India's Richest: Adar Poonawalla's shot at success

Adar Poonawalla is betting big that his family's Serum Institute of India will be among the first to produce Covid-19 vaccines

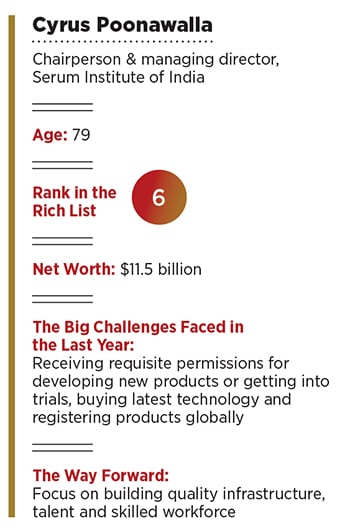

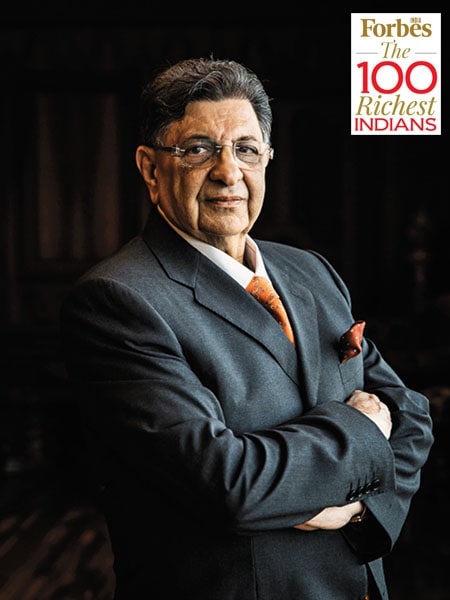

Cyrus Poonawalla founded the privately held Serum Institute in 1966

Cyrus Poonawalla founded the privately held Serum Institute in 1966Image Avinash Gowarikar

When the coronavirus pandemic broke out earlier this year, Adar Poonawalla, CEO of Serum Institute of India, the world’s largest vaccine maker by number of doses produced and sold, weighed the options: “Do absolutely nothing and watch how it unfolds, or take the risk and become a front-runner.”

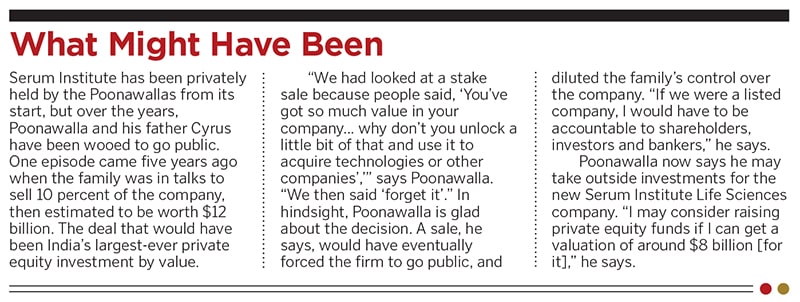

The 39-year-old chose the latter and went on a deal-making frenzy, which has put the privately held firm at the forefront of the global race to develop a Covid-19 vaccine, he says in a telephone interview in late September from the company’s Pune headquarters, the latest of two interviews for this article. His father, Cyrus Poonawalla, worth $11.5 billion, founded the Serum Institute in 1966 and remains its chairman. “It’s a huge personal risk I am taking,” says Poonawalla. The firm, he says, is investing $800 million to help find, and then produce, a vaccine, and has already spent $300 million of that.

To beat the virus, Serum Institute has secured five partnerships over the past six months; the biggest is its deal with AstraZeneca. In June, the UK pharma giant licensed Serum Institute to manufacture a billion doses of a potential Covid-19 vaccine called AZD1222—with 400 million to be delivered this year. For comparison, Serum Institute’s annual output now is over 1.5 billion doses.

Serum Institute’s deal with AstraZeneca likely involves an upfront payment based on the expected number of doses needed, says a company insider who asked to be unnamed. The scale-up to produce them is a major financial commitment. “I decided to sacrifice three of my existing facilities, which make some very lucrative vaccines,” Poonawalla says. That opportunity cost, Poonawalla reckons, could total millions of dollars. “I am afraid to even calculate that figure,” he says. “But again, I’m only accountable to myself.”

The vaccine is based on a genetically modified version of a common cold virus that infects chimpanzees, and was first developed by researchers at the University of Oxford, with AstraZeneca signing on to distribute it. “We are the only one [in India] who have the [manufacturing] capability,” Poonawalla says. Half the doses are planned for India, which will be marketed under the brand Covishield, and the other half are earmarked for the rest of the world, in particular developing countries.

