workshop can mean wacky brainstorming sessions in which managers roll on the floor pretending to be silent ninjas or wear Cabbage Patch Kids hand puppets while pretending to talk as a real customer.

A group of employees testing Intuit Financial Services’ mobile banking app spent a day in July at the Chevron Federal Credit Union in Concord, California, selling cupcakes for $2 each if paid for with cash or $1 if purchased with the app (which they were more than happy to demonstrate). The app is not even fully built—they just wanted to see if people have it or would bother to take out their phone to use it. The ‘willingness’ test is crucial to continuing with a new product’s development. Why bother if no one cares? The trick is to figure that out fast and inexpensively.

Since the publication of The Lean Startup (Crown Business, 2011), Eric Ries has become a Silicon Valley guru for entrepreneurs who, using little or no money, strive to turn an idea into a company. He makes a compelling case for companies to recognise that markets are too uncertain and time too precious to drag out decision making about what customers want and what products to build. Just do the best you can and keep getting better. (The principle doesn’t always apply. See under: Airplanes.)

But Intuit, with 8,000 employees, has also embraced Ries. The relationship began three years ago, when someone from Intuit videoed him speaking at the Web 2.0 Expo in San Francisco. Cook saw the clip and showed it to Smith. Neither at the time was happy with the data on Intuit’s product development process. An assessment completed in early 2008 showed that only 4 out of 50 products introduced in the prior decade achieved $50 million in revenue.

Cook asked Ries to talk to the troops, but Ries wasn’t interested in big companies and their problems. “But when Scott Cook calls you, you do what he says,” Ries remembers. As soon as Ries finished addressing 2,000 employees, Smith popped up and said, “Folks, remember Eric’s definition of a startup: ‘A human institution designed to create a new product or service under conditions of extreme uncertainty.’ We match up with that exactly.”

Ries was taken aback that Smith would say that, so much so that he devoted the entire first chapter of his book (including this story) to Intuit to make the point that no matter what size a company is, it can innovate if the senior management supports it.

“All the people I’ve met there, there’s no ego; they’re not afraid to change their behaviour,” says Ries. “I saw one senior guy whose idea they’d been working on for nine months get disproved in a day because someone had a better way. He got up in front of everyone and said, ‘This is my bad. I should have checked my hypothesis earlier’.”

One project inspired by Ries’ ideas is what’s called the Lean StartIN. It’s an intense two-day product brainstorming session in which three- to five-person teams are expected to come up with an idea and a series of tests to prove its merit. The first one was held in January in San Diego with 11 people. The next one, in February, had 52 people present at the company’s Mountain View headquarters, with Smith as chief judge.

To be sure, not everyone buys into it. Ries has met plenty of line employees who roll their eyes and say the equivalent of “Yeah, right” or are unhappy with the projects they’re working on. “But Intuit is proof that a little bit of the right mentality goes a long way.” Take the case of Mint, the easy-to-use personal finance website that Intuit snapped up in November 2009 for $170 million. Mint showed up Intuit with its far simpler execution of a financial dashboard, connecting all of the user’s bank, investment and credit card accounts. Mint’s founder, Aaron Patzer, was initially worried he was going to lose control of his baby. “Every startup fears being sucked up by the Borg,” he says. “But they told me I could run it as I saw fit, and they held true to their word.”

For a couple of years he oversaw the $100 million personal finance group that included Mint, Quicken and Quicken Bill Pay, but by 2011 he was itching to get back to product design and engineering. So Brad Smith granted him the role of making Intuit’s biggest products as easy as Mint is to set up for the first time. At the time the setup of QuickBooks’ desktop version had 45 screens of text that, in Patzer’s observation tests, few users ever took the time to read. QuickBooks’ engineers told him people had asked for each of the screens. Patzer ignored them and cut the setup down to three screens, burying any extra text behind a click. He kept in mind one of Marissa Mayer’s principles: Leave in any feature that more than 20 percent of people use and get rid of anything that fewer than 5 percent of people ever use.

One idea that came out of the Lean StartIN competition was called Mint PayBack, devised as a simple way for Mint users to get their friends to pay them money owed for things like groceries, rent, restaurant bills. They came up with a simple test to see if anyone would use it by creating a dummy page called mint.com/payback and tweeting the web address to its thousands of followers. Several dozen clicked on the address and saw a page that asked for their and their friends’ email addresses and the amount requested (minus a 50-cent fee). The rate of recipients clicking on the link was a lot higher than they had expected, so they designed a software to connect it to the real Intuit payments network, and in over three weeks collected $597 in fees. Twenty-four percent of the people using it weren’t even Mint users. The service is likely to become a real offering soon. The Lean StartIN programme is now graduating to a full world tour, with the goal of creating 100 ‘startups’ in 100 days, from which maybe 10 new products will be born.

Nearly 30 years after he came up with Quicken, Scott Cook is convinced that one of these new products can perhaps be as transformative for Intuit as that original cash cow. The place he has seen the most dramatic leaps in innovation from the bottom has been in India, where the company had no established habits in product development. One experiment that delivered crop price information to mobile phones through text messaging now has close to 1 million farmers using it across three states. Some users have reported close to 20 percent jumps in their take-home pay. “Human behaviour is so hard to predict. Unless you run an experiment you just don’t know what works. That’s how learning happens.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)