Banks and NBFCs have to become solution providers: Ramesh Iyer

Iyer, the VC and MD of Mahindra Finance, says that small-ticket loans is an emerging area and could see potential demand through the pandemic

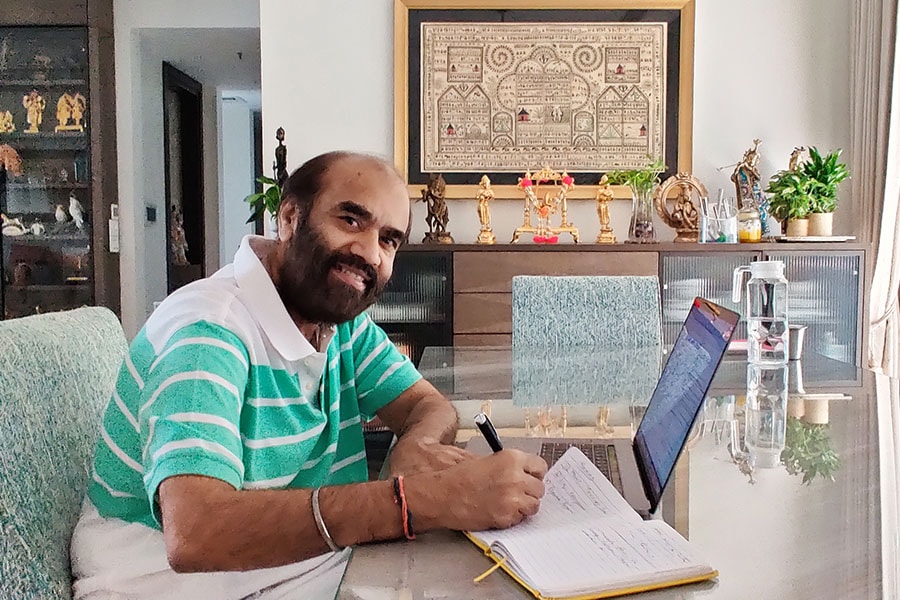

Ramesh Iyer, VC and MD of Mahindra Finance

Ramesh Iyer, VC and MD of Mahindra Finance

Q. How much of Mahindra Finance’s business comes from urban and rural India? Urban India seems to be worst hit by the coronavirus pandemic…

Mahindra Finance is a semi-urban rural-focussed finance company. All our 1,300-plus branches are in districts beyond metros. Therefore, 90 percent of our business is from semi-urban rural markets. Our urban presence would be limited to customers who are operating taxis for Ola and Uber in metros; beyond that we don’t have a major metro presence.

Yes, we don't see the depth of the problem in rural areas to be as severe as in urban areas, but they are also going through the same pressures of the lockdown. Customers are waiting for the lockdown to end. We are seeing green and orange zones picking up activity and sentiment turning positive.

Q. To what extent has the lockdown impacted farmers and the harvest season?

It was the harvest season in April and the lockdown was in place… that got a little delayed because of lack of labour. But once farm labour was allowed, the harvest picked up. It was completed almost on time and farmers are extremely positive about the yield as well as the support price. Their cash flows have improved substantially. We are seeing its benefit in our recovery from that community.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)