Commodities: Back To Barter

Commodities have firmly entered the Indian investor’s psyche. And the flood of liquidity expected in 2011 will open up an unprecedented opportunity

In banquets across India, it is customary for the diners to chew on cumin (jeera) after the meal to benefit from its digestive powers. But for a bunch of commodity traders in November 2010, it was indeed the main course.

On the 18th of that month, rains lashed Saurashtra, the main cumin growing region in India. It was clear that 2011 would be a year of cumin shortage; prices would rise. But the traders hadn’t waited till the rains came. They had considered weather forecasts and had bought cumin cheap. A week later, they were counting their fortune.

The incident showed that India’s commodities market was now processing information not just quickly but in anticipation of events. “Commodity traders have become sharp and mature and are starting to behave like their equity brothers,” says Kunal N. Shah, head of commodities research at brokerage Nirmal Bang.

History will record 2010 as the year commodities entered the mainstream of investing in India. From a bunch of insiders controlling supply as well as prices, the market has evolved into a complex, active and information-hungry universe of a range of investment options. Dipak Sheth, who has engaged in physical trading of commodities for 35 years, acknowledges the change and believes that buying commodities online is the ‘new sunrise industry.’ “Physical trade needs storage facility and a lot of logistics background,” he says. “But investing in commodities through futures or spot markets is convenient, easier and cheaper. Internationally also, commodity and debt markets are much bigger and have more investors than equity markets. India will also follow the same trend.”

While the Indian commodities market is still largely a trading arena dominated by short-term calls and volatility, it is possible for the prudent wealth-builder to partake of some of those gains in 2011. Here’s how.

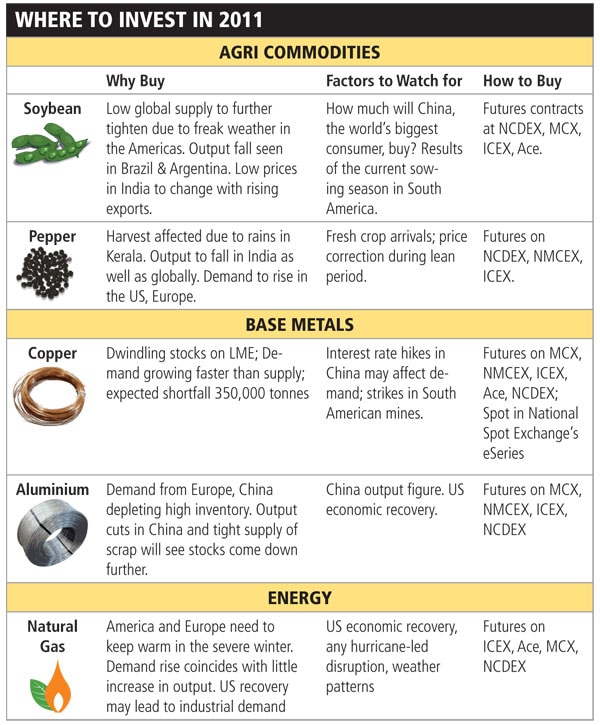

Agri Commodities

The slow-moving US economy and the Federal Reserve’s favourite ploy of throwing money at all problems have pushed down the dollar’s value. As the currency remains weaker, real assets are gaining in value. In India and China, which account for a third of the world’s population, demand for food and other commodities is rising steadily. The combination of all these factors is bound to lead to an increase in agri commodity prices in the New Year.

The biggest opportunity for investors lies in crops where carry-over stocks from the last year are low, the harvest next year is expected to be poor or the demand is rising more than supply. “It is one area where most of the volatility comes from the supply side. Everyone knows that with growing population and change in consumer profile, demand for food will only increase,” says Madan Sabnavis, chief economist at Care Ratings. But what makes them volatile, he explains, “is the vulnerability to supply shocks in the form of climate.”

Already, excessive rains in parts of India and Australia, frost in Russia and dry weather in South America have brought volatility in prices of spices, rubber, soybean and wheat. In particular, pepper and soybean are good opportunities as the tight supply will not be able to meet demand growth globally.

Avoid commodities like rice, wheat and sugar. These are regulated by the government and may be banned from the futures market when the whim hits the wise men and women in Delhi.

Base Metals

Surpluses in zinc and lead might lead to some correction in prices in 2011. Investors might also need to be wary of an interest rate hike by the Chinese central bank to tame inflation. That will tame demand for metals from Chinese industries. “This may trigger some correction in non-ferrous complex but this decline in prices shall be taken as good opportunity to go long in metals such as copper which is fundamentally better placed amongst other peers,” says Shah. Analysts also find aluminium ‘attractive.’ Though the metal’s prices have largely remained subdued in 2010, industry watchers expect a northward journey next year owing to a cut in Chinese production.

Energy

The New Year might well be the time for natural gas. It has been one of the worst performing commodities in 2010 and that itself has attracted a whole lot of contrarian investors to bet their dollars on it.

In the short term, the demand for gas is set to rise because the severe winter in the Western hemisphere is boosting demand. In the long term, the shift of countries like India to become natural gas economies will drive demand.

Crude oil will find it extremely difficult to break the level of $100 per barrel sustainably. But watch for a recovery in the US economy and geo-political tensions. This slippery customer will be back in the business then.

One Last Word

Commodities are an extremely volatile asset class that requires deep research in several areas such as supply and demand, government policy, weather, global money supply and political developments. Take the plunge only if you’re prepared for the hard work. Also, the market is largely in futures contracts, which you would have to roll over to stay invested. That is an extra cost. In the super-hot forwards market, one blizzard in a corner of the world could make or destroy your fortune.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)