Family tree: How Jonathan Saperstein built one of the biggest nurseries

Jonathan Saperstein began his efforts to professionalise and dominate the nursery industry with a hostile takeover of a grower—from his dad

Branch manager: Upstart CEO Saperstein is shaking up a traditional business with technology

Branch manager: Upstart CEO Saperstein is shaking up a traditional business with technologyImage: Justin Clemons for Forbes

In the summer of 2014, Jonathan Saperstein, then a 27-year-old executive at and minority shareholder in TreeTown USA, a decorative tree grower, was worried. “We were up against the clock because of the cash position,” he says. The company’s founder—his father, David Saperstein, who had vaulted onto The Forbes 400 after he sold his previous company, Metro Networks, for $900 million—seemed disengaged. David, who was often travelling overseas, wasn’t investing in the company, which had around $30 million in revenue; instead he was trying to grow it fast and cheap and then take it public. When Jonathan proposed a long-term strategic plan, David ignored it. When Jonathan offered to buy the company—if his father wouldn’t manage it right, he would—David responded with what Jonathan calls “an outrageous number” and the declaration that it was not for sale.

Walking away would have been the easy—and, arguably, the smart—move. What rich kid in his right mind wants to get into a fight with his centimillionaire dad over control of a small company in a zero-glamour business? In this case, though, the rich kid, now an alumnus of Forbes’ 30 Under 30, turned out to be every bit the audacious, shrewd and determined entrepreneur his old man had been. And he decided to stand up to his dad.

In October 2014, Jonathan, with the help of his sisters, Stefanie and Alexis, filed papers to force the company into involuntary bankruptcy. They could do that because TreeTown’s parent company, Seven S Capital, controlled by their father, owed $21 million to three trusts in their names. David never saw it coming. The evening of the day the papers were filed, he called Jonathan and started discussing the terms of his surrender. They quickly reached an agreement. Jonathan’s holding company acquired TreeTown’s assets, and he and his sisters sold their stakes in Seven S to their father. The purchase price, including assumption of debts, was around $50 million. At a companywide meeting called to announce the new ownership, a TreeTown executive brought Kool-Aid and cups and declared, “We’re ready to drink the Kool-Aid!” Of his father’s tenure, Jonathan only says, “We underestimated the complexity, and when I say ‘we,’ I mean we as a family.” David, now 76, declined to be interviewed.

Since then, with savvy acquisitions and tech-enabled operations, TreeTown has leapfrogged past competitors to become the country’s largest tree producer and one of its biggest nurseries. It employs almost 1,600 people and grows 4 million trees and 18 million shrubs and perennials on 16 farms in Texas, Florida and California. Clients include landscapers and big retailers like Home Depot. Revenue is expected to surpass $120 million in 2018, with operating profits around 15 percent, above those of most competitors. While a few private-equity-financed startups have tried without much success to shake up the nursery business, the roughly $18 billion industry remains populated largely by underfunded mom-and-pop nurseries. Saperstein is trying to break that mould and build a national giant. He and his sisters, who have no operating role in the business, own equal stakes with no outside investors. Jonathan says that while his relationship with his father survived the takeover, they don’t talk about the business.

When David founded TreeTown in 2000, Jonathan, his son with his second wife, Suzanne, was growing up mostly in Los Angeles, where his parents were building an epic white elephant, a 12-bedroom château called Fleur de Lys. (Suzanne and David divorced in 2007. The house sat on the market for years before selling in 2014.) Jonathan, who wears farmer jeans and carries his cellphone in a pouch on his belt, preferred Texas, where he was born. During college at the University of Texas, Austin, he spent summers and school breaks working at the company. After graduating in 2010, he joined TreeTown full-time. “I’d much rather be on the farm in boots and working with people than in the office,” he says.

When demand for trees fell following the crash of 2008, David, who was funding TreeTown himself, responded by letting some acreage go unplanted and postponing maintenance. But, by the summer of 2014, although the recession was long past, David was still unwilling to spend, and some TreeTown executives worried that the company had pulled back too far. Unless it started planting soon, it wouldn’t have enough product later to keep up with competitors. That’s when Jonathan made his move to take over the company.

