India's Richest 2019: Berger Paints' Dhingras score flying colours

With a slow and steady approach, the Dhingras have made Berger Paints India's second-largest paint company

(From left) Berger Paints executive director Rishma Kaur, chairman Kuldip S Dhingra, vice chairman Gurbachan S Dhingra, and executive director Kanwardip S Dhingra

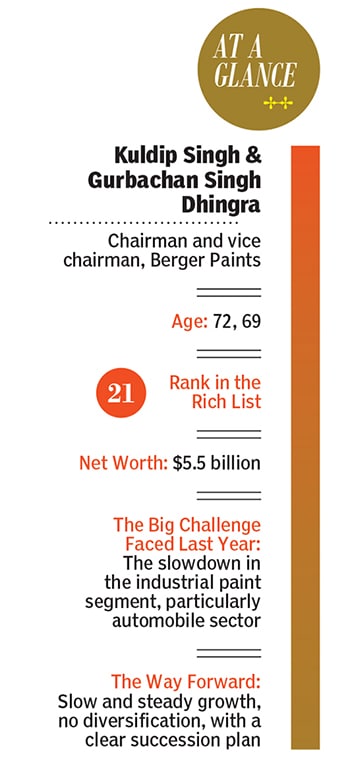

(From left) Berger Paints executive director Rishma Kaur, chairman Kuldip S Dhingra, vice chairman Gurbachan S Dhingra, and executive director Kanwardip S DhingraSitting in his opulent home in Lutyens’ Delhi’s Tees January Marg, which borders the Mahatma Gandhi Smriti, Kuldip Singh Dhingra appears nonchalant despite having leapfrogged 13 places on the 2019 Forbes India Rich List. Along with brother Gurbachan Singh, the 72-year-old patriarch of the Dhingra family is worth a staggering $5.5 billion (₹39,000 crore)—almost equivalent to Bermuda’s GDP. They are No. 21 on the list and a bulk of their wealth comes from their controlling stake in India’s second-largest paint company, Berger Paints.

“I don’t care about all this. This is all paper wealth,” says Kuldip, who’s dressed in a casual half-sleeve shirt and sipping coffee on a pleasant October morning. “We have seen so many people who were there [on the list] and they've disappeared. I don't like to be high profile and much in the public eye. All I want to do is focus on my work.”

This clarity of thought has brought about a change in the gardening enthusiast’s lifestyle as well. “I used to travel a lot,” says Kuldip. “Now I don’t like travelling or socialising. I try and do about 700 metres of swimming every day.” An early riser, he works six days a week, and has maintained this work ethic from the time he took over Berger Paints in 1991 from beleaguered liquor baron Vijay Mallya. The brothers are not involved in the day-to-day operations though. “As chairman, I am very active. We work as a team with the management. They are busy with the day-to-day operations while we chip in when there are some missing gaps or acquisitions, joint ventures and planning for which they don’t have time,” says Kuldip.

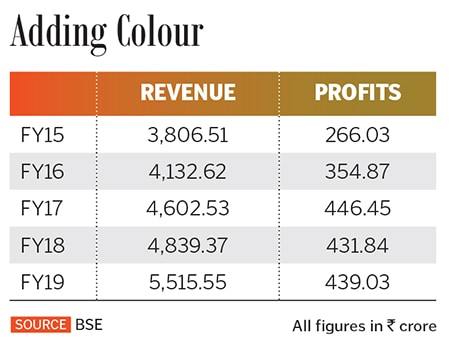

“What we have done has worked for us all these years. Why would I want to change that now? I have always looked at logic and a sustainable model of doing business,” he adds. An emphasis on the last aspect has ensured the Kolkata-headquartered company’s annual revenues jumped from ₹90 crore in 1991 to ₹5,515 crore in 2019. Profits, too, have shot up from ₹1 crore to ₹439.03 crore in the same period. Market cap stands at over ₹46,000 crore.

“I believe if you are getting better year on year, why chase risks? This [growth] has taken 29 years. The growth has been incremental, but I am happy with the pace. This is my style. We are not competing against anybody, but against ourselves,” Kuldip tells Forbes India.

The rise to the top, however, hasn’t been a smooth ride. The brothers lost their father at a young age, forcing them to leave their Delhi residence and move to Amritsar, where they started afresh.

Shopkeeper to Billionaires

The Dhingra family has always been in the paint business. “We were known as rangwallas,” says Kuldip. His great-grandfather and grandfather set up a paint distribution shop in Amritsar in 1898. In the following decades, the family expanded the business to Lahore, New Delhi and London, and set up a paint manufacturing facility in the national capital. A family split meant that Kuldip’s father was left with the Delhi unit and the shop in Amritsar.

Tragedy struck when Kuldip’s father passed away in an accident in 1957. “I was ten years old,” recalls Kuldip. His mother sold the factory, but retained the Amritsar shop. Kuldip’s older brother Sohan Singh Dhingra (who had a stroke in 1982 and passed away later) had then enrolled with IIT-Kharagpur while Gurbachan and he were in school. The family’s source of income was from renting one floor of their Delhi house while they stayed in another, and the interest earned from the proceeds of the factory sale. “I was the head of the family then, with my elder brother away,” says Kuldip.

