Shari Redstone and the real-life life 'Succession' drama

Shari Redstone faced a vicious uphill battle for her father's company—including, at times, with Sumner Redstone himself. Finally victorious in uniting Viacom and CBS under her, she tells her side of the story for the first time

Shari Redstone

Shari RedstoneImage: Martina Albertazzi / Bloomberg via Getty Images

For nearly two decades, Sumner Redstone lorded over the media juggernaut he created from the corner of the 52nd floor of Viacom’s headquarters, a classic power perch down to the tan leather sofas.

As the 96-year-old founder gradually fades from the scene, there’s a new occupant in the chairman’s office: His daughter, Shari, who emerged victorious from arguably the most vicious corporate battle of this century so far—one that occasionally pitted her against her own father.

She’s wasted no time making the place her own, with an overstuffed white couch and matching chairs arrayed around a coffee table with a floral centrepiece. Family is everywhere, the pictures of her children and grandchildren covering every flat surface. Shari herself poses with the six Super Bowl trophies claimed by her beloved New England Patriots. And Sumner is represented, too, his portrait sitting behind her desk. Rather than the confident, austere, imposing image that most founders favour, this one depicts him closer to how he looks now: Frail, bent over, shrunken with age, dressed in the jersey of their shared team, the Patriots. “No matter how hard or challenging it got, I tried to keep my head down, fight for what was right and not read the press,” Redstone says during one of a series of interviews with Forbes, the first she’s given since she won the fight for the future of CBS and Viacom that started four years ago. “For me, it was really important to ignore the noise and to keep looking forward.” That required some steely discipline. The battle royale played out on a seemingly daily basis, and it had the kinds of twists and drama that even HBO’s Succession, clearly inspired in part by the Redstones (with a larger dash of Murdochs), couldn’t make up. After years of lobbying, cajoling, legal wrangling and boardroom manoeuvering, the petite, 65-year-old Shari Redstone officially emerged in August as the chairman of the soon-to-be combined entity, having remade the recalcitrant boards of both Viacom and CBS.

“There were a lot of men around her, very powerful men, either telling her she wasn’t going to win or who were her foes,” says Jason Hirschhorn, a former chief digital officer for MTV, who later garnered an investment from Redstone’s venture firm. “They thought she was the rich guy’s daughter who didn’t know anything. And that, as much as anything else, is why she’s won.” Redstone, a lawyer by training, repeatedly declined to talk about many of the battle’s granular details, including her dealings with Les Moonves, with whom CBS is currently involved in arbitration. Her vantage point, as with her office, reverts to family—in this case, one with a $4.1 billion fortune and a roller-coaster relationship with her legendarily headstrong father at the center.

That saga now has a surprising new chapter, including a strong claim to Redstone being the most powerful woman in media.

***** The senior Redstone was so pleased that he reportedly said, “Your life is not complete until you have met Shari.”

The senior Redstone was so pleased that he reportedly said, “Your life is not complete until you have met Shari.”

Image: Mark Sullivan / Getty Images

Shari Redstone was born in 1954, the same year that Sumner Redstone became Sumner Redstone: He quit his lucrative career as an antitrust lawyer to join the family’s 14-theatre drive-in chain, National Amusements. “There isn’t a day that I don’t walk into that office and remember that it all began with my father and his vision so many years ago,” Redstone says.

In contrast to their complicated adult years, her early memories include him taking her to school, having breakfast together and doing college tours. She recalls one rainy morning while slogging it out through law school, as her dad did, when he ran out at 3 am in search of a copy shop for one of her school papers.

She inherited her father’s auburn hair and sharp intellect. After the birth of her third child, she stopped practising law full-time. While studying to be a social worker, she found her life changing course as her 13-year marriage to Ira Korff ended in 1993.

“When I got divorced and I needed to get a job, [my father’s] the one who pushed me into National,” Redstone says. “He wanted me to go on the boards when I just got divorced, and I said no, because I was trying to take care of my kids and balance working. This was all my dad’spushing.”

After she joined National Amusements as vice president of corporate strategy in 1994, she expanded the company globally, opening theatres in Russia and Latin America. She pioneered a concept still in vogue today—introducing gourmet food, lounges and valet parking at theatres in Los Angeles and elsewhere. The senior Redstone was so pleased, he reportedly said, “Your life is not complete until you have met Shari.”

The sunshine of his approval did not last long. The patriarch, who frequently boasted of his immortality—he famously clung to a third-storey window ledge during a deadly blaze at the Copley Plaza hotel in Boston, which left burns over almost half of his body— was also famous for refusing to surrender power, dispensing with a long string of well-regarded executives, from Frank Biondi to Mel Karmazin to Tom Freston.

