Gold glitters as a safe haven amid global uncertainty

The yellow metal has outperformed the US dollar as well as global bonds despite Covid-19 and the invasion of Ukraine by Russia, Juan Carlos Artigas, global head of research, World Gold Council writes

Gold’s price performance has been supported by strong investment demand. Illustration: Chaitanya Dinesh Surpur

Gold’s price performance has been supported by strong investment demand. Illustration: Chaitanya Dinesh Surpur

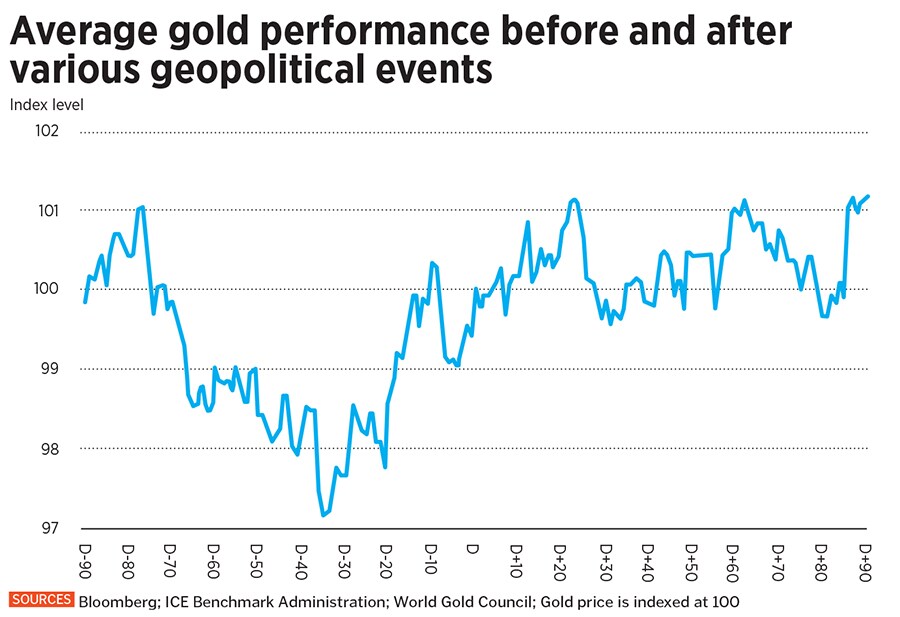

So far this year, global investors have seen first-hand gold’s attributes as a safe haven. Gold surged past $2,000/oz in early March as equities tumbled, driven by the war in Ukraine, swelling commodity prices, and, more generally, potential knock-off effects for the global economy.

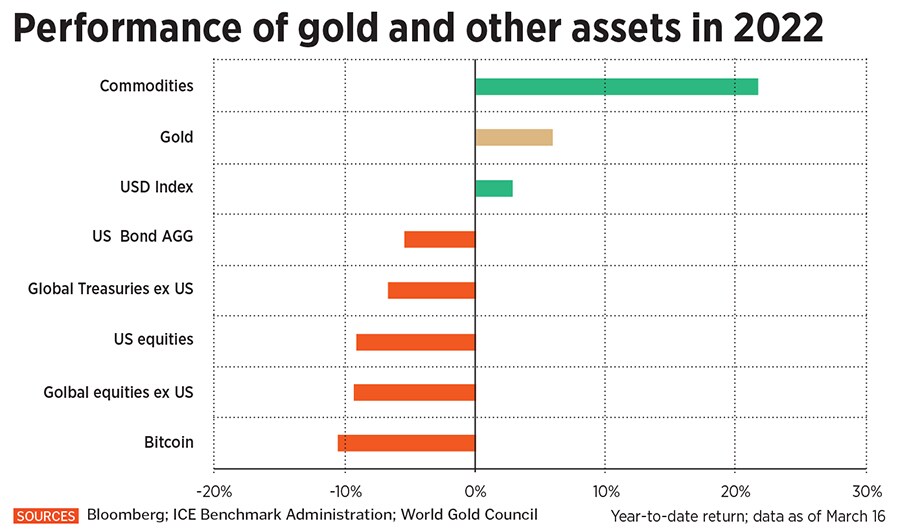

While the price of gold has pullback as equities have gained ground, gold is still 6 percent higher year-to-date, significantly outperforming global equities which are down 11 percent over the same period (see chart). Gold has also outperformed the US dollar and global bonds. And gold’s role as a store of value stands in stark contrast to cryptocurrencies, which have instead performed in line with equities during the recent crisis.

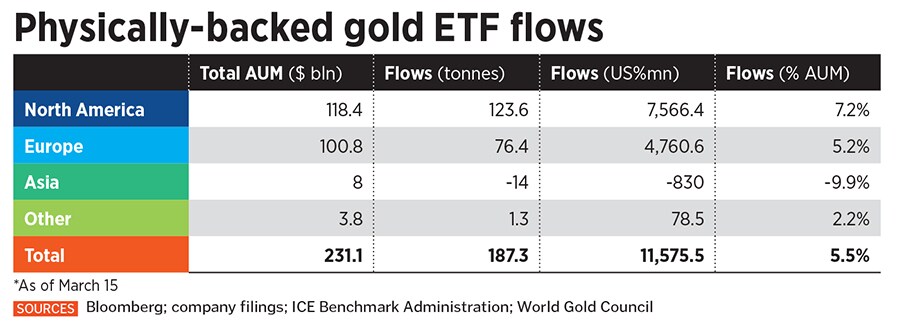

Gold’s price performance has been supported by strong investment demand. Gold-backed ETFs, often favoured by investors as a cost-effective way to gain exposure to gold, have seen $11.2 billion of inflows so far in 2022. These inflows have more than offset the total annual outflows of $9.1 billion seen last year. There’s also been increased interest in gold futures. Net long positioning on COMEX has risen to $65 billion, the highest level since March 2020. Retail investors have also been buying gold: The US Mint has sold close to $1 billion year-to-date, and there’s similar anecdotal evidence from other markets.