Reverse Mortgage: The Bank Pays you The EMI

Reverse mortgage has so far been a lousy product that senior citizens didnít want. But thatís about to change

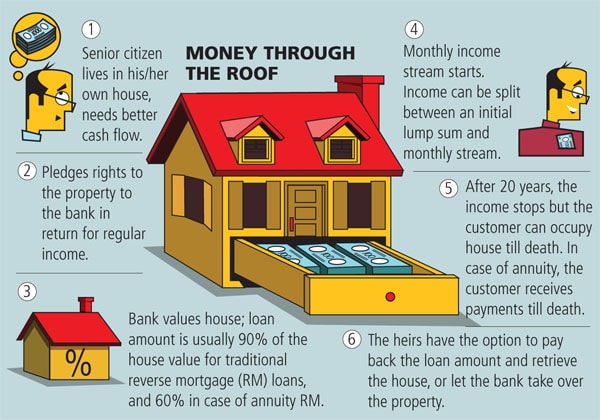

In 2007, P. Chidambaram, the then finance minister, announced a rather novel scheme called reverse mortgages, which promised to give senior citizens an income stream based on the value of property they owned. Many who are past their sixties suddenly find themselves in a piquant situation: Salaries have

shrunk to pensions, the risk of sudden medical expenses is higher and inflation simply unbearable.

Reverse mortgages give them a chance to convert their one big asset — their home — into a regular income stream, without sacrificing its ownership. However, till now, only about 7,000 reverse mortgages have been sold, though over 20 banks offer the product. The predominant reason is cultural. “Most elderly see residences as entitlements of bequeaths for their offspring as in many cases they have also come to inherit them from their parents,” says Ravi Nawal of Celent, a financial advisory firm.

There are other reasons too. The loan tenure, maximum of 20 years, is a drawback. After 20 years, the borrower will either have to repay or let the bank take possession (to be sold after the person’s death). The borrowers were concerned about low valuations that banks gave to their houses. The bank, of course, was taking a risk that the property price could have fallen below the loan amount. The result: Bankers were not too keen to promote or sell the product, and the potential customers did not give enough thought to reverse mortgage as a financing option.

Things might change going forward. The main reason: The product is evolving. The earlier reverse mortgage product ran for 20 years, after which the income stream stopped. A new product (launched in early 2010) born out of a bank-insurance company tie-up, combines annuity with reverse mortgage, which means the income stream will continue throughout the lifetime of a customer. The amount the customers get is also more by 50-75 percent, because insurance companies with actuarial skills understand the risk better and price the products better, says R.V. Verma, chairman and managing director of National Housing Bank.

Central Bank of India, which has tied up with Star Union Dai-ichi Life Insurance to launch an annuity product called Cent Swabhiman Plus, has already garnered 25 percent share. Verma believes that more life insurance companies will enter the market in 2011, and the customers will have more products to choose from. LIC has already shown interest, he says.

The new product is not without a pain point. It’s not clear how this product will be treated by the tax authorities. While reverse mortgages are exempt from tax, annuities are not.

In the long run, demand for reverse mortgages is likely to go up. There are broader social changes — growth of nuclear families, elderly people living alone, children settling abroad or in bigger cities — that will drive the growth of the product. “The market opportunity is growing. Senior citizens living alone or with only spouse are expected to grow to 25 percent by 2015 from 15 percent now. We estimate the target market of 6 million households by 2015 for the RML offering,”says Nawal.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)