Sumner and Shari began to clash over succession, corporate governance and the future of the theatre business. A major point of contention was her father’s investment in Midway Games, a company that later filed for bankruptcy. The tension erupted publicly in 2007, after Shari voted to block a $105 million charitable gift that her father wanted to make to hospital systems in Massachusetts and California. In a letter to the trustees of the National Amusements Trust, Sumner wrote that his daughter “does not have the requisite business judgement and abilities to serve as chairman of the three companies”, according to a lawsuit later filed by one of Sumner’s former companions. In a letter sent to Forbes five months later, he publicly blasted her for making an effort to succeed him as chair of Viacom and CBS, saying she and her brother, Brent, had made “little or no contribution” to building the media empire. “While my daughter talks of good governance, she apparently ignores the cardinal rule of good governance that the boards of two public companies, Viacom and CBS, should select my successor,” he wrote.

Philippe Dauman was like a son to Sumner Redstone. He was pushed out as CEO in 2016

Philippe Dauman was like a son to Sumner Redstone. He was pushed out as CEO in 2016Image: Reuters

Brent had sued his father in 2006 for shutting him out of big deals—including the decision to split Viacom into two companies—and for self-dealing. Shari took Sumner’s side, and the company issued a statement accusing her brother of “abusing the court system in an attempt to extract a financial settlement in a family dispute”. Brent sued for access to his one-sixth interest in the company and walked away with $240 million. (Attempts to reach him at his home in Colorado were unsuccessful.)

That left Shari Redstone with a 20 percent stake in National Amusements, which had morphed into a holding company for Viacom and CBS. It was complex. She had defended her father and publicly rebuked her brother. She forgave and protected Sumner even after he denigrated her to Viacom executives. But the elder Redstone had taken a shine to two other executives, Philippe Dauman and Les Moonves.

*****

To Sumner, Dauman was like another son. The Columbia-educated lawyer earned Sumner’s confidence while hunkered down in a one-bedroom room at the Carlyle Hotel in New York plotting his hostile bidding war for Viacom. National Amusements outmanoeuvered a management-led buyout team in 1987, acquiring the company’s assets, including MTV Networks, Showtime, The Movie Channel and Nickelodeon.

Dauman was named chief executive of Viacom when cable television was at its peak. Viacom’s MTV was arguably the most influential cultural force of that generation, Nickelodeon became the dominant channel for kids with fare like SpongeBob SquarePants, and Comedy Central became iconic for offerings like South Park and The Daily Show.

But Dauman lost his touch in 2014, when Viacom’s stock started to decline, in lockstep with television ratings and Paramount Filmed Entertainment revenue fell by $557 million—a trend that would accelerate the following year. Redstone, who pulled away from National Amusements, and in 2011 started a venture firm with her son-in-law, was growing increasingly concerned. Executives past and present were lamenting the slow erosion of a culture built around her father’s oft-stated mantra, “Content is king.”

“The culture and the values that represented everything that Viacom was disappeared under Philippe,” she says. “The belief in content, that it matters, disappeared under Philippe.”

Dauman declined comment.

Viacom spent $15 billion on buybacks in an attempt to prop up the stock, while rivals were acquiring properties that added immense long-term value to their libraries, such as Disney’s purchases of Marvel Entertainment and Lucas film. Redstone, who sat on the board, was constrained without her father’s support.

“Basically, it was really a lot about financial engineering and stock buybacks and not believing in the people who created content, not supporting the people creating content, not creating a culture of creating content,” Redstone says. “So, I was up against that, and I tried to fight that battle for years to no avail.”

She watched helplessly as the legacy Sumner built faded away. MTV and Nickelodeon were losing relevance as young audiences turned their gaze online. Paramount Pictures, the studio of the Godfather movies was releasing duds like Hot Tub Time Machine 2 and a remake of Ben-Hur.

“We have the best opportunity of any media company in the world to be number one going forward,” she recalls saying to the board at the time. “We own these people. Shame on us if we lose them.”

But while she found the board indifferent to her concerns, she says much of the company was rallying behind her. “People were rooting for me—not for me, but because they wanted Viacom back,” she says.

Ailing and struggling with physical mobility but still in control, her father proved to be her biggest challenge. For a time, Shari and her family wouldn’t visit the Beverly Hills mansion that Sumner shared with two women, then-girlfriend Sydney Holland and a former companion, Manuela Herzer, and communication was limited.

She took a more active role in her father’s life after he went through a series of hospitalisations in 2014, claiming in a court filing that a nurse confided he had witnessed emotional and financial abuse of the frail billionaire. While the two women denied the allegations, they were removed from the home in 2015, and after a legal battle that revealed embarrassing details of Sumner’s sexual and other appetites, Shari took charge of his care and once again began visiting her father.

