Born-Again Balance Sheets

Company financial statements are going to change forever. Are you prepared?

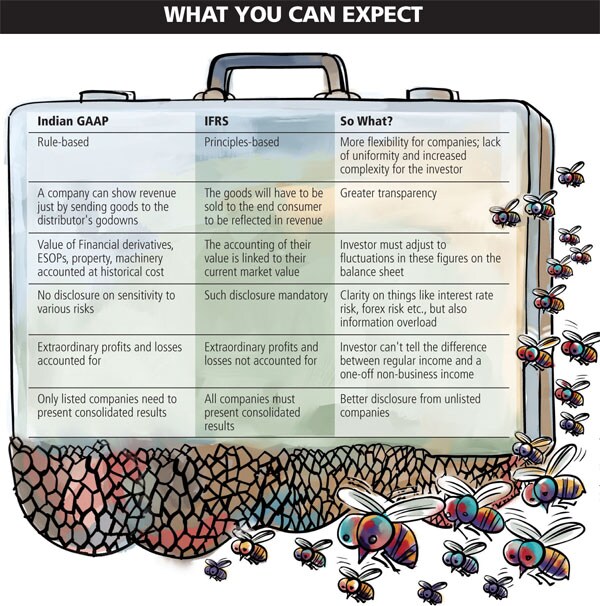

Come 2011 and the manner in which Indian companies present their profit and loss accounts (P&L) and balance sheets will change significantly. That is when it will become mandatory for them to adopt the International Financial Reporting Standards (IFRS). Here is a quick guide to surviving that transformation.

PROFIT & LOSS ACCOUNT

Deferred Revenue: Currently, a telecom company selling a connection can immediately account the activation charges as revenue, even though they will be paid by the subscriber only after a month. This is called deferred revenue recognition. IFRS prohibits that. A company can account only for revenues that it gets in hand.

ESOP Valuation: IFRS will usher in significant changes in expenditure accounting. For instance, when companies issue employee stock options, they currently follow the “intrinsic value” method. It will change to “fair value” method. This is expected to reflect the real cost of ESOPs including the impact of market volatility.

Illustration: Malay Karmakar

Preference Shares: Dividends on redeemable preference shares were so far accounted as appropriation from the profits. With IFRS, they would be classified as a liability payment. This will pull down the net profit figure.

BALANCE SHEET

Mergers & Acquisitions: When a company acquires another, it not only pays for the book value of the firm, but also a premium for the business potential. Current balance sheets consider anything above book value to be goodwill payment, while IFRS gives a considerable leeway to the acquirer to determine the fair value of the assets before coming to the goodwill portion. This is aimed at attaching a more updated value to the business.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)