Crossover: A software sweatshop

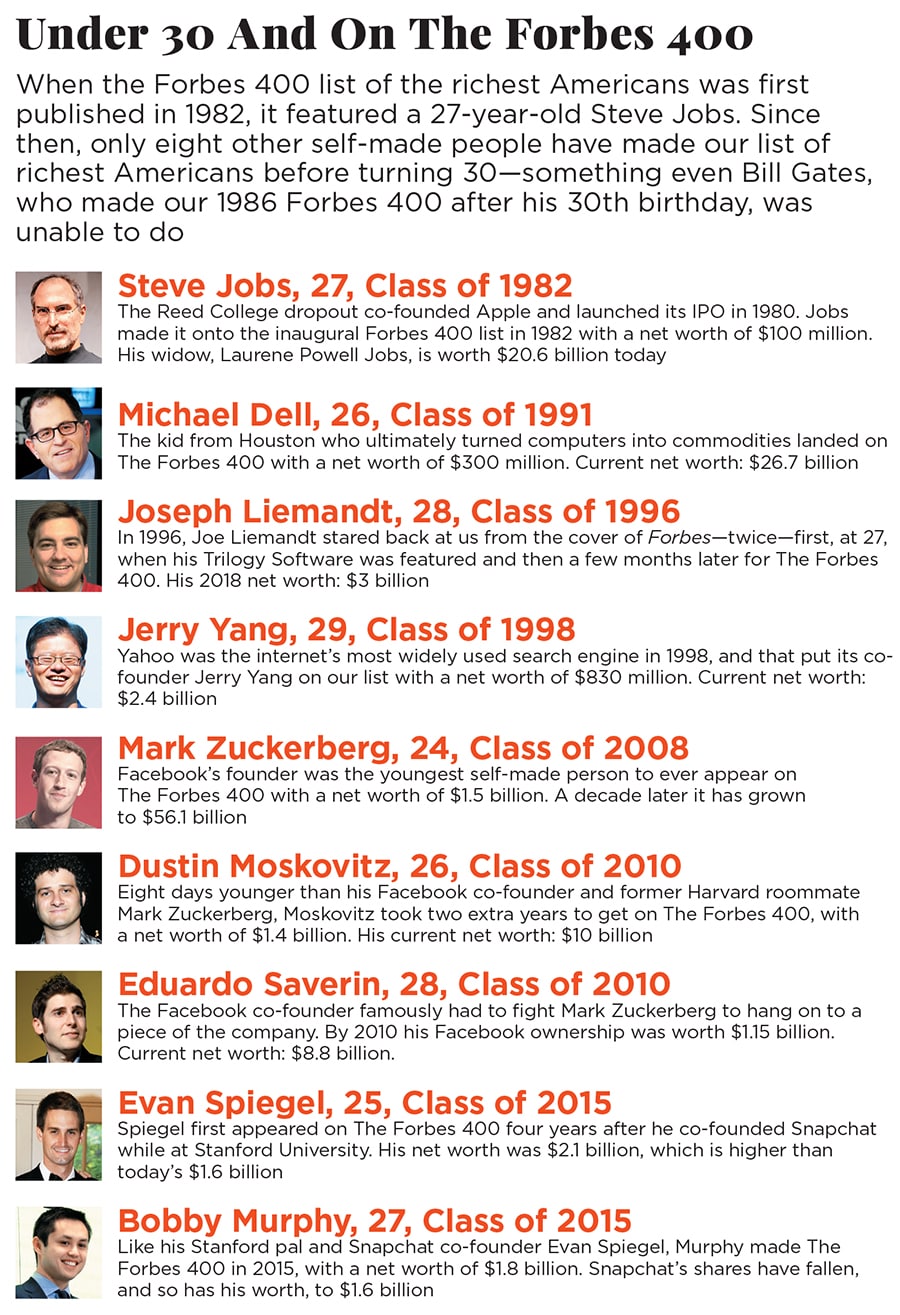

Two decades ago, Joe Liemandt became the youngest member of the Forbes 400 by building an enterprise software juggernaut. He's quietly returned, bigger than ever, with a darker model

Illustration: Sameer Pawar

Illustration: Sameer Pawar

From an office suite on the 26th floor of the iconic Frost Bank Tower in Austin, Texas, a little-known recruiting firm called Crossover is searching the globe for software engineers. Crossover is looking for anyone who can commit to a 40- or 50-hour workweek, but it has no interest in full-time employees. It wants contract workers who are willing to toil from their homes or even in local cafes.

