How Paras Defence is building itself to become India's one stop shop for everything critical

Paras Defence specialises in high-end manufacturing of electronics and optronics for defence and space applications. It's involved in key projects commissioned by the government, and is now betting on drones and UAVs

From right: Munjal Shah, managing director; Harsh Bhansali,CFO; Shilpa Mahajan, wholetime director; Amit Mahajan, director, technical & R&D; Anish Mehta, director, business development of Paras Defence &Space Technologies

Image: Swapnil Sakhare For Forbes India

From right: Munjal Shah, managing director; Harsh Bhansali,CFO; Shilpa Mahajan, wholetime director; Amit Mahajan, director, technical & R&D; Anish Mehta, director, business development of Paras Defence &Space Technologies

Image: Swapnil Sakhare For Forbes India

In the late 1980s, when visiting cards remained a gateway to one’s credentials, Sharad Shah would add the following against his name: “Import substitution is our specialty”. He used to then run a company called Paras Engineering Limited. A decade later, when his son Munjal joined Shah in his business, the duo tweaked their tagline on the card. This time, it read, “Stop here only when failed elsewhere,” Shah tells Forbes India.

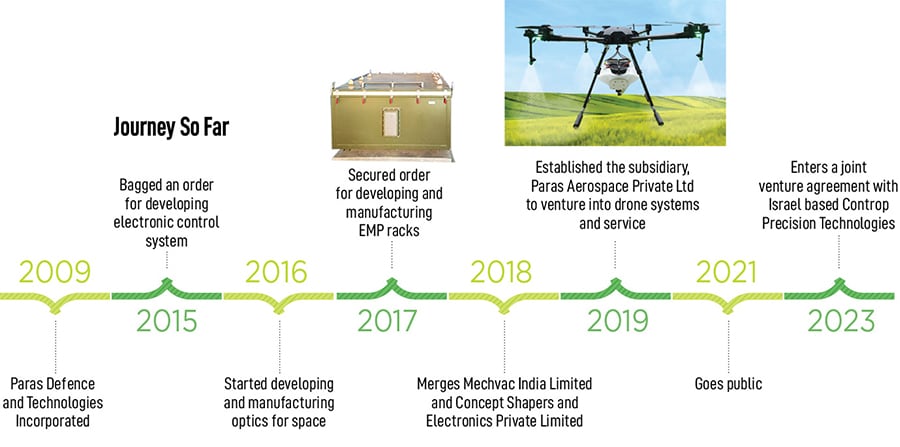

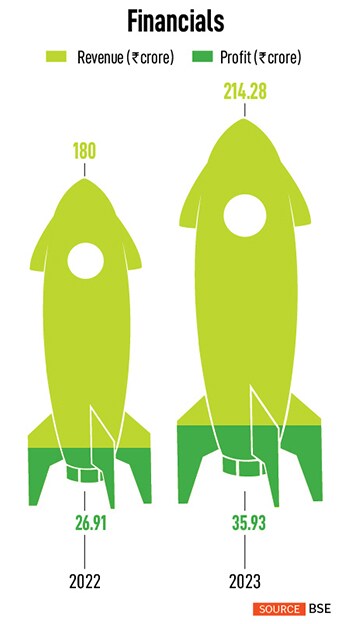

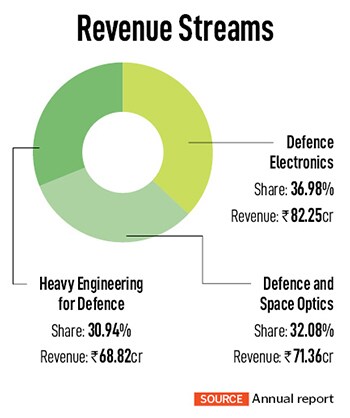

In a gist, that is the story of the father-son duo who have built the ₹2,500 crore Paras Defence and Space Technologies. Paras Defence, named after the Jain God, Parasnath, is a 40-year-old company that specialises in technologies needed for rockets and missiles, space research, naval systems, electronic warfare, drones, and quantum communication, among others.

Paras Defence currently counts the likes of DRDO, Isro, defence shipyards, Hindustan Aeronautics, Larsen & Toubro, and the Tata group among its key customers. The company went public in 2021, its issue oversubscribed was by 304.26 times, receiving bids for 217.26 crore shares against an IPO size of 71.4 lakh shares. It raised ₹170 crore, and on the day of the listing, the shares jumped a staggering 185 percent to its listing price.

“We started in the late 1970s, manufacturing mechanical parts,” says Shah, managing director of Paras Defence. “We were a tier 3 company then.” Today, the company’s prowess has moved into advanced technology such as providing protection against electromagnetic pulse, manufacturing telescopes for submarines, and manufacturing drones for agricultural use.

“Paras Defence is one of the few companies in India that specialises in the high-end manufacturing of electronics and optronics for defence and space applications,” says Harshavardhan Dabbiru, senior defence analyst at consultancy firm GlobalData. “The company has been growing as a sub-system supplier in the Indian defence industry and is involved in some of the key aerospace and defence projects commissioned by the Indian government.”

In 2021, in an attempt to promote the indigenous drone industry, the government allowed for a production linked incentive (PLI) scheme for drones and drone components with a total incentive of ₹120 crore for the next three years. In February, the US also approved the sale of 31 MQ-9B armed drones to India at an estimated cost of $3.99 billion.

In 2021, in an attempt to promote the indigenous drone industry, the government allowed for a production linked incentive (PLI) scheme for drones and drone components with a total incentive of ₹120 crore for the next three years. In February, the US also approved the sale of 31 MQ-9B armed drones to India at an estimated cost of $3.99 billion.

The company has a funnel of over ₹1,500 crore, of which it reckons that as much as 90 percent is recognisable. “These days, you get a call saying I want to get married to you,” Shah says about new partnerships being formed. “They will say you are very beautiful and lets us let us get married in a week. We will meet at a common place where we discuss engagement and within a month both the lawyers come together and get the deal done.” Among its newest partners are Israel-based Controp and US-based US-based Mico-Lam. The company also has partnerships with ISISpace for CubeSat sub-systems, Holland Shielding Systems BV for EMP shielding products, and Invent Gmbh for carbon fiber-reinforced plastic (CFRP) structures.

The company has a funnel of over ₹1,500 crore, of which it reckons that as much as 90 percent is recognisable. “These days, you get a call saying I want to get married to you,” Shah says about new partnerships being formed. “They will say you are very beautiful and lets us let us get married in a week. We will meet at a common place where we discuss engagement and within a month both the lawyers come together and get the deal done.” Among its newest partners are Israel-based Controp and US-based US-based Mico-Lam. The company also has partnerships with ISISpace for CubeSat sub-systems, Holland Shielding Systems BV for EMP shielding products, and Invent Gmbh for carbon fiber-reinforced plastic (CFRP) structures.