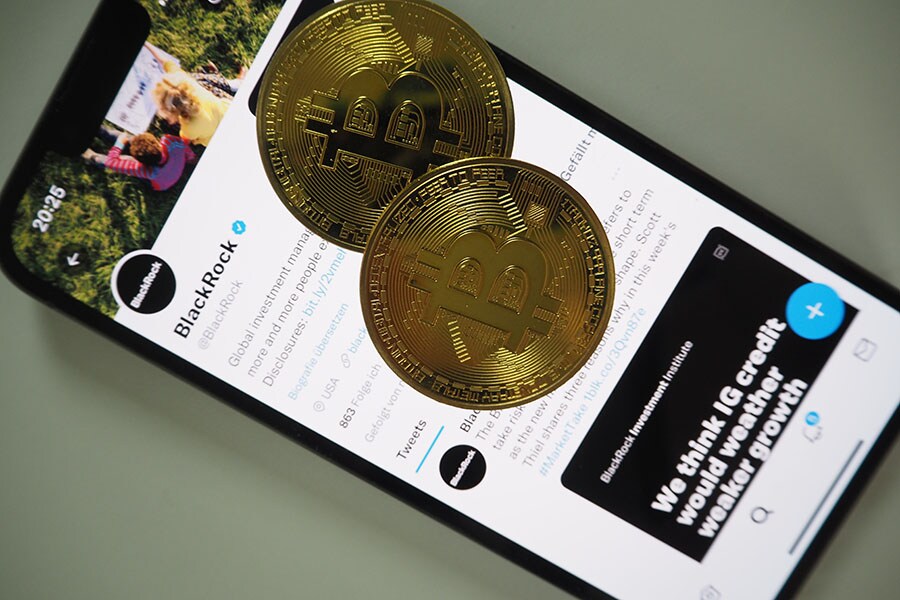

SEC Commences Regulatory Review as BlackRock's Bitcoin ETF Application Gets Accepted

SEC begins a regulatory review as BlackRock's Bitcoin ETF application gains acceptance, paving the way for potential crypto market expansion

Image: Shutterstock

Image: Shutterstock

The United States Securities and Exchange Commission (SEC) has taken a significant step toward embracing the potential of cryptos by accepting BlackRock's application for a spot Bitcoin Exchange-Traded Fund (ETF).

This decision comes shortly after the SEC acknowledged a similar application by Bitwise, marking the official commencement of the regulatory review process for BlackRock's ETF proposal.

ETFs are investment funds that track specific indexes and are traded on exchanges. In the world of cryptos, a crypto ETF mirrors the value of digital tokens and may comprise a variety of cryptos.

The involvement of BlackRock, a prominent player in the financial industry, adds considerable weight to the spot Bitcoin ETF race. In their filing, BlackRock also secured an agreement for "surveillance-sharing" with Coinbase, a leading crypto exchange. This collaboration emphasises the company's commitment to addressing regulatory concerns and promoting transparency in the crypto market.

The competition among companies striving to launch a Bitcoin ETF in the United States is viewed as a positive development for the crypto industry. With multiple filings in progress, the likelihood of success increases, and the SEC gains the opportunity to evaluate different strategies and address various concerns presented by the applicants.