Commodity price rise temporary, no super cycle yet: Naveen Mathur

Liquidity pumping or weather shocks or the ongoing war can be attributed to the rising prices of commodities across the table. The current bull rally, termed a super-cycle, would require a structural change followed by strong consistent demand over several years, especially from China, Anand Rathi Share and Stock Brokers' Mathur writes

Most commodity stocks and commodity exchange-traded funds (ETFs) have been profitable lately

Illustration: Chaitanya Dinesh Surpur

Most commodity stocks and commodity exchange-traded funds (ETFs) have been profitable lately

Illustration: Chaitanya Dinesh Surpur

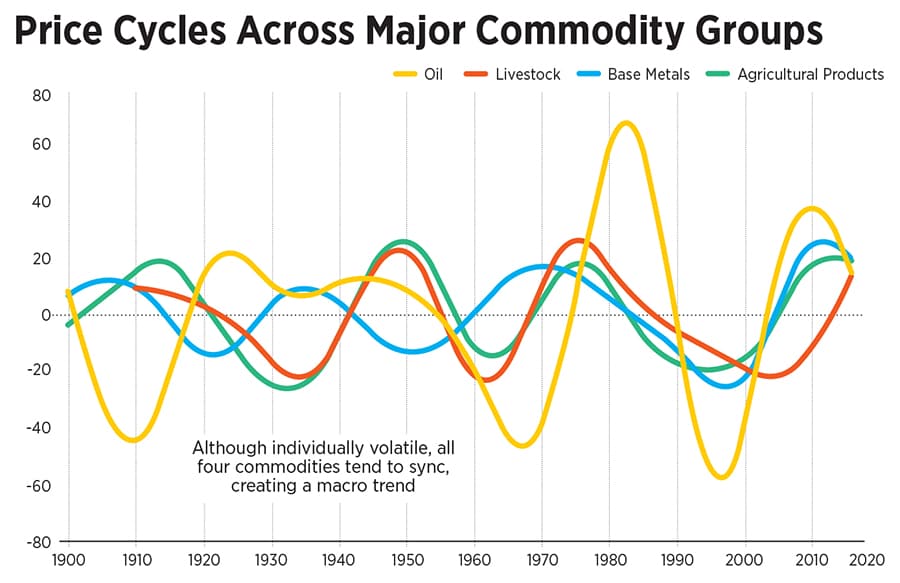

Commodity prices have surged dramatically over the last couple of years. The Bloomberg Commodity Index has risen by over 59 percent year-to-date, the highest since 2015, and more than double the 2020 lows (see chart).

After the pandemic-led disruptions in H12020, commodity prices started recovering and gained consistently, driven by liquidity-led demand growth in H22020. Precious metals rallied to record levels owing to safe haven rush after world economies faltered with the spread of Covid-19. The base metals appreciated sharply amid push for the renewable energy and ample stimulus support from the central banks. Energy commodities skyrocketed from the record lows in the second half of 2020 as travel restrictions were lifted gradually after advanced economies vaccinated a majority of the population.

After the pandemic-led disruptions in H12020, commodity prices started recovering and gained consistently, driven by liquidity-led demand growth in H22020. Precious metals rallied to record levels owing to safe haven rush after world economies faltered with the spread of Covid-19. The base metals appreciated sharply amid push for the renewable energy and ample stimulus support from the central banks. Energy commodities skyrocketed from the record lows in the second half of 2020 as travel restrictions were lifted gradually after advanced economies vaccinated a majority of the population.

In 2020, agricultural commodities were comparatively resilient to the pandemic mayhem. In fact, prices of many agro-commodities, including oilseeds, edible oils and grains, rallied in H22020 and hit a multi-year high in 2021. Gains in the farm commodities were partly driven by weather disruptions, or, to be more specific, the La-Nina-led drought situation in many parts of the US, Brazil, Argentina and the Black Sea region. On the other hand, demand from China rose substantially as it rebuilt its hog herd following losses from a devastating pig disease.

For industrial metals, the bullish sentiment continued in 2021 on expectations of demand growth amid a green energy push. Even the manufacturing PMI world over rebounded to the pre-pandemic levels. On the supply front, base metals moved into a deficit amid production cuts from the ongoing energy crisis and supply chain disruptions due to the pandemic. Precious metals witnessed a profit booking owing to the rise in risk on sentiment due to a rally in the equities. Energy commodities further advanced in 2021 as demand outpaced supply.

Latest price explosion

The most recent price explosion across commodity markets is undoubtedly the result of geopolitical tension, raising fears regarding supplies in metals, energy and agro, to be precise. Bullion gained on account of improved investment demand and fear of global growth.

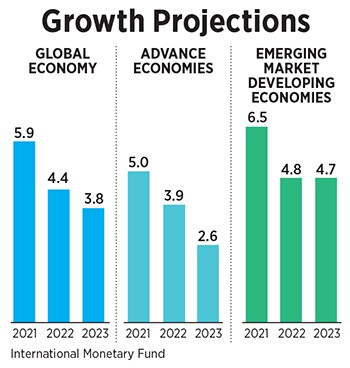

A declining dollar and lower interest rates underpinned the previous super-cycle. The situation now, though, is different. Inflation compels central banks to go in for monetary tightening, even at the cost of economic recovery.

A declining dollar and lower interest rates underpinned the previous super-cycle. The situation now, though, is different. Inflation compels central banks to go in for monetary tightening, even at the cost of economic recovery. A super-cycle is a sustained period of expansion, usually driven by robust demand growth for products and services, commonly caused by structural changes globally. The rapid industrialisation and growth of a nation or region are chief drivers of such commodity super-cycles.

A super-cycle is a sustained period of expansion, usually driven by robust demand growth for products and services, commonly caused by structural changes globally. The rapid industrialisation and growth of a nation or region are chief drivers of such commodity super-cycles.