Lenovo's India Takeaway

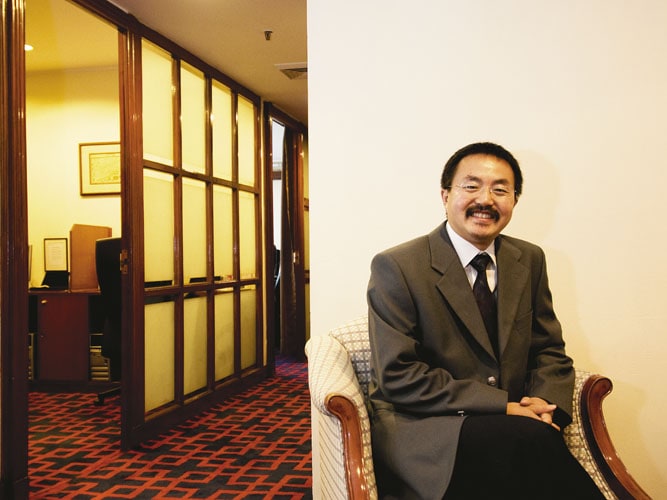

Alex Li from China teams up with India's Amar Babu to restructure the computer company's stuttering India business

Alex Li was serving as the worldwide product head for Lenovo in Taiwan early this year when he received a call from his boss, Shao Peng, Senior Vice President, Emerging Markets. Peng was looking for a capable hand to drive growth and restructure the channel mode of business in India, a key market for Lenovo. “He just asked me to go to India and a few weeks later, here I was,” says Li. He visited India for the first time just last year.

Six months later, Li has absorbed Indian culture. He listens to Indian music in his car, even when he is back home in China. He keeps a miniature idol of Ganesha in his car to ward off evil. He is, in fact, now referred to as “Alex Kumar” in the India office where he serves as the vice president of Transaction (Consumer and SMB) vertical of Lenovo India.

Li still shuttles between China and India but hopes to bring his family over to Bangalore to live with him. That will happen when it does but Li is bringing something that is equally valuable for him to India: Lenovo’s China model.

Lenovo’s China model is a way of working that has made Lenovo the largest selling personal computer (PC) maker in China, with 30 percent of the market share. The China model is essentially a way of distribution. Its uniqueness is in Lenovo’s ability to distribute through large format retail shops, corporate sales, regional distributors and even small retailers. The model allows Lenovo to provide seamless after-sales service as well.

Lenovo needs something special in India for sure. The company had its worst year in FY 2009 globally and India was no different. Sumanta Mukherjee, manager, computing products research firm, International Data Corporation (IDC) says, “They started on a high note, but somewhere down the line lost the momentum. There was a consistent slide in market share, quarter on quarter.” Li has been sent with the China model to fix exactly that.

It is always difficult to transplant something as local as a product distribution system but the senior team at Lenovo thinks that there are similarities between China and India. Lenovo CEO Yang Yuanqing believes most emerging markets are similar to China in consumer behaviour, channel distribution model, product trends and go-to-market strategy.

Li concurs: “In China and India, the festival seasons are peak time for sales. Customers like to touch and look and experience the products in both markets, hence they like to buy from the channel.” The company firmly believes that the formula that made Lenovo successful in China can be rolled out for other large emerging markets, India included. Globally as well in India, the company has split the business in two key verticals: Relationship (sale to large enterprise) and Transactional (sale to consumer and small and medium businesses). Li will build the transaction business for Lenovo in India.

The China Triumph

So how does the Lenovo model work in China? It sells through 6,000 outlets. In spite of its vast reach, it operates with a lean structure and cost efficiencies are so well built in that even the office space allotted to the staff is planned and accounted for. Every PC sold is tracked to its last mile. The service centre network is spread wide across the nation to enable prompt service.

Lenovo manages to reach even the inner parts of China. “We sell to distributors who sell to retailers and then it reaches customers,” says Amar Babu, managing director, Lenovo India. They know the inventory at every step, and post sales service is very important. The whole thing is to develop each partner, not just build a large number of partners. “In China we have partners where we have a very large share of their wallets. A lot of outlets, few partners, a lot of alignment,” says Babu.

