Plaid: Fintech's happy plumbers

Plaid is approaching a billion-dollar valuation by building the pipes that connect your apps to your checking account. Will the big banks try to snuff it?

Perret (left) and Hockey: Plaid helps apps save money on bank transaction costs, but faces tough competition

Image: Timothy Archibald for Forbes

Image: Timothy Archibald for Forbes

Climbing isn’t just an office perk—it’s part of company lore. On one of their first outings together, Perret dropped his co-founder 15 feet. They laugh about it now: Six years after the company’s founding in 2012, Plaid is exploding in lockstep with the fintech sector it helps power. Its software acts as a kind of plumbing, connecting apps to each new user’s bank to quickly confirm an account holder, without any penny deposits or paperwork. If online financial planning, stock picking and bitcoin trading are in gold rush mode, Perret and Hockey have the surefire business: The shovels and pans.

Look under the hood at startups like Acorns, Betterment, Coinbase and Clarity Money, and you’ll find Plaid humming away. Developers love Plaid’s fast tech; founders and their investors like saving money by not having to build their own connections. “We built this for ourselves,” Hockey says, “solving problems that were incredibly hard to do.”

Plaid hooks into around 10,000 banks. It’s internal fortunes have improved, with $59 million in funding from investors such as Spark Capital, NEA and the venture arms of Citi and American Express. In 2016, its $44-million Goldman-led series B valued the company at $250 million. Today, with sales quadrupled, the company has recently received funding interest valuing the company at $1 billion, according to a source with knowledge of its finances. Perret and Hockey employ 130 people out of a spacious two-storey office in the South of Market area of San Francisco.

Hockey, 28, sees Plaid as a core building block for startups: “We talk to people before they raise money, sometimes when it’s just two people in a room.” Adds Perret, 30: “Our mission isn’t [simply] financial services innovation. It’s to enable innovation anywhere by delivering access to the financial services system.”

The pair met as young consultants at Bain’s Atlanta office: Hockey, a California native, was straight out of Emory; Perret, a Duke grad, was a year ahead of him. Their bond cemented by that climbing mishap, Perret and Hockey shared a love for coding and began working on projects in their spare time. Unhappy with the lack of transparency in the bills they were paying, they tried to cook up a financial planning tool. It floundered, but in the process they solved the technical challenge of connecting their app to their bank accounts.

Though Yodlee gained traction more than a decade ago as an aggregator of financial data, many businesses still depended on one-penny micro-transactions to verify customer bank accounts. Others uploaded PDFs of paper statements and typed in the data manually. Perret and Hockey sought to create an application programming interface, or API, to perform the same function with only a bank customer’s online user name and password.

Setting up shop in New York in the spring of 2012, with Perret as CEO and Hockey as CTO, the pair scored a stroke of luck. Venmo’s engineering chief was in the process of cutting the cost of a peer-to-peer money transfer for making payments. The solution was settling transactions in big batches; while Venmo customers would transact instantly, the actual payment was delayed a day. Plaid helped remove the risk: Venmo would know in real time that the sender had a sufficient bank balance.

Venmo’s validation helped the startup take off among other fintech customers that were looking to emulate Venmo’s success. Some now-well-known apps would sign up months before they became household names. “We’d think, that idea’s kind of weird. And then they’d get crazy scale,” Hockey says.

After moving to San Francisco that fall in search of more engineers, Plaid sought out Silicon Valley’s venture capitalists with high hopes. The startup had customers, a working product and revenue. It also had two first-time founders who still struggle to explain what they do in non-nerd English. “We got rejected 50 times,” Hockey says. “You think it was only 50?” Perret interrupts.

Plaid survived on a shoestring budget. Hockey lived on a friend’s couch. Perret moved in with a new girlfriend. Friends would take them to dinner. Finally, Spark Capital led a $2.9 million seed round in July 2013, and money has flowed ever since. (Hockey and Perret also hit Forbes’s 30 Under 30 list in 2015.) “They were really young, but they ran a tight ship,” says Spark co-founder Santo Politi.

