Passive Funds: The Sense in Sensex

Passive funds are becoming popular. Find out if they are right for you

In the mid-1970s, John Bogle and Ed Johnson started their respective mutual funds based on totally contrary philosophies. Bogle went for passive management, the selection of stocks based on an index and Johnson chose active management, the selection of stocks based on one’s own research to produce returns superior to the index. In other words, Bogle was like a tortoise and Johnson the hare.

Johnson’s Fidelity grew fast by hiring star fund managers and Bogle’s Vanguard languished for long. It was generally believed that active management would always produce greater returns.

All that changed in 2008. The global financial crisis exposed the vulnerability of active fund managers, many of whom underperformed the wider market. As investors started to look for lower costs, Vanguard benefitted. For the first time in two decades, its assets crossed Fidelity’s, making it the biggest mutual fund in history.

Some of this change is spilling over in faraway India, where star fund managers have produced phenomenal returns for more than a decade. Here too, the key stock market indices humbled active managers, making investors turn to passive funds. What started as a trickle has become a steady stream now, say the pro-passive insiders.

Truth be told, passive funds are just a tiny part of the mutual fund industry, but the growth has already begun. In 2010, when the average assets of equity funds were largely flat, passive funds grew rapidly from a small base. Benchmark, a fully passive fund house, saw its assets swell by 82 percent.

The industry is divided vertically on whether passive funds will work in India or not. “In India the market is not evolved,” says Sandesh Kirkire, CEO of Kotak Mutual Fund which has both types of funds in its stable. “There is lot of information asymmetry and there is a huge scope for fund managers to beat the markets as compared to passive funds. It is interesting to see passive funds doing well but still our markets are inefficient,” he says.

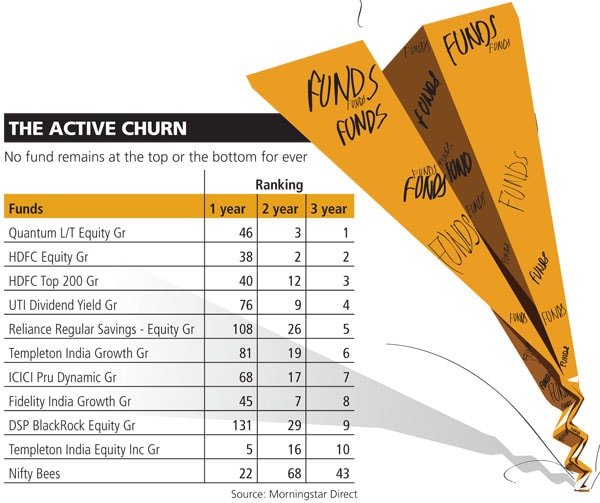

For the last 10 years, diversified equity mutual funds have delivered returns of around 20 percent while the index has delivered around 16 percent. But the record is waning. Each year, the number of funds that do better than the index is only falling. Even star manager Prashant Jain, who managed HDFC Top 200 and HDFC Equity funds, was beaten in 2007 as he didn’t ride the boom in real estate stocks.

Among the 170 funds in the large cap category, only 21 funds have managed to do better than the index over the last one year, according to Morningstar data. What does that mean for you as an investor? It simply means that you would have been better off investing in any of the low-cost index funds than in 149 of the equity funds where fund managers charged a fee to invest your money.

So, should you invest in passive funds?

Krishnamurthy Vijayan, managing director and CEO of IDBI Mutual Fund, certainly thinks so. He was earlier CEI of JPMorgan Mutual Fund and had been championing active management for long. But he saw a dichotomy in telling his investors to invest for the long term while his own fund managers were dealing in the short term to produce returns. He switched over to being an evangelist for passive funds.

“For most people index funds should do well for their long-term equity investments. For those who have a lot of money or those who believe that they have the time to follow the markets can always build their own portfolios or go for active management,” says Vijayan.

But there are others who assert that star fund managers will bounce back and produce greater returns in the long term. “India is an emerging market where stock picking will work as compared to passive investments. I think investors should stick to active funds,” says Gopal Agarwal, deputy chief investment officer at Mirae Asset Management Company.

In India, index funds have always been looked down upon. The segment accounts for hardly 1 percent of the total assets of equity funds. Most distributors don’t want to sell index funds because the commission is quite low. But with the market regulator changing the commission structure, this type of funds has come into the mainstream.

“Earlier the distributor was being paid by the mutual fund and today he is being paid by the customer. Now the distributor will have to see to it that his customer earns returns and now he cannot afford to ignore index funds which he has earlier ignored,” says Sanjiv Shah, executive director, Benchmark mutual fund who manages Rs. 2,500 crore through exchange traded funds (ETFs).

ETFs, which are aligned with indices, are now becoming the preferred vehicle for passive investment. Unlike the index fund which is tracked on a daily basis, ETFs are tracked closely on a tick basis and are traded like a stock. In India, the expense ratio of an ETF works out to a mere 0.5 percent of assets compared to 2 percent for active funds and 1 percent for index funds. According to a Blackrock study, Total assets in Indian ETFs work out to $0.6 billion which is the highest in Asia. Continent-wide assets in ETFs stand at $1.5 billion.

“Apart from transparency and low costs, investors want the ability to adjust their positions when they want to. ETFs give investors the ability to trade out of a position during the trading day if they want to reallocate,” says Koel Ghosh, director of business development at Standard and Poors Indices.

India primarily deals in equity and gold ETFs. Over a period of time, the list of asset classes will grow in the country and that is the time India will see a series of asset allocation products based on ETFs of commodities other than gold.

On balance, passive funds are a great way to enter the world of equity investing and earn returns higher than bank deposits. But for those with higher risk appetite and a desire for greater returns, active funds will remain attractive, especially in 2011 when the market returns are expected to

be subdued.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)