Pham Nhat Vuong's electric ambitions for VinFast

Vietnam's richest person, Pham Nhat Vuong, is investing over $10 billion to turn his EV maker VinFast into a global brand—while facing major challenges in its US market entry

Pham Nhat Vuong, founder and chairman of Vingroup, expects VinFast to be profitable by 2025

Image: En Duong/Bloomberg via Getty Images

Pham Nhat Vuong, founder and chairman of Vingroup, expects VinFast to be profitable by 2025

Image: En Duong/Bloomberg via Getty Images

His current venture is to create Vietnam’s first global automaker, VinFast Auto, and he’s betting over $10 billion to make the company into a viable brand in the global electric vehicle market. But its journey so far has been bumpy, and there’s skepticism about whether it can compete outside its home country. Still, VinFast’s CEO, a former banker, is full of confidence. “Our mission is to make EVs accessible to everyone,” says Le Thi Thu Thuy, 49.

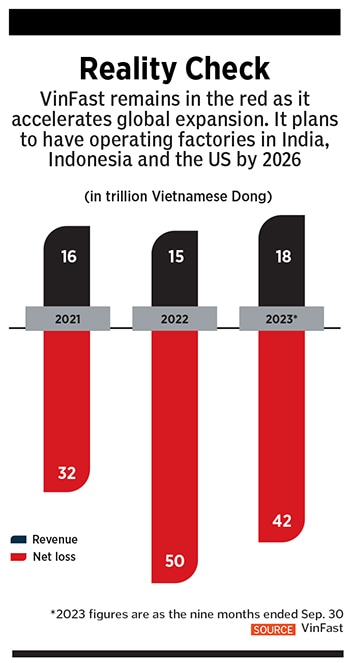

VinFast has aggressive targets, including selling 1 million EVs worldwide within six years. (It took Tesla 17 years.) After investing almost $10 billion to roll out several EV models, develop a charging infrastructure and build a fully automated factory in Vietnam, the company plans to invest a further $1.8 billion in the next three years to get factories running in the US by 2025, and Indonesia and India in 2026. Of that total, $1.4 billion is going into the first phase of a North Carolina plant under construction. The goal is to take advantage of government subsidies and tax benefits in these locations and increase the group’s annual production capacity to about 550,000 units by 2026 from 300,000, the current capacity of its sole factory in Vietnam.

VinFast currently is a tiny player in the massive US market. According to automotive industry site Mark Lines, in 2023’s first nine months, the company sold merely 2,000 EVs in America. In total, the Vietnamese manufacturer says it delivered about 21,000 EVs in the first three quarters, but roughly 13,000, or more than 60 percent, stayed home for use by Green and Smart Mobility (GSM), an electric taxi company owned by Pham and his flagship company Vingroup. It says GSM ordered 30,000 EVs for the rollout of an electric taxi service across Vietnam, which is being expanded to Laos, then to Cambodia. GSM says it is mulling an entry into the US taxi market.

Sales to the group affiliate are indicative of sluggish demand, Fathima Shifara Samsudeen, Colombo-based analyst at LightStream Research, said in a note published in September on research platform SmartKarma. Separately, in an email, she says the company “will struggle to sell its EV models in the global markets”. In the US, sales of the midsize SUV dubbed VF 8, the first and only model available, were hurt by an embarrassing recall in May—two months after sales began.

VinFast says it voluntarily recalled vehicles to fix a software glitch after the US National Highway Traffic Safety Administration warned the flaw blocked safety information and “may increase the risk of a crash”. Thuy says the company used the market feedback to help it fix the vehicles. “We have released software updates that provide important enhancements,” says Thuy by email.

While he believes VinFast can be a global brand, Snyder says he decided to leave after fewer than two years once the strategy and leadership structure had been put in place. He sums up the challenge for VinFast this way: “If you’re building an SUV and it’s not better than a Tesla in every single way or significantly cheaper, the consumer is going to buy a Tesla.”

While he believes VinFast can be a global brand, Snyder says he decided to leave after fewer than two years once the strategy and leadership structure had been put in place. He sums up the challenge for VinFast this way: “If you’re building an SUV and it’s not better than a Tesla in every single way or significantly cheaper, the consumer is going to buy a Tesla.”