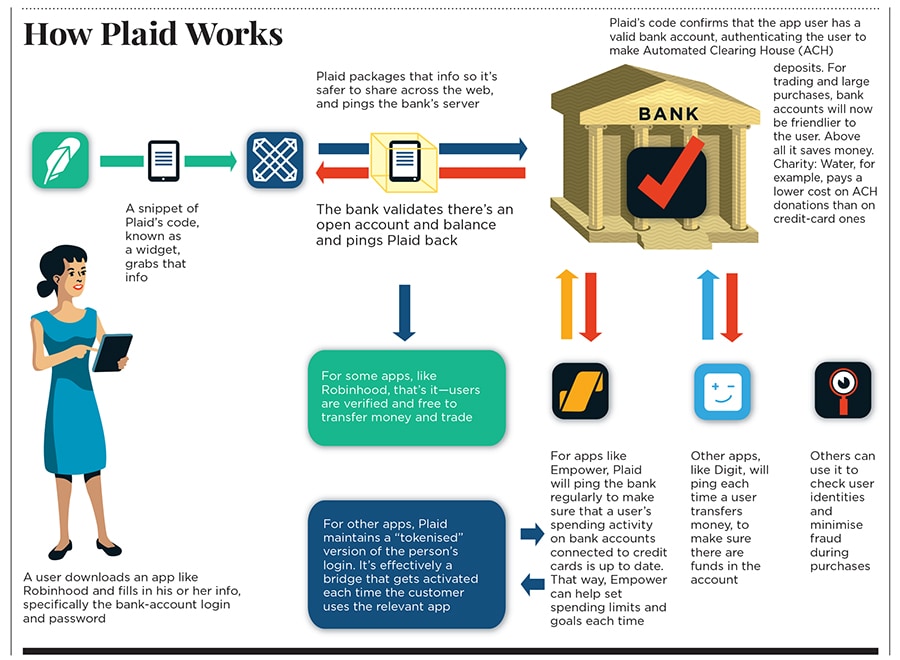

Infographic: Peter and Maria Hoey for Forbes

Infographic: Peter and Maria Hoey for Forbes Today Plaid’s reach extends across tens of millions of end users and thousands of apps, which account for hundreds of billions in spending and financial planning. The company’s revenue was $40 million last year, according to Forbes’s estimate, and its cash-flow is close to breakeven. But in a software industry that lionises “the three nines”, or services that run properly 99.9 percent of the time, Plaid is an unusual success: It doesn’t always work. Plaid’s own public status page reveals connections to banks with uptime of 98 percent or even 95 percent—meaning that 5 out of every 100 authentications with that bank will fail in that moment, a rate that would be unacceptable were it not for the difficulties imposed by the banks. App makers who integrate with services like Amazon and Google expect their apps to work with a consistency impossible for a service like Plaid to even approach, says Warren Hogarth, who uses Plaid at his money manager startup, Empower. The problem, he says, is that Plaid remains at the mercy of the banks, which don’t feel any urgency to share their customers’ data with apps that aren’t helping their bottom line. “It’s a tricky place to be,” he says.

Should the banks ever band together to offer their own joint APIs, they could undercut much of Plaid’s business. Competition is also heating up, from new startups and from holdovers such as Yodlee and Finicity, which also offer solutions for connecting to banks by API. One venture capitalist who has studied fintech warns that with many bank accounts concentrated with a few leading banks, it could be hard for Plaid to maintain pricing if customers focus more on cost. “None of these companies using Plaid are cost optimising yet,” he says. “What happens when they’re not focussed on adding tons of new customers?”

Plaid’s founders know that they need to expand the uses of Plaid if they want to be a company much larger than their predecessors, some of which ended up aggregating data and bundling it to third parties. (Plaid says it will never sell its users’ data.) Perret says the big opportunity is to expand how bank accounts are used today. Plaid could help apps in hospitality, travel and shopping understand their users’ spending to make them better offers. The company is already experimenting with this approach with mortgages. And companies like Airbnb and Uber could move away from credit card transactions to pass along lower fees to their customers. “Every company is becoming a tech company,” Hockey says. “And we have this thesis that every company needs to be a financial services company, too.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

X