KKR: Build up rather than break up

"Barbarians" Henry Kravis and George Roberts were the 1980s poster boys for slash-and-burn leveraged buyouts. Now, with trillions pouring into private equity, KKR and its peers have little choice but to buy and build

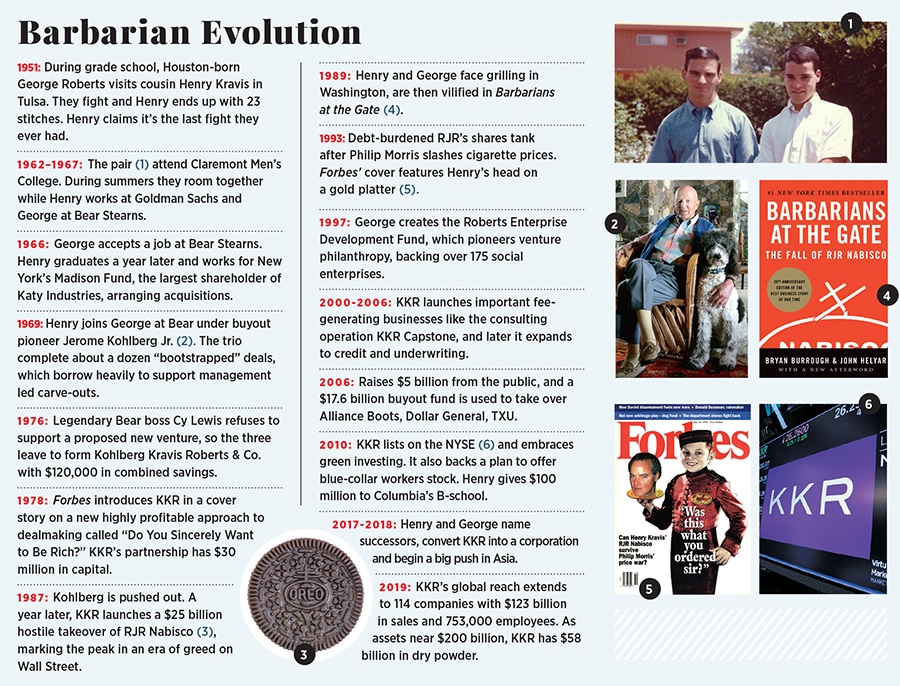

(left)Henry Kravis and George Roberts, the billionaire co-founders of KKR & Co

(left)Henry Kravis and George Roberts, the billionaire co-founders of KKR & CoImage: Ko Sasaki for Forbes

For most of this decade, the saga of Gardner Denver, a Milwaukee-based manufacturer of industrial machinery since 1859, has played out like another sequel to Oliver Stone’s iconic 1987 movie, Wall Street. Sales from its oil pumps and compressors slumped, its shares on the New York Stock Exchange languished, and in 2012 opportunistic financiers, now in the form of a hedge fund, pounded the table for change. Eventually management was shuffled, Goldman Sachs oversaw a sale, and a giant New York City buyout firm emerged as the winning bidder in 2013, paying some $3.9 billion, including $2.8 billion in new debt. The only thing missing was Michael Douglas insisting that greed was good.

But a funny thing happened on the way to the cliché of shuttered plants, downsized employees and pawned-off assets. More than $325 million was invested to update equipment, make plants safer and improve operations. New funding allowed the company to expand into the medical and environmental sectors. Its 6,400-person workforce increased by 5 percent, revenues rose by 15 percent and operating cash flow surged by 54 percent. When Gardner Denver returned to the NYSE nearly two years ago, every employee at the company was given stock equal to 40 percent of annual base pay, $100 million in all. “If we do better, the company does better, which means the shares grow,” says Josh Shelle, a 29-year-old assembly line supervisor, who has taken financial education, courtesy of Gardner Denver, to think more like an owner. “Everybody wins.”

