Bid, Ask, Hang Up

The mobile phone helps you do away with the middleman and increase your investment returns

Over the next few years, your friendly broker, ever so willing to fill up your application forms and run around for you, will shrink and shrink so much that you can place him in your pocket.

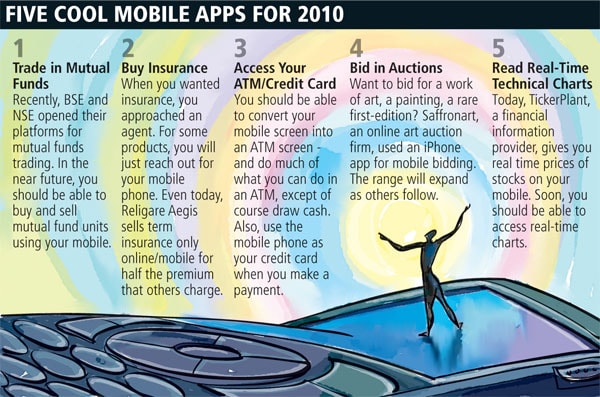

Not really. But, a lot of what a broker does today, you will be able to do over your mobile phone tomorrow. It’s not difficult to see why. Once 3G (shorthand for third generation technology that promises broadband on your mobile) is in place, there is a lot more that you can do with your handset. Including making money.

Illustration: Malay Karmakar

To get a sense of how it will be, look no further than trading shares online. From less than 2 percent of total trades on NSE in 2002, online retail trading has gone over to 20 percent now. Average brokerage on online trading is 25-30 percent lower than offline brokerage, says CLSA. Some of these trades happen over mobile phones. ICICI Direct and Reliance Money, for example, offer lighter versions of their Web sites for handsets.

Now, mutual fund investors can do the same. Recently, NSE and BSE opened their platforms for MFs, which makes buying and selling of units as easy as trading a share. BSE also said it would allow brokers, and eventually investors, to buy and sell MF units over mobile phones. (Add to this the fact that SEBI, capital market regulator, scrapped the upfront agent commission.) This would redefine the role of a broker, says Rajesh Krishnamoorthy of iFast Financial, which provides mutual fund distribution platform for independent financial advisers. A significant portion of a broker’s time is spent on managing documents. Moving them online would free up their time for providing advice to the customers, he says.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)