Illustration: Hemal Sheth

Illustration: Hemal Sheth

The India Promise

The Indian market is slightly different. For starters it is much smaller. At roughly around 8 million units a year, it is a sixth of China’s market. For Lenovo though, to win in Asia, it believes it has to win India. Last year, even as its sales in Brazil, Russia and China grew despite the slowdown, its sales in India tanked. A poor performance in India, one of the most promising markets in the world, is hurting Lenovo. Its total market share in India according to IDC is only about 5 percent and it’s the number five player in the market.

What gives Babu and Li the confidence to transplant their China learning’s to Indian markets is the similarity in the trade characteristics in both countries. Babu believes Lenovo India is at the same stage of evolution where China was 10 years ago. “We had a single digit market share in China just 10 years ago. Today, it commands a significant lead in market share over its competitors.” He believes the Chinese formula will do the same in India.

China and India both operate with channel partners comprising distributors and retail stores. In China, Lenovo has a six-tier structure. For India, the company has instituted a three-tier model consisting of four national distributors at the top who serve the seven regions India is split into. To address conflict of interest among distributors, as a rule not more than three Tier 1 distributors are allotted to a specified region. “We have done this so that distributors can have a larger overall share of the market and it builds a sustained interest among them in selling Lenovo products,” says Yathindra Nath, Director – consumer & SMB sales & distribution, Lenovo India. “Earlier the distribution was too fragmented and no one had a sizeable share of the market,” he adds.

Just like China, even in India Lenovo is getting its large channel partners to be almost a part of the company. “We have identified 25 large retailers, and have started engaging them early and discuss campaigns. We have already got some great feedback and [are] using it to research our products,” says Babu.

Using China to Go Upcountry

The biggest challenge for the model is reaching the upcountry markets — a strong growth area — and this is where a strongly hierarchical system helps with bigger retailers feeding the smaller retailers. The company sells its products to national distributors who sell it down further to exclusive outlets, multi-brand outlets, large retailers and regional distributors. The regional distributors (RD) hold the key to unlocking the upcountry markets for Lenovo.

The problem with RDs in the past has been duplication of inventory. Previously, the company had no clarity on how much stock an RD had and RDs would keep rotating the credit by buying from a different national distributor each time. Lenovo itself did not help matters because its sales culture was driven by volume growth and meeting stiff targets, and that resulted in dumping of stocks. Written documentation of each policy and a strong information system that tracks each sale will take care of the problem.

Since large channel partners are more clued into Lenovo’s needs, there is better understanding between the company and the channel. “Sometimes the cultural integration has indeed been painful in the past, but we now have a new Lenovo culture. Earlier it was IBM culture. Now we focus more on people, how to succeed together,” Li says.

Another similarity between the two countries that lends credence to the China model’s applicability here is the product range in emerging markets — the entry-level product mix is more or less the same in both nations, allowing India to choose the inventory available with their Chinese counterparts. Though, they are open to innovation customised for Indian needs.

Lenovo India also plans to ape the Chinese integrated operations model where all functions from product development to marketing, sales, supply chain and services are closely linked for speed and efficiency. Similarly in India, all functions now report to the India MD, Amar Babu, including Alex Li. Babu holds the entire P&L responsibility and has the liberty to plug and play resources at his disposal.

The earlier focus on volume growth has been done away with and every sale is tracked till the last mile. All discounts or special sanctions now need a written approval and documentation because unfulfilled verbal commitments by the sales team had created distrust amongst distributors and channel partners.

Tightening Costs

Pre-planning and forecasting is the norm in China and the same is now being practiced in India. Products like a notebook are perishable commodities — so you can’t have a long supply chain, hence tight planning is mandatory. This helps saving transportation cost and products can be shipped instead of flying them in. Thus, margins that are wafer thin in the business can be saved and competitive pressures built in the market.

If Li moved to India some months ago to head the transaction business and build the channel structure akin to the China model, a few Indian team members are being sent to China for a few months to baptise them on the sacred model.

Additionally, a few of Lenovo’s China-based employees await visa clearances, and will soon base themselves here. What might also be attracting them to India is Li’s infectious passion for Indian food and travel. They know how patiently he awaits his Indian driver’s license to hit the road and explore India. Thanks to his India sojourn, he now nurtures a dream to open an Indian restaurant back home someday.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)