Clarion call for climate donors: Need for philanthropic capital for climate action

A collective and multi-pronged philanthropic effort is required from individuals, corporates and countries to solve the climate crisis

That climate change is a huge concern and has a cascading effect on businesses and the economy are clear. A collective and multi-pronged effort is required from individuals, corporates and countries to solve the climate crisis.

Illustration: Chaitanya Dinesh Surpur

That climate change is a huge concern and has a cascading effect on businesses and the economy are clear. A collective and multi-pronged effort is required from individuals, corporates and countries to solve the climate crisis.

Illustration: Chaitanya Dinesh Surpur

Last year, specifically, the world experienced telling signs of a notable shift in weather patterns and a dramatic rise in natural calamities: Catastrophic storms, torrential rainfall and relentless heat waves. This took a toll on lives, livelihoods and economies. The general degradation of air, soil, oceans, ecology and forests has cast an urgent need for a swift course correction towards sustainable living.

The problem is daunting, agrees Zerodha’s CTO Kailash Nadh, who envisioned and helped set up the Zerodha-sponsored Rainmatter Foundation as a philanthropic initiative for climate action. “There is no technology to reverse climate change, and one is forced to have a pessimistic outlook, but we have to try,” he adds.

That climate change is a huge concern and has a cascading effect on businesses and the economy are clear. There is no ambiguity on those fronts. Decades of inertia and ignorance have compounded the problem to a magnitude that it is now hard to solve at a singular level. A collective and multi-pronged effort is required from individuals, corporates and countries to solve the climate crisis.

This requires large-scale funding, and a move towards green alternatives. Private and public investments come with riders and an underlying objective of profit. It would make a big difference if investments are augmented with philanthropic capital—the powerful impact of which has been seen in areas such as health and education.

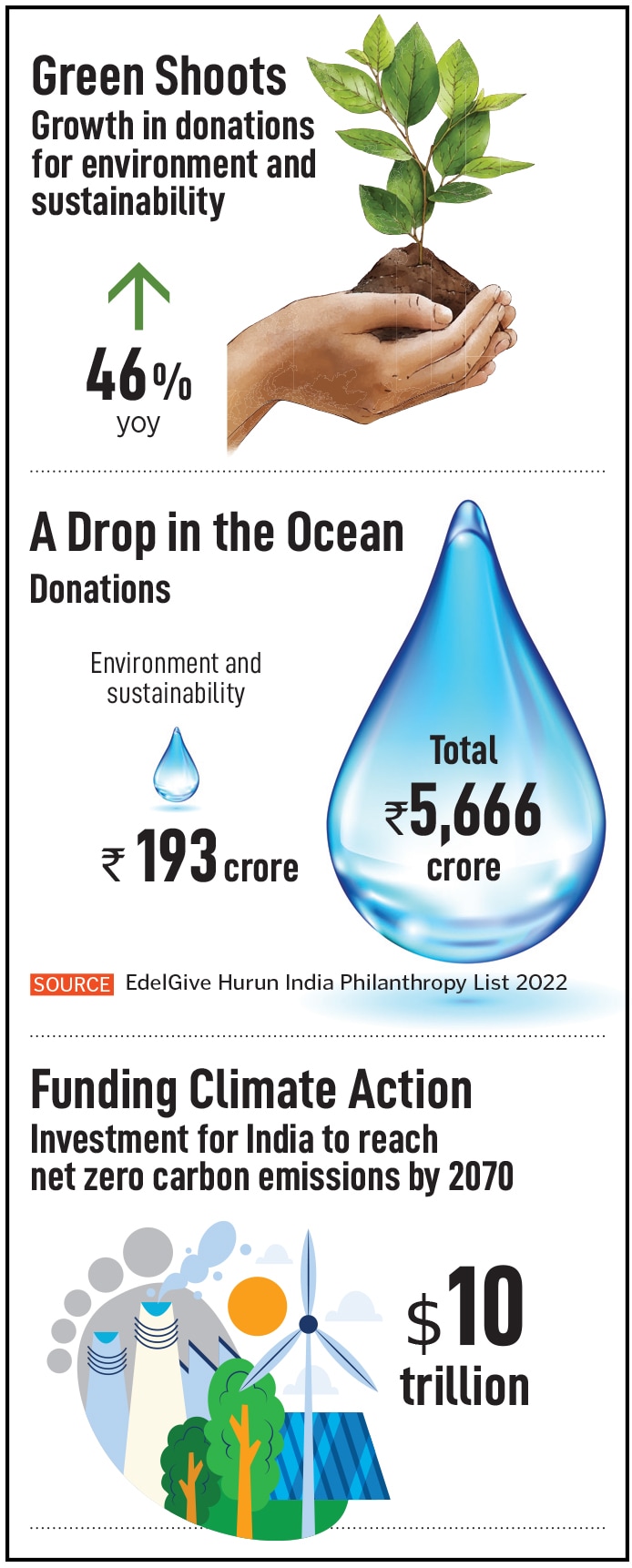

However, private and foundation philanthropy for climate action have been unremarkable so far. According to EdelGive Hurun India Philanthropy List 2022, donations towards environment and sustainability accounted for ₹193 crore out of total charitable donations of ₹5,666 crore. The silver lining is that this is an increase of 46 percent over the previous year.

The economy isn’t structured to slow down, and investors, though aware about the deteriorating quality of the environment and its unforgiving repercussions for humanity, are incentivised to deliver short-term gains over sacrifices for long-term benefits.

The economy isn’t structured to slow down, and investors, though aware about the deteriorating quality of the environment and its unforgiving repercussions for humanity, are incentivised to deliver short-term gains over sacrifices for long-term benefits.