“Sadly, people came into his life who had a different agenda, and their agenda was to separate us. And in some ways they did a good job,” Redstone says. “It never meant we stopped loving each other or caring about each other, but it became really hard.”

Once they were reconciled, she shared her concerns about Viacom with her father. She talked about his lost legacy and lamented the damaged culture.

“He asked me a question, and the question caused me to say, ‘Look, dad, let me tell you what happened at Viacom’. And I went through all of the businesses of Viacom, the positions I had taken on the board, which had not necessarily been well received. So he was only hearing Philippe’s view of what was going on at the company, what was going on at the board and what my views were,” Redstone says. “So I kind of came in, and I gave my dad that whole sense. And even at the end of that, I think when he understood what was going on in the company, he wasn’t ready to let Philippe go.”

Then one day in February 2016 Dauman drove past the metal gates of Sumner’s home to propose selling an equity stake in Paramount, in a meeting vividly described in Keach Hagey’s biography of Sumner, The King of Content. Sumner’s 1994 triumph over QVC Chairman Barry Diller in the pursuit of Paramount, the oldest surviving film studio in the US, was the career victory he would savour most. Selling it was tantamount to treason.

Sumner instructed his lawyers not to sell, but it was his daughter he turned to to ensure that it didn’t happen. “I said to him, ‘I will do this, but this is your battle’,” she recalls. “It wasn’t my battle for me. It was my battle for him.”

*****

Shari Redstone says she had no master blueprint for the fight ahead. “It wasn’t a long-range plan because I kept having short-range challenges,” she says.

By March 2016, Dauman and Viacom board member George Abrams had both been removed from the seven-person family trust. That pair sued, challenging Sumner’s mental competency and accusing Shari of manipulating her father. Then Dauman was removed from the Viacom board along with four other pliant directors. A new legal challenge was mounted, but before the courtroom dramas could play out, Dauman agreed to a lucrative exit, which included $58 million in severance pay.

Shari was faced with one more significant opponent, an executive she’d considered a trusted friend, who stood in the way of the merger she felt would be in the best interest of the company and its shareholders: CBS chief executive Les Moonves.

Moonves was hired by Sumner in July 1995, taking over as president of CBS Entertainment when the Tiffany Network was the laughing stock of the television industry. The savvy programming executive, who had green-lighted Friends and ER, set out making hits like CSI, NCIS and Cold Case, transforming CBS into the nation’s most-watched broadcast network, winning himself the CEO title. Moonves had little interest in taking on the woes of the network’s struggling corporate sibling, Viacom, and even went to court to block the merger with Viacom.

Then came the #MeToo movement, which quickly ensnared CBS. The company first fired CBS This Morning host Charlie Rose, citing reports of “disturbing and intolerable behaviour”, and then 60 Minutes executive producer Jeff Fager for “violating company policy”— specifically, threatening a CBS reporter who was following up on reports of sexual misconduct at the company. Rose apologised for his inappropriate behaviour but said not all of the allegations were accurate.

But the most powerful executive at risk was Moonves, who in July 2018 found himself the focus of a story published in the New Yorker reporting allegations of sexual misconduct and threats of retribution. Moonves resigned in September 2018, and six new members joined the CBS board. With interim CEO Joseph Ianniello in place, the company moved swiftly to repair a culture described as toxic and misogynistic—donating $20 million to organisations committed to eliminating workplace harassment, installing a new chief people officer and naming a woman, Susan Zirinsky, president of CBS News.

“I was speaking before a women’s group... and they said to me, ‘After everything you’ve been through, why shouldn’t every woman in this room be pessimistic?’” Redstone recalls. “Because I’m here, because we can do this’. But this is a moment in time where, I think, we can’t drop the ball. We have an opportunity and a responsibility to do what we can to have an impact.”

*****

Her two chief rivals having been dispatched and imploding, respectively, Redstone’s ascension went from a long shot to almost a fait accompli. While it wasn’t made official until this past August, when CBS and Viacom announced their $12 billion merger deal, Shari Redstone began looking to the future last year.

To get there she will need to keep the family on her side. Sumner’s 80 percent stake will be divided in two on his passing, half for the benefit of his descendants, whose trustees will include Shari and her son as well as others with long ties to members of the family, including divorce lawyers for Sumner and his former wife, Phyllis, and a National Amusements executive. The other trust will be for the benefit of Phyllis. In other words, more drama could be on the horizon.