“The best people in the world aren’t in your Zip code,” says Andy Tryba, chief executive of Crossover, in a promotional YouTube video. Which, Tryba emphasises, also means you don’t have to pay them like they are your neighbours. “The world is going to a cloud wage.”

Tryba’s video has 61,717 views, but he is no random YouTube proselytiser. He worked in sales at Intel for 14 years before serving in the White House as an advisor to US President Barack Obama’s Council on Jobs and Competitiveness. Since 2014, Tryba has been the right-hand man of Joe Liemandt, one of the most mysterious and innovative figures in technology.

In the 1990s Liemandt was the golden boy of enterprise software, a 30 Under 30 wunderkind before there was a Forbes 30 Under 30 list. Like Bill Gates before him, he dropped out of college, in his case Stanford, to start a company, Trilogy, and build his fortune. In 1996, at the age of 27, he made the cover of Forbes, and a few months later he appeared as the youngest self-made member of The Forbes 400, with a $500 million net worth.

In its first iteration, Trilogy Development Group sold product configuration and sales software to the likes of Hewlett-Packard and Boeing (think of the zillion variations of computers and airplanes those companies sell). Trilogy became the hot place for young coders to land in the late 1990s. Known for its testosterone-fuelled work environment and an alcohol-infused mix of long hours, fast cars, gambling and sex, Trilogy served as the model for Silicon Valley’s boys club. Its programmers were paid like rock stars and partied like them, too.

It made sense back then, because at the time coding was a rare and unique skill. Companies like Trilogy, eBay, Apple and Microsoft were making groundbreaking, innovative software, the first versions of everything from web browsers to ecommerce platforms. But it makes no sense in a world of $200 laptops, where any kid in Cairo can learn to code on YouTube. And mostly what they are coding is updates to old versions of stuff like payroll and inventory management software. You pay an artist to design a Maserati; you pay a mechanic to change its oil.

And the new version of Trilogy, now part of ESW Capital, Liemandt’s Austin private equity firm, is all about changing the oil.

Tryba argues that the current cloud wage for a C++ programmer, for example, is $15 an hour. That’s what Amazon pays its warehouse workers. Crossover, which is actually the recruiting wing of ESW, has amassed an army of 5,000 workers in 131 countries from Ukraine to Pakistan to Egypt. In the past 12 years, ESW has quietly acquired some 75 software companies, mostly in the US, and it exports as many as 150 high-tech jobs every week.

