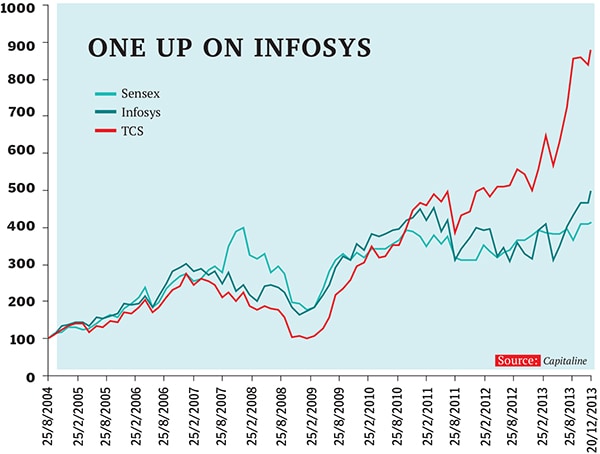

TCS vs Infosys: How the IT Big Guns Will Fare

In the battle between India’s two big IT firms, TCS’s recent wins give it an edge over Infosys, whose turnaround is still a work in progress

If the Indian IT sector has gained the reputation of being boring in the last few years, it is not without justification. There is nothing novel about its business model. It has been tried and tested. All companies largely have the same value proposition, cost structures and revenue streams. Nasscom Chairman and Mindtree CEO Krishnakumar Natarajan often jokes that if you take away the name and logo from the presentations of Indian IT companies, you cannot tell one from the other.

The big questions—and the differentiations—lie around execution. One, whether a company has consistently shown the ability to execute, and two, whether it has pulled the right levers to keep revenues growing and margins stable, and also keep the markets happy.

In the past few years, the companies that have managed to keep the markets happy have done so by pulling one or the other of these levers. For example, Cognizant, which has always maintained its margins at 20 percent, has grown the fastest. Even HCL Tech, which has a lower operating margin, has pursued faster than industry growth (pegged at 10-12 percent) in 2013-14. Wipro has had to struggle with lower growth, and has maintained a low profile, unlike TCS and Infosys.

TCS and Infosys were under constant media glare, albeit for different reasons.

TCS has had a dream run in the last five years. Its share price grew from Rs 250 in January 2009, when the world was still recovering from its worst financial crisis, to Rs 2,158 as of December 20, 2013. The big question around its market cap is not if it will cross $100 billion but when, and what would that mean to the company. Its CEO N Chandrasekaran has been one of the most praised chief executives in the country (also winning the 2012 Forbes India Leadership Award for Best Private Sector CEO). The stock market surge is backed by the company’s performance: Its sales have grown; its profits are up; its profit margins have improved.

It is not as if all problems disappeared on his return. Infosys continues to lag the industry. Eight senior members have quit since Murthy’s comeback. Yet, the stock market has cheered the company on. The stock has gained 50 percent since its ace founder’s return, and its market cap crossed Rs 2 lakh crore in December 2013—only the sixth Indian company to do so.

Thus, 2014 begins with an important question: After a great run for five years, will TCS take a breather, as is common for IT stocks? And, at the same time, will the rebound that seems to have happened in the Infy stock since Murthy’s return gain further momentum as the first stories of a real turnaround surface over the next few years?

Part of the answer lies in the overall demand for outsourced IT services. While TCS has done well even when the market was bad, Infosys had maintained that its revenues get more impacted by market conditions because it gets a bigger proportion of its revenues from discretionary spending. Ashwin Mehta and Pinku Pappan of brokerage Nomura said in a recent report that the demand for IT services will accelerate in the next financial year on the back of manufacturing growth in the US, client financial performance and job additions. While robust demand will help both firms, Infosys is likely to gain more than TCS.

But what matters is execution—and the biggest difference between the two companies lies there. In both cases, it goes back to the time they designed a new strategy. For TCS, Chandrasekaran sliced the company into smaller chunks, empowered the leaders of individual units and let them continue with what they were doing. The result was one large company with the energy of several small companies. For Infosys, the change was more radical. Business leaders were encouraged to prepare their clients for tomorrow’s enterprise. The result was that the company lost sight of the segment that accounted for nearly two-thirds of its revenues. When Murthy came back, he was determined to set that right. There are some early signs of success. Its sales team has gotten more aggressive, and is not as obsessed with quarterly margins as earlier. Even then, Infy’s turnaround is a work in progress.

The bottomline: If you are a conservative investor, stick to TCS. After the spectacular run of the last five years, its performance will seem a little lacklustre but it is a well-oiled machine. Meanwhile, Infosys is still being tinkered and tuned. Once that is done, it might give its competitors a run for their money. But it’s still a question of ‘might’.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)