This feel-good plot has two unlikely directors: Henry Kravis and George Roberts, the billionaire co-founders of KKR & Co, the now $200 billion (assets) private equity giant. “You can’t buy a company and strip out all the costs. It’s not a sustainable business model,” says Kravis, 75, from his private meeting room in New York overlooking Central Park. “If you’re not putting money back in to come up with new products, new plants and new ways of doing business in new geographies, you’ll die eventually.” Roberts, 75, his longtime partner, adds, “The businesses that have owners that care about them and management that cares about them are going to outperform.”

Students of financial history can now remove their jaws from the floor. KKR, of course, popularised the leveraged buyout in the 1970s and 1980s and became the face of Wall Street’s conquest of corporate America. Forever known as “barbarians”, after the bestselling book that chronicled their $25 billion takeover of RJR Nabisco, KKR was grilled by Congress for tax avoidance and the aggressive use of debt as they swallowed up RJR and other corporate giants of yesteryear like Wometco Enterprises and Beatrice Foods.

Thirty years later they epitomise a fundamental shift. No longer a clubby partnership, KKR is now a publicly traded corporation. Half of its investments and the majority of its dealmakers live abroad, with its biggest growth potential in Asia. And rather than torture the management of assets they treat like chits, Kravis and Roberts are management, responsible for 114 companies around the globe that generate $123 billion in annual sales and employ 753,000 people. In this sequel, it’s the hedge funds that play the role of secretive, amoral financial engineers. For KKR, and competitors like Blackstone and Apollo Global, we’ve entered the era of public equity, with PE as the white hats.

It’s a transformation born of necessity. In the past five years alone, $3.7 trillion has poured into private equity funds. KKR operates on a different scale today than it did when it took over RJR. Its next US buyout fund is expected to be a staggering $20 billion, its Asia fund $15 billion and its European $5 billion. At Apollo and Blackstone, funds push beyond $20 billion. Fees have swelled with assets—to $1.8 billion at KKR in 2018 and $3.1 billion at Blackstone—but the existential question is how to beat the S&P 500 and justify them. KKR’s first five buyout funds, from 1976 to 1986, returned from 4 to 17 times. Today, there are hundreds of private equity firms. Worse, the financial and operational manoeuvre that buyout firms pioneered are now basic blocking and tackling for corporate CFOs. Since 2002, no KKR buyout fund has returned more than 2.4 times its money. “Let’s not delude ourselves,” says John Skjervem, chief investment officer of the $100 billion Oregon State Treasury, a KKR investor since 1981. “This is getting much harder.”

As George Roberts says of the leveraged buyout game, “There’s no art in it anymore. What’s relevant is what you’re going to do with the business.”

*****

Like most iconic duos, Kravis and Roberts are a study in contrasts. They are first cousins and best friends going on 70 years with fathers who became wealthy from oil, and they attended college together at Claremont McKenna in California. They learnt the art of dealmaking from the same mentor—KKR’s third co-founder, Jerome Kohlberg—and have been business partners for 43 years, working in harmony virtually all that time, 2,930 miles apart, high-profile Kravis in New York and low-profile Roberts in San Francisco.

To see Kravis at his perch on 57th Street, visitors have to walk by a dark, mahogany-clad elevator bank towards a guard who sits behind a formal window that resembles a casino cage. Once approved, visitors enter another reception area through imposing mahogany doors that open to a flood of light and majestic floor-to-ceiling views of Central Park and the Plaza and Pierre hotels. Down a long hallway that’s decked in more mahogany, you pass formal meeting rooms and an ominous array of masks made by Ugo Rondinone. At the end is Kravis, sitting in his private meeting room, fit and 5-foot-6 with piercing blue eyes, dressed in a tailored suit with a magenta tie.

The consummate pitchman, whose name graces wings at the Metropolitan Museum of Art, a building at Columbia Business School and a children’s hospital at Mount Sinai, Kravis seems well rehearsed. “We’ve always thought of investing and acting and thinking like an industrialist,” he says. “Don’t congratulate us when we buy a company. Any fool can buy a company.” In a meeting room brimming with plaques commemorating KKR conquests, the framed words from Machiavelli speak most authentically: “The innovator has for enemies all those who did well under the old system, and lukewarm defenders in those who might do well under the new.”