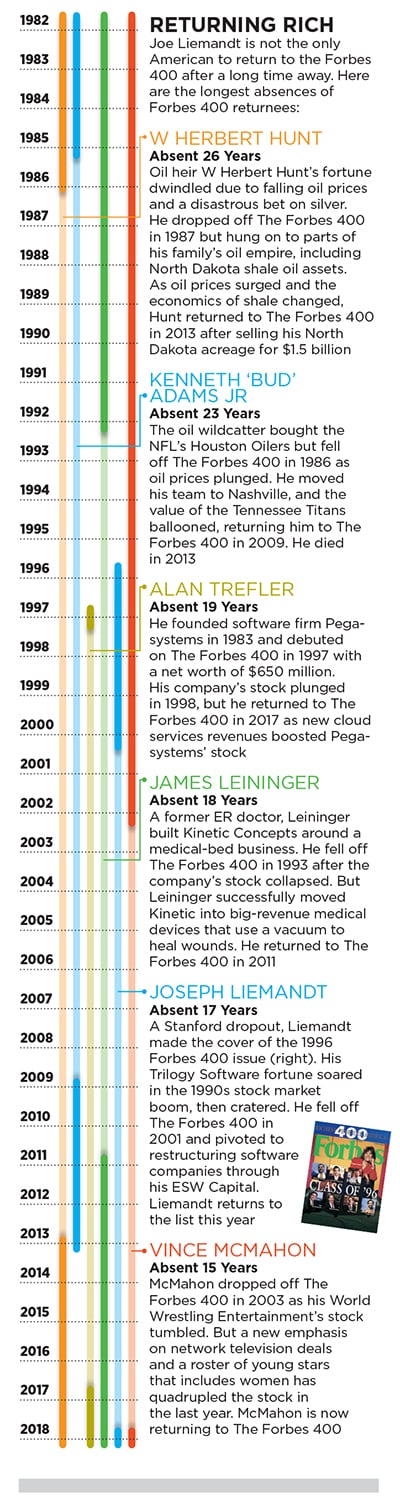

After the dotcom crash, Trilogy faded from view, but from its ranks numerous successful tech companies, including Nutanix and SendGrid, were spawned. It also played a big part in Austin’s emergence as a technology hub. Like others with dotcom fortunes, Liemandt dropped off The Forbes 400 in 2001. He stopped giving press interviews, outsourced Trilogy’s US workforce and took his public company private. Most assumed Liemandt had burnt out, but nothing could be farther from the truth.

Using his closely held ESW Capital, Liemandt began buying dozens of business-software firms with values ranging from $10 million to $250 million. Ever heard of Nextance, Infopia, Kayako or Exinda? Not many have, but these are the types of firms that run things like customer service and document management, humming in the background of an untold number of businesses.

Liemandt’s team was on a quest for the regular income streams associated with sticky software maintenance contracts. To cut costs, R&D and employee benefits were to be gutted. And as a sweetener, he began assembling a patent-litigation war chest. Through one of his holdings, Liemandt has sued 20 companies, ranging from SAP to Sears and Toyota. He’s currently suing Ford for $300 million.

For the founders and shareholders of the middle-aged firms that are ESW’s targets, Liemandt offers quick cash: There are no earn-outs or contingencies, and the deals typically close within 45 days. For the rank and file it’s a different story. Most are replaced by cheaper overseas talent.

These days it’s standard for US tech companies to have a foreign workforce strategy. The gig economy has also produced freelancer hubs like Amazon’s Mechanical Turk marketplace and Upwork. But Liemandt’s software roll-up takes this idea to its extreme.

His workers must agree to instal spyware on their computers so Crossover’s productivity team can track the number of times they click their mouse or stroke their keyboard. The tracking software takes screenshots every ten minutes and, in some cases, snaps photos from PC webcams.

Spyware or not, programmers are applying in droves, and it’s made Liemandt richer than ever. At age 50 he’s back on The Forbes 400, with a net worth of $3 billion. But rather than celebrate his return, he refused to speak to Forbes for this article. “I am very private; I am an introvert,” Liemandt told Forbes in 2017.

His preference for anonymity is no surprise. Liemandt’s metamorphosis has transformed him from every dorm-room coder’s hero to an ominous force in tech as his expanding global cloud-force pushes down wages and turns computer programming into factory work.

Twenty years ago, Joseph Liemandt was the life of the tech party. Wall Street was in a frenzy over tech stocks that soared higher every day. Inspirational computer programmers like Bill Gates, Marc Andreessen and young Liemandt were the new masters of the universe.

Trilogy had become a recruiting machine for talented programmers fresh out of Harvard, Stanford, Carnegie Mellon and MIT. A job at Trilogy meant long hours, but the money was good, and the perks—like beer parties on the patio every Friday—made it like campus life without mid-terms or finals. “Everyone was very young, and all we did was work hard and play hard together,” says Rishi Dave, who worked at Trilogy in business development.

Trilogy’s recruiting weekends were legendary. Wild parties were thrown at Austin’s hotels and 6th Street bars, and beautiful women were hired to help recruit. Liemandt was known for doling out lavish signing bonuses and gifting Porsches and BMWs.

“We kind of felt like celebrities,” says Russell Glass, who started his career at Trilogy and went on to found an ad platform that he sold to LinkedIn for $175 million. “They got these nice-looking, young, fun recruiters, and if you are a dorky engineer or product guy you fell in love with the entire thing.”