AstraZeneca launched advanced clinical trials for tens of thousands in Brazil, South Africa, the UK and the US, while Serum Institute started its own trials with 1,600 volunteers across India and dedicated three of its facilities to begin production of more than 60 million doses monthly of the vaccine—with plans to ramp up to 100 million doses by December. Trials in several countries, including India, were briefly halted, then resumed, after an unexplained illness in one patient in a UK trial in early September.

Despite that hiccup, on October 26, AstraZeneca said that its vaccine produced a robust immune response in adults and the young, raising hopes about the vaccine’s potency, and a subsequent rollout soon. Serum Institute has already manufactured 40 million doses of the vaccine, under an at-risk manufacturing and stockpiling licence from the Drugs Controller General of India (DCGI)

“We could have launched the vaccine early next year if the trials hadn’t been stopped. That has really put a wrench into the works,” says Poonawalla, estimating the trials could now extend to January. “We’re trying everything we can to make up for lost time.”

He’s also hedged his bets by developing other Covid-19 vaccines. “We are working with multiple partners across the US, UK and Europe on four different vaccine candidates,” he says. “We never assumed that only one vaccine candidate would work. Vaccine production is like a roller coaster ride with all sorts of probable results; you just need to be patient until the final result is out.”  Cyrus Poonawala

Cyrus Poonawala

Image: Sanjit Das Bloomberg via Getty Images

In February, Serum Institute teamed with Codagenix, a clinical-stage biotech company in New York, to co-develop a single-dose intranasal Covid-19 vaccine that removes the virus’s harmful properties while keeping the antigens. Serum has since secured Indian regulatory approval to manufacture it. Meanwhile, work is underway with global pharma giant Merck to co-develop a vaccine by modifying a measles virus vector to carry coronavirus antigens.

For these two vaccine candidates, “We’re co-developing, scaling it up and doing the trials ourselves”, he says. In September, the company inked another deal with US pharma firm Novavax to develop and commercialise its Covid-19 vaccine candidate NVX-CoV2373 in low- and middle-income countries, including India. Serum Institute aims to deliver a billion doses of NVX-CoV2373 by 2021. “Along with these, we are working on two of our own candidates, which we hope should be available towards the end of 2021,” he says.

Technicians monitor vaccine vials passing through a filling and capping machine at a Serum Institute plant in Pune

Technicians monitor vaccine vials passing through a filling and capping machine at a Serum Institute plant in Pune

To support all these initiatives, Poonawalla has set up and chairs a new company, Serum Institute Life Sciences, that is building a $300 million, first-of-its kind “pandemic-level” manufacturing facility in Pune, including research and development labs. It will be capable of producing one billion vaccine doses when it opens two years hence. He believes the world will likely see another pandemic in the next few decades. “That [next] pandemic could be even worse and deadlier than Covid-19,” he says. “The only lesson we have learnt from this epidemic is how underprepared we were in manufacturing, in our health systems, detection and testing.”

In Serum Institute’s home market of India, a vaccine is sorely needed. India has over eight million Covid-19 cases—putting it second worldwide in cases behind the US—and more than 100,000 related deaths. The pandemic is more than a health care crisis—the Indian economy saw a 24 percent contraction year-on-year in the June-ended quarter, due in part to nationwide lockdowns in April and May.

Serum Institute is also looking beyond vaccines. In April, the company partnered with Pune-based molecular diagnostics firm Mylab Discovery Solutions to expand production of its Covid-19 testing kits. “We kept thinking about what we could do to help open up the economy, because a vaccine may or may not come, even after a year,” says Poonawalla.

Working with multiple partners has other benefits: Even if only one vaccine candidate proves successful, Serum Institute and its partners can springboard off it to produce more effective variants. When a vaccine is finally found, demand from governments should be huge. “Governments will want to vaccinate their whole population, and stockpile,” says Poonawalla.

Setting up these partnerships is a calculated move, says Anurag Rathore, a professor of chemical engineering at the Indian Institute of Technology (IIT) Delhi and a scientific advisor to several biotech companies. “Historically, companies that were the first to bring out a medicine have always had an advantage, even if a second drug was of better quality,” he says. At the same time, “the challenge is to capitalise on the gains, and that means manufacturing at risk to start selling the drugs as and when the trials are over. In that sense, Serum Institute’s call is a commercial decision, a bet that is like any other, which could go either way”, he says.