Contrast that with Roberts’ domain, a two-story building in Menlo Park set among tulips and purple foxgloves and singing wrens. The firm’s airy lobby is shared with venture firm Sequoia Capital and decorated with gelatin silver photographic prints by Ansel Adams. It’s hard to find the entrance to KKR until you spot the dark mahogany doors, but the art here is more whimsical and provocative, albeit no less expensive. There are red flowers and a large black-and-white drawing of Chairman Mao by Andy Warhol, a lithograph by Jasper Johns and a staircase painted in diagonal blue lines by the contemporary artist Terry Haggerty. In keeping with the Northern California setting, Roberts has an active Instagram profile for his dog (@ScruffyRoberts) and challenges deep-thinking West Coast dealmakers with a puzzling, blue fluorescent-light display: “Do Not Pay More Than $18,000.”

Roberts is responsible for the duo’s start in the buyout business. As a junior at Claremont, then a men’s college, he interned at Bear Stearns in New York, covering insurance companies. Ambitious, he would comb regulatory filings on his beat in the morning and look for extra work in the afternoons, catching the eye of Kohlberg, who as the head of the firm’s corporate finance division was pioneering what was then known as “bootstrapped acquisitions”, because they were highly levered. In the 1960s, corporate America was bloated by conglomerates built by ambitious businessmen like Harold Geneen of ITT. Kohlberg deployed novel financing techniques to move in the other direction, helping sharp divisional managers buy unloved businesses from their overstretched parents.

Kravis, who grew up in Tulsa, got his start working for the closed-end Madison Fund in New York, which controlled a railroad operator called Katy Industries and used its tax losses to make acquisitions. While getting his MBA at Columbia, he canvassed the Southeast for oil service companies to buy. When Roberts moved up the ranks at Bear, he recommended Kravis to look at Kohlberg’s buyout invention. In 1969, the three joined forces, running a small group at the investment bank, with Kravis based in New York while Roberts moved to California. After about a dozen successful deals, they set out on their own in 1976.

They were just in time for Michael Milken and the Drexel Burnham Lambert junk-bond money machine. Kravis and Roberts were buying large companies outright: Beatrice and Safeway in 1986, Owens-Illinois a year later. Duracell, Stop & Shop and RJR at the apex of the debt-fueled 1980s. Kohlberg balked at the aggressive model and was pushed out in 1987, and Kravis and Roberts, particularly the former, became synonymous with the buyout era after the publication of Barbarians at the Gate.

*****

KKR’s transformation began before the 2008 financial crisis, surprisingly with one of its worst deals, for the Texas-based power producer TXU. The $45 billion buyout, inked in February 2007, was controversial from the start because of TXU’s expansion plans in coal. As KKR and its partners cut the deal, they reached out to the Environmental Defense Fund, an advocacy group that got McDonald’s to stop using polystyrene containers. Kravis and Roberts were interested in the connection between environmental efficiency and profits.

Within a year of closing TXU, KKR and the nonprofit formalised a pioneering “green portfolio” partnership in which KKR would rigorously track its companies’ waste, greenhouse gas emissions, water consumption and use of toxic materials. Within five years, the conservation efforts saved its portfolio companies nearly $1 billion, most notably at retailer Dollar General, which saved $775 million alone—or 6 million tonnes of waste—and was one of the crisis era’s most successful buyouts, making KKR 4.5 times its money. “Twenty years ago I wasn’t a big believer in ESG [environmental, social and governance]. I thought the most important thing is if you make good money for the company, all stakeholders will benefit,” Kravis says. “I’m a convert.”

Helping its portfolio companies became a top priority for the firm. To that end it expanded its in-house consulting arm, KKR Capstone, which now has 66 consultants advising the portfolio of companies on growth plans, acquisitions and cost savings. To spot risks, KKR has added teams to study global macroeconomics, technological disruption and political change.

