Budget? Er, What?

Is our income inflation adjusted?

The Budget has come and gone and some of us did not even blink.

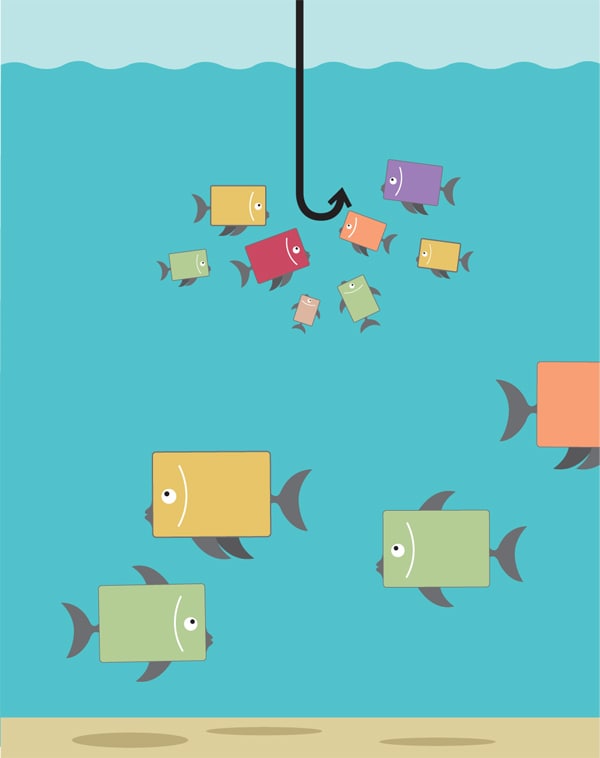

For those who eye the sunny shores of the Mediterranean for their next vacation, or the next shopping spree at the up-end label from the UK, Pranab Mukherjee’s 33-page Budget Speech might as well have been a 140-character tweet.

The price of vegetables may inch up every now and then, as might the cost of fuel, but that does not cast the palest of shadows on their, or their family’s, spending habits. A night out with friends or a luxury handbag may invite a heavier price tag, but that does not stop the bubbly from flowing.

When asked if the rising prices of electronic goodies (read: Products of the house of Steve Jobs) and international travel will affect her spending patterns, a consultant said, “No. It should, but no.” A Mumbai-based banker explained why the Budget would probably make a difference only to her annual savings: “My income is inflation adjusted. My spending habits are a function of my income and this will not be taxed differently.”

But this response is not restricted to the banking and consulting community. A senior journalist said, “If biscuits are more expensive, will we cut down on them at home?”

So, yes, prices will rise and bills will be higher, but the buying of all things good (and dear) shall continue unabated.

(Research: Samar Srivastava and Jasodhara Banerjee)

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)