India Inc Gets Smarter With Travel Spends

Managing travel costs during economic downturn isn't about spending less, it's about spending smarter

Staying profitable in lean times is about fine margins. How much can you save here, shave a bit off there? Travel and entertainment are usually the first expenses to be grounded when business is slow. Yet, India’s most successful companies have found ways to keep their executives mobile while getting the most out of their travel budget. Wipro, Infosys and TCS together spent over Rs 3,000 crore on travel last year. In fact, in sectors like IT and consulting, travel spends have increased.

Choice Picks: India’s IT giants manage hundreds of travel itineraries—short domestic trips for senior execs and long-haul international placements for engineers. In the process, the entire corporate travel infrastructure—from bulk booking, industry benchmarking and data analytics to adhering to company policy—has evolved to a stage where business travellers have some flexibility in making their choices.

Wipro, for example, has created a system (to be included in a mobile app) that integrates all the global hotel chains and airlines it has deals with. Its employees can see which flights, hotels and car rentals they can pick that suit the company best.

Wipro, of course, benefits from economies of scale through these bulk bookings. Hariprasad Hegde, global head of operations at Wipro, says controlling travel is about focusing on the sourcing as well as consumption. All of Wipro’s travel is managed by Wipro Travel Services, a separate ISO-approved company, rather than a travel service implant. Hegde says this allows Wipro to deal directly with airlines like Etihad, KLM and Lufthansa. “We compare ourselves sector by sector, quarter by quarter against every other travel company in India,” says Hegde.

Squeezing Out More Benefits: While on the face of it, the Mumbai-Delhi fare for an individual on Cleartrip, for example, will be the same as the corporate fare, there are many hidden disadvantages to booking on Cleartrip that corporate clients prefer to avoid, such as inflexible timings, cancellation fees and low baggage allowances.

On Cleartrip, 12 percent of individual passengers cancel their bookings, while the figure is 17 percent for corporate travellers, because of rescheduled meetings and itineraries. Companies cannot afford to pay a 50 percent penalty each time for such changes, and therefore work these features into large annual contracts with airlines. Noel Swain, executive vice president of Cleartrip, breaks down how these bulk deals work: “Airlines offer a flat fare to the locations you frequent,” he says. “Irrespective of how much in advance you book, they’ll give you the same discount—2 percent of base fare, going up to 10 percent for big buyers.” Carriers like Emirates and Lufthansa are dependent on such deals.

The Changed Travel Co: The online revolution, connecting customers to airlines and hotels, means traditional travel companies have had to evolve. Options for booking hotels online, at all price points, have grown tremendously; 13 percent of bookings on Cleartrip take place via mobile devices, many through its app. There’s been a boom in Cleartrip’s tie-ups with hotels in the three-star category and below. It offers 567 hotels in Delhi alone. Makemytrip acquired Amsterdam-based hotel booking firm Easytobook in early February.

Jeet Sawnhey, MD of travel services company Abacus India, says, with the rise of low-cost carriers and travel portals, travel companies now add value by, for example, offering visa and passport services. “For a travel agent it was easy to increase top line,” he says. “If a customer moves to a competitor, you get him back by giving a higher discount. But would he add to my bottom line?” The cost of business is going up and Ebitdas (earnings before interest, taxes, depreciation, and amortisation) are falling. But, Sawnhey says, corporate air travel spends have gone up 7 to 9 percent in the last year; air travel products still make up 80 percent of revenues for travel agents.

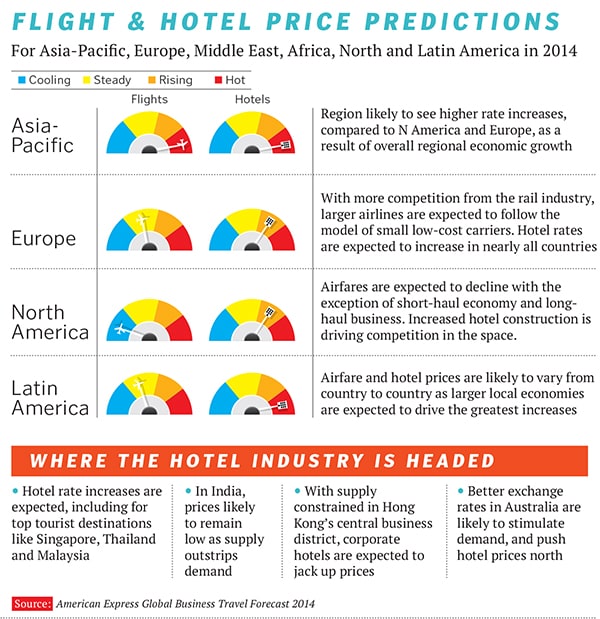

Rather than book flights through agents, many companies outsource their travel management to global companies, like American Express, which, with airline and hotel partnerships, negotiate better deals. “Once a large travel company has the entire company’s data, it’s easier to consolidate spends with airlines and hotels,” says Sandeep Shastri, India head, American Express. After identifying sectors a client frequents, AmEx can negotiate multi-year deals for those routes.

Smaller companies have taken note. “SMEs have begun planning travel budgets. Travel costs have gone up, and most see the advantage of fixing the volume of travel and starting negotiations,” says Zakir Ahmed of Trust Travels. Most companies don’t allow business/first class travel for journeys less than five hours long. There’s been a big jump in LCC bookings, particularly for Middle East and South-East Asia. A year ago, about 10 percent of Cleartrip’s bookings on international routes were on LCCs; now it is 30 percent.

If companies have many employees going to Gujarat, they tie up with—for instance— Jet Airways, because it has the most routes in that sector.

The onus to invest shrewdly in travel lies with companies themselves. It starts with insisting that bookings be made a minimum of two weeks in advance for international flights and one week for domestic ones. AmEx’s Shastri says that though spends for large events are well tracked, smaller meetings are managed in an ad-hoc way.

The consensus is that travel is an investment rather than an expense, and needs to be tracked and analysed. A company wouldn’t generally buy materials from seven different suppliers at seven different rates, so why wouldn’t they apply the same to hotel rooms?

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)