“At this moment, we can simply hope that Serum Institute can deliver, and we are eagerly looking for an escape from the situation,” says Arokiaswamy Velumani, chairman of Thyrocare Technologies, one of India’s largest private testing laboratories.

The Poonawallas have been fierce advocates of increasing global access to immunisations, and their company is a key supplier of vaccines to the developing world. In September, Serum Institute clinched a $600 million deal to supply 200 million doses of Covid-19 vaccines at $3 per dose to the global vaccine alliance Gavi and the Bill & Melinda Gates Foundation for distribution in India and low- and middle-income countries. The Gates foundation will provide a total of $300 million to Serum Institute as an advance. “I see the next decade as the golden years for the vaccines industry worldwide,” says Poonawalla.

In India, Serum Institute plans to cap the cost of a Covid-19 vaccine at $3 a dose, though Poonawalla concedes it could be slightly higher once all the approvals are in place. It will be up to the government to decide on how best to distribute nationwide an estimated 2.8 billion doses (it’s a two-dose vaccine), he says, but he hopes the government will cover the costs. “We are not asking for any money for dedicating a manufacturing plant, including the manpower, energy cost, and other things, from the government. All we are saying is, buy the vaccine and give it free to everyone so that no citizen of India has to pay for a Covid-19 vaccine,” he says.

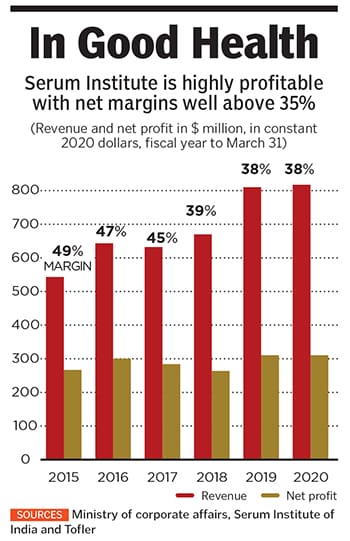

For more than five decades, his father Cyrus built this business empire on the back of affordable vaccines, which helped Serum Institute penetrate the export market without large-scale promotions or marketing. The company, which had $804 million in revenue in its latest fiscal year, estimates that about 65 percent of the world’s children have received at least one of its vaccines. Cyrus started the company with a small factory on the family’s stud farm.

Back then, the farm’s retired horses were donated to the government-owned Haffkine Institute in Mumbai, which made vaccines from horse serum. With locally produced vaccines in short supply in India and imports commanding high prices, Cyrus saw an opportunity and launched Serum Institute. In 1974, it introduced a diphtheria, tetanus, and pertussis (DTP) vaccine for children, a serum for snakebites in 1981 and a measles vaccine in 1989. By the following year it was the country’s largest vaccine manufacturer, and obtained accreditation from the World Health Organization. That accreditation “meant we could export our products and sell in other countries”, says Poonawalla, who joined the family business in 2001 and became a director five years later. “That was the real turning point.”

In 2012, Serum Institute bought Dutch vaccine maker Bilthoven Biologicals—its first international acquisition. With it came the technology to make an injectable polio vaccine, which then was available from only three producers globally. Five years later it bought Czech Republic-based firm Nanotherapeutics for $81.4 million and increased its production capacity four-fold. This business was sold in May for $167 million to Novavax.

“We’re in 170 countries globally now. Until the Narendra Modi government came to power and started buying a lot of vaccines, exports contributed 85 percent of our total sales. Now it’s about 60 percent exports and 40 percent local sales,” Poonawalla says. Despite pandemic- led disruptions this year, the company is still on track to launch a new dengue drug in addition to a vaccine for malaria two years hence, he adds.

But over the next few months, Poonawalla warns production costs will rise. “With the extremely high GMP (good manufacturing practice) costs and regulations, we may have to slowly start increasing prices of vaccines.” To mitigate the increase, he expects the Indian government to allocate more money to the health care sector. Between its Covid-19 partnerships, ongoing development of key vaccines and the firm’s foray into testing kits and newer areas of business, Poonawalla has his hands full. “I don’t imagine myself expanding in a major way, or diversifying in anything else,” he says. Going forward, Poonawalla sees the firm leading the industry. “The significance of what Serum Institute does—and what other vaccine manufacturers do—has always been understated and underplayed. Vaccines aren’t recognised or spoken about like automobiles or the consumer sector,” he says. “But, people have now realised how critical vaccine manufacturing and research really are to humanity.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)