In 2010, a Chicagoan named Pete Stavros was made head of KKR’s industrial buyout division. Stavros, now 44, the son of a Greek-American construction worker and a first-generation college graduate, believed productivity and profitability would increase if you gave equity to hourly workers on manufacturing lines, truckers and other nonexecutive employees. At Harvard Business School, Stavros dedicated his thesis to the benefits of employee stock ownership. He put his idea in play at KKR, giving 10,000-plus workers over $200 million of equity in the eight deals his group has done.

Gardner Denver is a shining example. The stock is up 37 percent since its IPO in May 2017. All told, the $4 billion of equity Stavros and his team have invested in their eight industrial buyouts, including Capsugel, Capital Safety and CHI Overhead Doors, is now worth $12 billion. “This is a different way of operating. You need to be willing to engage with people in a different way,” Stavros says. “Treat them like business partners.”

Few cases illustrate Stavros’ thesis better than KKR’s experience with Toys “R” Us. Acquired for $6.6 billion in 2005, the retailer wound up filing for bankruptcy in 2017 and shuttering its US stores in 2018. Rather than simply lick its wounds and walk away, as KKR might have 30 years ago, the firm and its deal partners contributed $20 million to a severance fund set up for former employees.

“Clients want to invest in firms where they think people are doing right for the world and not ones that are destroying the planet, or the workforce,” says Mason Morfit, chief investment officer of the hedge fund ValueAct Capital, KKR’s largest outside shareholder.

While the amount invested in the Toys “R” Us severance fund was trivial for KKR’s partners, the fact that its large pension investors, like the state investment boards of Minnesota and Washington, insisted they do so wasn’t.

*****

KKR’s transformation isn’t only about doing good. It’s also about fees, which today are on a scale that makes RJR Nabisco’s $390 million in deal fees look quaint.

Take the firm’s push into credit, which plugged up a giant hole in its capabilities. Fifteen years ago, KKR was still fairly one-dimensional and lacked a fixed-income operation that would allow it to lend funds to companies for restructurings and acquisitions. The firm’s credit business now stands at $66 billion in assets. Despite losses in its alternative debt and its CLO business last year, KKR kicked off some $400 million in credit management and transaction fees in 2018.

The creation of an underwriting business has been another fee bonanza. “Between 2005 and 2007, we paid The Street almost $5 billion in fees, and we didn’t get much back for it except we were invited into a few auctions,” Kravis says. So Scott Nuttall, the firm’s co-president, built an in-house underwriting business for KKR’s portfolio companies, which underwrote 204 debt and equity offerings in 2018 and generated $631 million in fees.

KKR’s fee revenues climbed 19 percent in 2018 to $1.8 billion, including more than $1 billion in so-called transaction and monitoring charges, which the firm earned for, among other things, management advice to its portfolio companies. There were also $147 million in reimbursements for expenses and $60 million in consulting fees.

Remember the feel-good IPO of Gardner Denver in 2017? After charging the company $3.4 million a year on average in transaction and monitoring fees, KKR levied a special onetime termination fee of $16.2 million in conjunction with its IPO. High fees translate to generous compensation for KKR partners. Last year the firm paid out an eye-watering $1.5 billion in compensation to its 1,300 staffers.

*****

By far the biggest innovations at KKR have been structural. A few years ago, on a plane ride back to California, Roberts made a revealing calculation: Had KKR been able to hold on to its investments in perpetuity, it would have a bigger market capitalisation than Berkshire Hathaway. To that end, in 2006 KKR was the first major US buyout firm to tap public stock markets, raising $5 billion of permanent capital in Amsterdam to invest in its own deals. When shares in that public vehicle, KKR Private Equity Investors, plunged from $25 to below $2 during the financial crisis, Kravis and Roberts knew that many of their deals (like Dollar General and Hospital Corporation of America) were undervalued, trading for pennies on the dollar. So the partners shrewdly folded KKR’s core operations into KKR Private Equity Investors and listed the new entity on the New York Stock Exchange. Since asset prices recovered, KKR’s permanent capital has swelled to $13 billion and seeded its fundraising expansion into new sectors like infrastructure, real estate, healthcare and technology.

