Google's New Shopping List

The search giant has yet to buy a company in 2012. It's not for lack of appetite, but rather a drastic change of taste

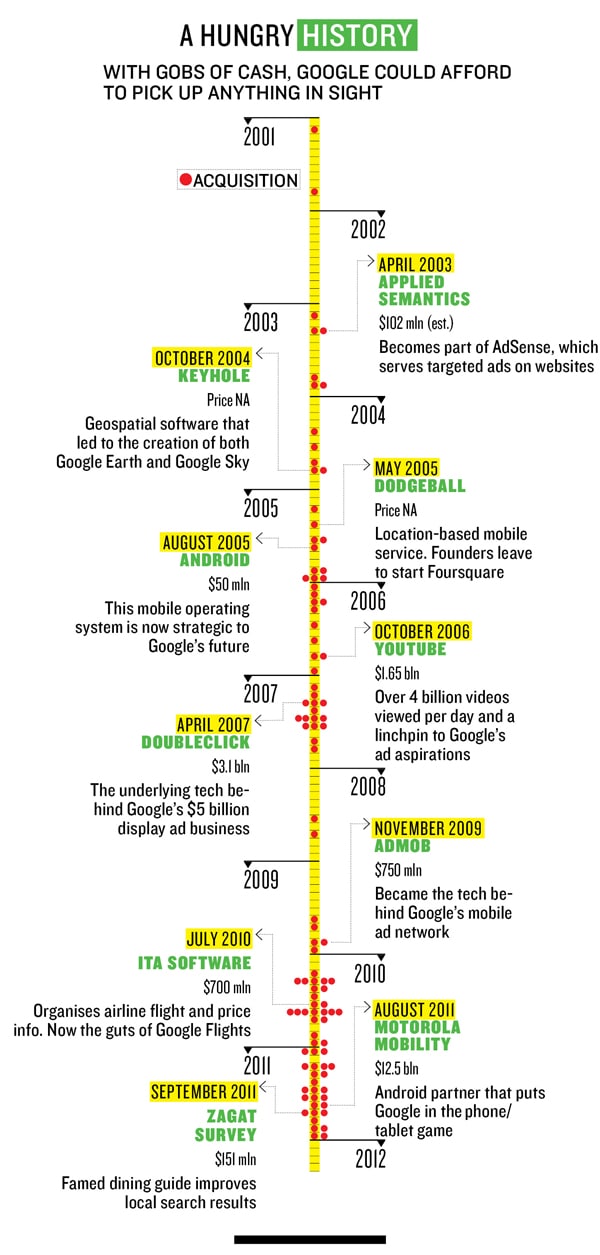

Over the last two years Google has been a ferocious, startup- munching acquisition machine. In 2010 it did 48 deals. In 2011 the company announced a record 79 purchases and investments, shelling out about $2 billion, not counting the still-pending deal to buy Motorola Mobility for $12.5 billion. But here we are one-quarter of the way through 2012, and there have been no deals at all. Radio silence. Zilch. Has Google’s once-hearty appetite for acquisitions been sated? In short, no. David Lawee, head of the mergers and acquisitions group at the internet search giant, says its fasting will end any day now.

“The store is still open,” says the Canadian-born entrepreneur and former venture capitalist in an interview at Google’s offices in Mountain View, California. “There’s just less randomness in moving things through.” Where once such randomness meant picking up lots of “interesting” companies that might one day become important, now acquisitions have to be deemed “strategically important” at the outset by the business leaders overseeing Google’s seven main product areas: Search, ads, social, commerce/local, YouTube, Android and the Chrome browser.

“We have a set of things that we’re working on building that are so vast that getting them right is critical,” says Lawee, 46, who manages a couple of dozen people in the M&A group. “There may come a time when we get all these things done and we end up taking a more, I don’t know, opportunistic approach. But I think we know what we’re executing on. We have a lot of opportunities in those areas.”

Lawee hasn’t previously spent a whole lot of time explaining Google’s acquisition strategy, which he’s been overseeing since February 2008 after a two-year stint running marketing.Over the past few months, though, Lawee has become comparatively garrulous about Google’s new approach to M&A, especially as attention has focussed on deals that haven’t panned out. The company’s crazed shopping spree— averaging better than one deal a week for two years—has produced a fair share of duds and missed opportunities.