Once in control, he immediately started to execute his strategic plan, which called for $10 million in improvements partly financed by lines of credit with Bank of America and Wells Fargo. He also hired a new chief financial officer and human resources director and set up merit-based bonuses for employees. Then he went shopping for acquisitions. Soon after buying TreeTown, he learnt about a troubled tree farm in Bunnell, Florida, and bought it for $5 million in October 2015. In February 2016, he bought a smaller Florida farm that produces palm trees.

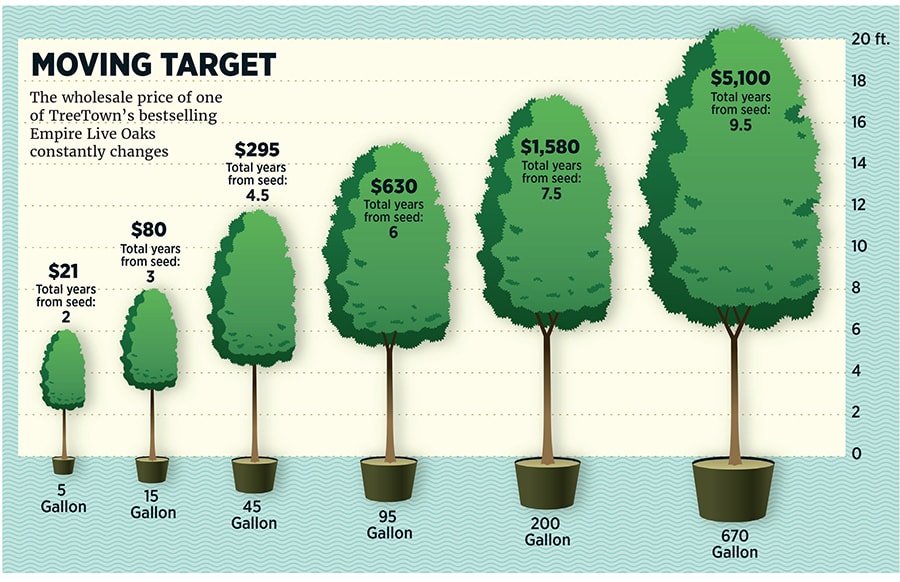

He also set about improving the company’s tree-manufacturing process, gearing operations to data and efficiency. Tree farming is a highly complex form of manufacturing in which numerous variables, including the economy and the weather, must be managed carefully over long periods. The Texas and Bunnell farms have customised automated potting lines that provide the precise amount of soil and fertiliser each seedling requires. In monthly meetings, Saperstein and his team tweak production forecasts, based on demand data from customers and the latest growth numbers from the fields. The trees are grown in containers, and as they mature, they are moved to larger containers to prevent them from getting rootbound. The company’s most popular tree, an Empire Live Oak, comes in containers ranging from five gallons, which wholesales for $21, to 670 gallons, which goes for $5,100. Saperstein must forecast demand a decade in advance to determine how many trees to sell at each stage. He also has to figure out how to arrange those that remain so they can be maintained efficiently. “You take a Rubik’s cube and throw it in the blender,” he says with a laugh. Saperstein is now rolling out handheld devices at the farms to better analyse labour costs and complete work orders.

Meanwhile, he continues to buy farms. In September, after 18 months of negotiation, he acquired Village Nurseries, a California grower with more than 900 acres under cultivation. The $75 million deal, paid for with a combination of cash from operations and debt, more than doubled TreeTown’s revenue. It also further diversified the company. Village Nurseries’ specialty is shrubs, such as azaleas and philodendrons, which grow more quickly and cheaply than trees. Its location in the country’s largest nursery market gives TreeTown a new customer base.

Saperstein says a greater variety of products will help him increase sales to existing customers—and should also help him withstand the next recession. “If the market slows down,” he says, “you have more flexibility.”

Unlike his father, who was hoping for a quick IPO and exit, Jonathan plans to be in the tree business a long time. “We don’t have equity partners, so no one is telling us to grow at a certain rate per year,” he says. Even if prices were to drop by a third, he says, TreeTown would still have positive cash flow, allowing him to buy more farms.

What worries him? “My biggest fear is that we are going to get complacent,” he says, “and that’s what we won’t allow to happen.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

X