The new capital was also used to buy 35 percent of Marshall Wace, a quantitative hedge fund whose assets have since doubled to nearly $40 billion, and to resuscitate KKR’s investment in the payments processor First Data, which now stands at $1.5 billion on the firm’s balance sheet after a 67 percent surge in its stock price over the past year. “We made lemonade out of some lemons,” Roberts says. “I have respect for our competitors, but none of them have the mousetrap we have.”

Last year, KKR’s overhaul strategy culminated with its conversion from a partnership into a corporation, eliminating the need for complicated K-1 tax filings by its public shareholders. This change, plus an earlier one, which fixed its dividend payout to a modest percentage of aftertax earnings (currently 13 percent), ensures that the firm will retain more profits than its competitors. It will also likely make its stock more desirable to a larger population of institutional investors. “We wanted to have the power of compounding,” Kravis says, emboldened by the fact that KKR now holds $10 billion of its investments on its balance sheet. “If you think about Warren Buffett, who has never paid a penny out in dividends, and you look at how much capital he’s been able to accumulate and the value of Berkshire today, it’s really impressive. We can do the same thing.”

Among old-guard private equity giants, KKR was the first to formally announce lines of succession, naming Scott Nuttall, 46, and Joseph Bae, 47, as co-presidents and granting each $121 million in stock awards in 2017. Nuttall is a familiar face to public stockholders and is the driving force behind KKR’s expansion in credit and capital markets. Bae oversees the firm’s core global buyout business, which includes a big expansion in Asia as well as real estate and infrastructure. The firm’s business in Asia now spans eight offices and $20 billion in assets.

“When you look at the complexity of what we do and how we operate around the world, you need two people,” Roberts says.

The rich stock grants to Bae and Nuttall have caused grumbling inside the firm, when you consider that KKR has since significantly reduced stock compensation to staffers in what may be a maneuver to reduce share dilution and bolster the stock price. The performance of KKR stock, like that of other PE firms, has been underwhelming. Over the past five years it has returned on average just 4 percent annually, less than half the total return of Blackstone. Both underperformed the S&P 500’s 12 percent annualised gain.

Of course, the hard part will be maintaining KKR’s entrepreneurial DNA as it expands as a corporation.

Some of its newer ventures have already run into trouble. In 2012, KKR bet on hedge funds via a fund-of-funds business, buying $8 billion (assets) Prisma Capital Partners, only to see its performance languish. An $884 million natural-resources fund, raised in 2010, lost most of its value. Between 2012 and 2014, KKR raised over $5 billion in special-situations funds that have produced annual net returns of 3 percent or lower.

During much of the 1980s, KKR’s dealmakers could fit in single boardroom.

“If you think about what this firm was, it basically was started with three guys and a broom—Jerry, George and me,” Kravis says. By 1996, when KKR’s heirs, Nuttall and Bae, joined the firm, it employed about two dozen investors. Now dealmakers number 447, and two thirds of the firm’s 1,300 staffers don’t invest, instead tending to tasks like back-office, tax and legal.

With its growing pains have come notable departures: Recent exits include David Liu and Julian Wolhardt, two top investors in Asia, and Alexander Navab, the former head of its U.S. buyout business, each now raising multibillion-dollar funds elsewhere.

Despite all the changes at KKR, Kravis and Roberts show no signs of slowing down—and are especially excited about prospects in Asia. Under the stewardship of Korean-born Bae and New Zealand-born Nuttall, KKR is building entire new businesses in the region.

According to Kravis, Japan is littered with cheaply priced conglomerates loaded with underperforming assets. He recalls asking the CEO of one of Japan’s big trading companies how many subsidiaries the company owned. The Japanese executive said 2,000. When Kravis asked how many were core, the answer was still 2,000.

“I would have had a better conversation with a glass, but we got along just fine,” Kravis says. In April KKR gathered its 75 partners for its annual meeting in Tokyo.

“I’ve been going to Japan since 1978. I always saw the light at the end of the tunnel. Now it’s real,” Kravis says with a youthful glint in his eye. Roberts adds, “Japan today reminds me of the 1960s and 1970s in the United States.”

Only this time the nice guys at KKR will have to resist the urge to slash and burn, and instead figure out a way to buy and build.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)