A few years later, the family shifted to a rented home in Amritsar, to restart the paint business. In 1964, Sohan—a graduate by then—set up a small factory, Rajdoot Paints, with Kuldip joining the business in 1967. Two years later, Kuldip moved to Delhi to expand the business, taking orders and delivering them in his vehicle. “It was great fun running around,” he recalls. He set up a shop in Ajmeri Gate in Delhi and a factory in the capital in 1974.

The big break for the Dhingras came ahead of the Moscow Olympics in 1980. “I was in my office when a gentleman named Mr Galgotia called to inform that they were exporters to the former Soviet Union… and that they needed paint for the Moscow Olympics,” says Kuldip.

Kuldip sensed a massive potential in the Russian business because he did not have to deal with the taxes and duties in India as the country was looking at incentivising exports. So, he hired a professional from Kansai Nerolac to look after Rajdoot Paints while he shifted base to Russia. “I knew that he may not grow the business as much as I was doing,” says Kuldip. “But logic told me that it was better to pay this price since the Russian business would balance it.” Eventually, almost 100 percent of the export order—totalling over 20,000 tonnes a year—for paints from Russia came to him.

The canny businessman, however, knew his dream run may not last long. “It was too good to be true. My brother kept saying I was a pessimistic guy,” he says.

The Mallya connect

It was around this time that he heard about Vijay Mallya, former chairman of UB Group, wanting to sell his company, Berger Paints. “I got the news when I was in Moscow… I heard three people were in discussions with him,” recalls Kuldip. “I thought it was a professionally managed, decent-size business,” he says. So, he called a friend, requesting him to set up a meeting with Mallya only to be told that the deal had already been struck.

Persuasive as ever, Kuldip refused to give up. Mallya agreed to meet him and told him that he could buy Berger Paints if the existing buyer did not meet certain conditions that had been agreed upon. “After about 10-12 days, Mallya said the deal was off with the buyer and agreed to sell Berger to us,” says Kuldip. The year was 1990 and the deal was completed in 1991. Coincidentally, the Soviet Union collapsed in 1993. “It’s just luck. Pure luck,” laughs Kuldip.

The immediate focus was to pump money into Berger. “They were struggling and didn't have the money to pay salaries. So, I kept on supporting them and tried to instill the right values,” says Kuldip. The Dhingras then merged Rajdoot Paints with Berger.

Since then, Berger has been on a steady path of growth. It helped that Kuldip did not set ambitious targets and focussed on improving the company gradually. “I said give me conservative growth that can be mimicked without risks,” he says. Almost 29 years after that acquisition, Berger has 16 manufacturing units with over 170 sales offices and 3,500 employees. The company has expanded operations to Nepal, Bangladesh, Russia and Poland. Over the past five years, its annual revenues have grown over 45 percent while profits have risen by 65 percent.

Going forward

Despite the positives, the past few years have been challenging as the Indian economy has been battling a slowdown. “The paint industry isn’t doing any better,” says Kuldip. “The industrial segment has been in bad shape, particularly in the auto business. There is huge negative growth in that sector.” The silver lining comes from the repainting industry. “Eighty-seven percent of the architecture segment is repainting. So that’s doing reasonably okay,” explains Kuldip. Currently, the industrial segment comprises about 24 percent of the paint industry while the remaining comes from the architecture segment, he adds.

Traditionally, the paint industry has grown nearly 1.5 times the GDP growth rate. “I have been in the business for 52 years,” says Kuldip. “For many years before liberalisation, we have survived with 2 percent growth. We have been prospering throughout, so we are doing alright. We aren’t spoilt brats,” laughs Kuldip.

Berger Paints will continue with its “slow and steady” approach, says Kuldip. “And no diversification.”

Experts feel the company has no reason to block fast-paced growth in the coming years.

“What has happened in the last few years is that Berger has managed to transition itself from being in the low end of the paint business to the upper end,” says Abneesh Roy, executive vice president at Edelweiss Securities. “It has managed to plug in a lot of loopholes, increase distribution network, invest in a lot of technologies and most importantly, get a brand ambassador. The company is now doing remarkably well, and with the paint industry growing at double digits, and a professional management at the helm, the company looks on course for further growth.”

The Dhingras also have an eye on the future and have put together a guideline for succession. “The fifth generation is here and it is working well. We’ve told them how they should continue,” he adds. One of each brother’s children will get into the business full time while another can join part-time. The chairmanship will be by rotation. “The philosophy is to sustain growth and not destroy wealth,” says Kuldip.

Roy says the day-to-day work is handled by a professional management, which is a positive for the company. The promoters have not been giving them unrealistic targets, he adds.

That does not mean the septuagenarian is ready to hang his boots just yet. “I enjoy working,” says Kuldip. “I know that retirement means death and illness. So, I’ll carry on, but at the same time, the children are getting groomed. I am thinking when I will step down as chairman.”

For a man who knows a thing or two about timing, it’s unlikely it would be anytime soon.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)