They include the 2005 purchase of Dennis Crowley’s Dodgeball, a location-based social networking service. Crowley, saying he couldn’t get the support he needed for his mobile service, left and Google shut down Dodgeball in 2009. Crowley went on to start Foursquare, another location-based social networking service that boasts 15 million users.

Lawee admits missing the mark with Dodgeball. But he also notes that two-thirds of Google’s acquisitions have been successful, based on the company’s own metrics, and that the deals have been instrumental in bringing significant new businesses into the Googleplex. Among the more noteworthy success stories: Android (mobile), YouTube (video), DoubleClick (display advertising), Keyhole (which became Google Earth) and Writely (Google Docs).

“They’re big bets that took a little while, but they’ve really paid off,” says Dan Salmon, an analyst with BMO Capital Markets in New York. “DoubleClick and YouTube are linchpins to the company’s strategy today. DoubleClick is a massive platform that runs most of the Web’s display ad technology, and it’s become an even more dominant platform under their supervision.”

An undisclosed number of entrepreneurs—Lawee will only say it’s a “huge, crazy” number—have stayed on following the buyout of their companies, Crowley aside. Crowley “was way ahead of his time and years ahead of where we were strategically,” Lawee says. “It’s important to get the message out to entrepreneurs of the successes, just so they have a more balanced view. So they’re not just thinking, ‘I’m going to sell my company and leave,’ because that’s kind of a failure for us.”

John Hanke, founder of Keyhole, agrees that the type of entrepreneur being “acquired” is paramount to the success of the deal. “Not every great entrepreneur can work effectively within Google,” Hanke said in an e-mail. “David’s developed a good nose for people that are going to be able to land on their feet, apply themselves and use Google’s footprint and leverage to do even bigger things than they could have done on their own.”

The new approach to M&A mir- rors Google’s overall narrowing of focus since co-founder Larry Page took over as CEO a year ago, replacing Eric Schmidt. Lawee insists that Page never mandated the escalation of acquisition targets from interesting to “strategically important,” but he acknowledges some influence. “It is fascinating to see the founder take over the company and through his force of personality and his vision drive a higher level of accountabil- ity,” Lawee says. “People are working harder, with clearer objectives, with a greater sense of urgency, with a bigger sense of how things fit into the bigger picture. That’s what is inspiring people, which I think was what Google needed. I think Eric was a great CEO. What Google needed at this time was Larry.”

During Schmidt’s tenure, deals were approved by the CEO’s man- agement team. Now the business leads weigh in, since every deal will likely affect them. “It used to be a little bit harder for people to be as sure of themselves, in terms of whether [a deal] made sense for the company,” Lawee says. “Now they’re so clear on what their goals are that it’s a lot easier to have conviction to make the argument internally that we should proceed with an acquisition.”

That explains the interest in Motorola Mobility, which enables Google to offer its own smartphones and tablets as it battles Apple’s iPhone and iPad—and provides the company with a huge portfolio of valuable mobile-technology patents. Still, the all-cash deal is being viewed with skepticism. Other Android device makers are worried about being in direct competition with Google.

For its part Google has said Motorola will be run as a separate company and remain just another licensee of Android, which will “remain open.” Google is reportedly looking to sell off Motorola’s set-top box division, shedding itself of a technology that is likely in decline.

Earlier this year Lawee was quoted as saying he’s going to focus the company’s M&A energies on mobile and video technologies and companies, and that social network- ing probably wouldn’t grow through acquisitions as Google builds out its own platform, Google+. When asked if that’s still the case, he pauses. While he sees “a lot of opportunity in what we’re building,” Lawee says, it’s hard to rule out social deals because he’s unsure of “how things will pivot. It’s a fast-moving space.”

“The strategy at Google gets decided every day in a sense,” he continues. “In any fast-moving company in the internet space, you have a set of things that you’re trying to do, and then you’re taking in the market data every day. It’s too hard to come up with mandates—they’d be wrong the minute we make them.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)