Occasionally there were impromptu corporate off-sites to places like Las Vegas, where Liemandt would book suites at Luxor and charter a 737 to fly his team out after work.

Liemandt would encourage his coders to gamble, giving them chips at the roulette table (and later deducting the advance from their paychecks) or handing them $500 outright to play blackjack.

According to the 2018 bestselling book Brotopia, which focuses on the male-dominated corporate culture in technology, Trilogy “wrote the bro code” that would infect Silicon Valley and make tech hostile for women.

Liemandt’s formula—misogynistic as it was—worked well. When it came to hiring top programmers, Microsoft’s Steve Ballmer once said he worried about Trilogy as much as Oracle.

For many people living outside the US, Crossover’s compensation is a dream

Unlike Microsoft, however, Trilogy didn’t base its success on continual innovation, new products or brand marketing. Liemandt’s genius was turning the once manual process of keeping track of sales configurations into a complex combination of constraint-based equations and rule-based software programs. Say HP was selling a computer system with a different video card or printer. This might require a different specification or an additional cable and thus change the price of the package. The software Liemandt developed could handle thousands of combinations in minutes, saving money and costly mistakes. For customers like Boeing, a single product configuration mistake can cost millions.

Liemandt and Trilogy’s other founders developed their software as undergraduates at Stanford. The young Liemandt seemed destined for business success. His father, Gregory, worked directly under legendary GE executive Jack Welch, and the Liemandts vacationed with the Welches. After his father left GE to be CEO of a mainframe software company in Dallas in 1983, Liemandt began programming but also took a strong interest in entrepreneurship, frequently reading the business plans his father brought home. As a Stanford economics major, he was determined to create the kind of business that either Jack Welch or his father would want to buy.

His obsession with sales efficiency spawned Trilogy, and in 1990, at 21, he defied his parents’ wishes and dropped out of Stanford to build his software company.

Six years later his sales were some $120 million and he was on the cover of Forbes. Much of Liemandt’s initial wealth came from spinning off a Trilogy unit called pcOrder.com, which sold thousands of computer parts via the internet to resellers and individuals. In 1999 pcOrder.com went public.

Soon after, Trilogy, which was mostly owned by Liemandt, sold $124 million of pcOrder.com stock in a secondary offering. Liemandt set up other subsidiaries like carOrder.com, but he was unable to IPO his flagship Trilogy before the internet bubble burst in early 2000.

The stock market crash forced Liemandt to rethink his strategy. He shed most of Trilogy’s employees and bought back the shares of pcOrder that Trilogy didn’t own at $6 each, for $32 million. Liemandt began to shun publicity.

Amid the wreckage, Liemandt set his sights on a tech model he had long admired. Across the country, Charles Wang of Computer Associates had become a billionaire by methodically buying enterprise software companies (including Liemandt’s father’s in 1987), cutting costs and controlling big industry segments. Liemandt consolidated control of Trilogy and went to work.

Trilogy still produced cash thanks to its software maintenance contracts, particularly with auto manufacturers like Ford. It also had software patents. In 2006 Trilogy bought Versata, a beaten-down data management software outfit, for $3.3 million. After the deal closed, Versata merged parts of Trilogy into the company, and Liemandt began using Versata for acquisitions and to sue companies like Sun Microsystems, Sears and Toyota for infringing on Trilogy’s various software patents.

“For a time they were certainly more successful with their patent litigation than their product delivery,” says Tom Melsheimer, a trial lawyer who battled against Liemandt and Versata.

Versata, which like all other Liemandt entities became part of ESW, launched a flurry of patent lawsuits between 2006 and 2013. Most of the cases were settled. But some went to trial. In 2011 a federal jury delivered a $391 million judgment to Versata in a patent case it filed against the German software giant SAP. The case was ultimately settled during SAP’s appeals.

Some companies, like the software outfit Zoho, successfully defended themselves against Versata’s patent assault. But Liemandt’s other legal wins, plus income from his remaining software contracts, provided ample firepower for his new business scheme.