Shari Redstone will have a critical ally in Bob Bakish, who had been running Viacom International Media Networks. Initially designated as interim CEO, he was viewed as keeping the seat warm until Moonves would lead the combined companies. Bakish didn’t wait for that to happen. He shook up the executive ranks, recruited high-profile industry executives to lead the Paramount and Nickelodeon units, invested in developing content for social media and, most critically, acquired the free, ad-supported video service Pluto TV to give Viacom a foothold in the streaming world. Pluto TV now boasts 18 million regular users.

“Where have you been?” Redstone recalls asking Bakish after he presented his plans for the business unit to the board. She was struck by his digital strategy, which was more evolved than in the US business.

“I specifically decided that the board is important, has valuable perspective, and therefore I want to engage with them,” Bakish says, adding that Redstone “was a clear person that I thought it was important to build a relationship with based on transparency, trust and more.” Bakish’s management style and the gains at Viacom were rewarded: He will lead ViacomCBS as president and CEO once the merger is completed.

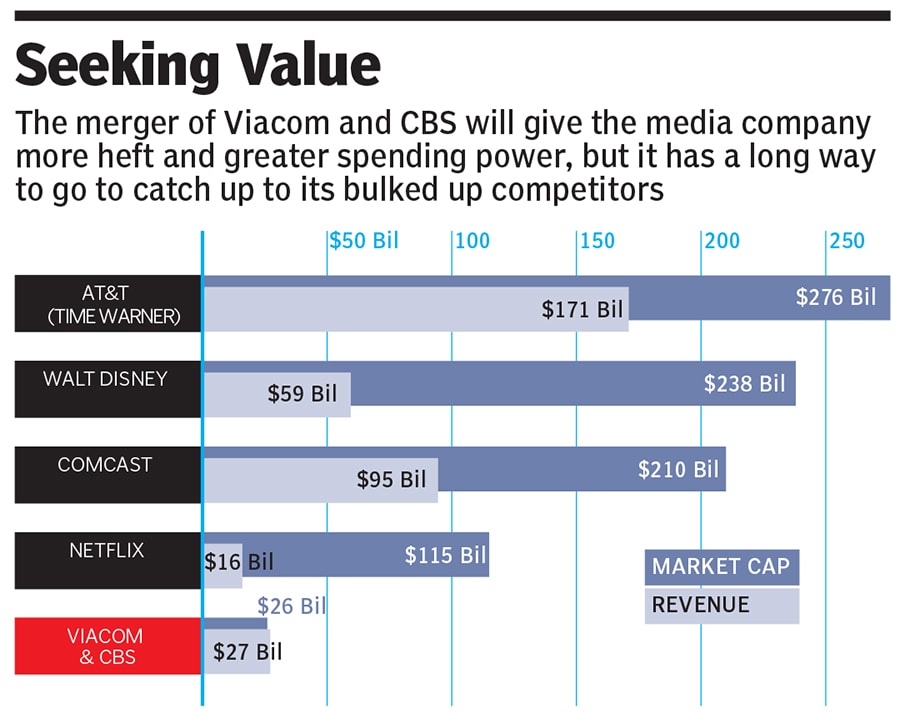

Bakish and Redstone argue that the combined companies’ global reach and production capacity, massive film and TV library (140,000 television episodes, 3,600 film titles) and $13 billion in spending on content (750 series on order) put it on a more equal footing with rivals. That’s on par with the spending binge Netflix has used to seize the narrative of the once insular and impenetrable industry, and eclipses reported figures for Amazon or Apple. But even together, ViacomCBS will be dwarfed in market value by traditional media rivals like Disney or Warner Media parent AT&T or Comcast, the cable giant whose holdings include NBC and Universal Pictures.

Redstone’s emerging media venture investments, from YouTube creator network Maker-Studios to podcast platform Wondery, inform how she thinks of the family’s traditional media business. She’s now looking to digital-savvy executives like Viacom’s digital studios chief Kelly Day, who’s been developing original programming for YouTube, Facebook and Snapchat and, before that, shows for Netflix.

She obsesses about ways to reach audiences beyond a linear broadcast. Her interest in emerging media began with a question she posed at a Viacom board meeting to which she never received a satisfactory answer: Who’s watching the MTV reality show Jersey Shore? The question led her to fund ventures like Niche, a startup that connected social media stars with advertisers and subsequently was acquired by Twitter, and Religion of Sports Media, a startup whose co-founders include Patriots quarterback Tom Brady.

“My dad had a line, ‘Little failure, little success; big failure, big success.’ You have to take risks,” Shari Redstone says. “That’s what a venture fund is all about. How much risk do you take? So I say, we take risks, but we take it conservatively. But you have to take risks. You have to be willing to fail in order to succeed. And we’ve all failed. So, thank God there’s a value to it.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)