In May 2017, Scott Brighton, chief executive of Aurea, an ESW portfolio company, walked into the Portland, Oregon, offices of intranet-collaboration software maker Jive Software. ESW had just agreed to buy Jive for $462 million in cash and fold it into Aurea. Brighton was there to give senior management a message: Jive’s work environment was about to change drastically.

“They were pretty clear their model was to reduce costs as much as possible, and with the engineers they said their goal was within a year everyone working at global competitive rates, which is like Bangladesh or Egypt rates,” says Sid Bos, vice president of engineering and one of 250 employees in Jive’s Portland office.

According to Bos, ESW viewed employee perks and benefits as excessive, including the free weekly bagels in Jive’s offices. “They were proud of their model and tools, like their WorkSmart key-logging tool,” he says.

This fall ESW closed Jive’s main Portland office, and after a mixture of buyouts, layoffs and voluntary exits, nearly all its 250 employees are gone. Less than a dozen remain as contract employees working from home.

“Almost everybody is a foreign contractor,” says Jim Janicki, who was CEO of Dallas-based Ignite Technologies when it was purchased by ESW in 2013. “They keep some and they let most go, and those they keep they turn into contractors.”

As with virtually all of Liemandt’s companies, Ignite’s headquarters were promptly moved to ESW’s Austin offices, and its founder and CEO was replaced by one of Liemandt’s key lieutenants. Then ESW’s Crossover recruited foreigners working from home to service the maintenance and support contracts in force.

For many people living outside the US, Crossover’s compensation is a dream. Software engineers with two years of experience make $15 an hour; those with five years, called software architects, earn $30 an hour. For engineers with eight years of experience, called chief software architects, the rate is $50 an hour, or $100,000 a year based on a 40-hour workweek. This compares to starting programmers at Google, for example, which Payscale reports earn about $130,000 per year fresh out of college.

For ESW’s contractors, there are no paid vacations, health care benefits or bonuses. There aren’t even company-issued PCs. Contractors use their own hardware. And when it comes to paperwork and regulations, it’s up to the contractors to report and pay taxes in their local jurisdictions. Crossover administers tests to determine whether a recruit can handle the work and would be a good fit, and often new recruits spend days working online during a boot camp to standardise workflow processes.

Not all of Crossover’s cloud-wage earners are happy. It was Alejandra Marquez’s job to find coders for Crossover while working from her home in Buenos Aires in 2015. “People who lived in Venezuela and Ukraine really needed the money,” Marquez says. “They would do anything to get a US dollar job.”

But Marquez took issue with the tracking software. “You don’t have any privacy. They can see through your desktop camera. They track everything,” she says.

Others say Crossover is running the cloud equivalent of a software sweatshop.

Alan Jhonnes spent a year as a Crossover chief architect working out of his home in Brazil, making $50 an hour and having a good experience until his group started doing work for Aurea. WorkSmart’s webcam tracking feature, previously disabled by his manager, needed to be turned on. “It bothered me because sometimes I am with my wife here because everyone works from home,” Jhonnes says.

But what really bothered Jhonnes was Aurea’s requirement that he work harder to achieve productivity metrics within time limits that didn’t account for the complexity of tasks like building a certain number of pages or closing a number of tickets.

“It was impossible to meet the metrics within 40 hours, even 50 or 60 hours,” says Jhonnes. Any unauthorised overtime he did was unpaid, and Jhonnes worried that his contract would be terminated. In June he quit and took another job.

Crossover CEO Andy Tryba, who happens to be the CEO of 12 ESW companies, has no qualms about Crossover’s tactics, including its WorkSmart productivity tracking tool, which Tryba calls “a Fitbit for how you work”.

Tryba, whose latest side gig in Liemandt’s expanding empire is running Think3, a $1 billion fund for busted software startups, argues that the data WorkSmart generates will actually improve the work experience. A company spokesperson points out that all contractors authorise the use of tracking software. “It provides visibility but also provides actionable coaching [tools] on how to actually solve problem areas,” Tryba says in his YouTube video.

Disgruntled employees be damned—the pool of skilled workers in emerging countries appears to be bottomless. That’s great news for ESW’s 75 portfolio companies and its clients, but not so much for software salaries, which could be facing some serious headwinds. Denizens of Silicon Valley, take note.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)