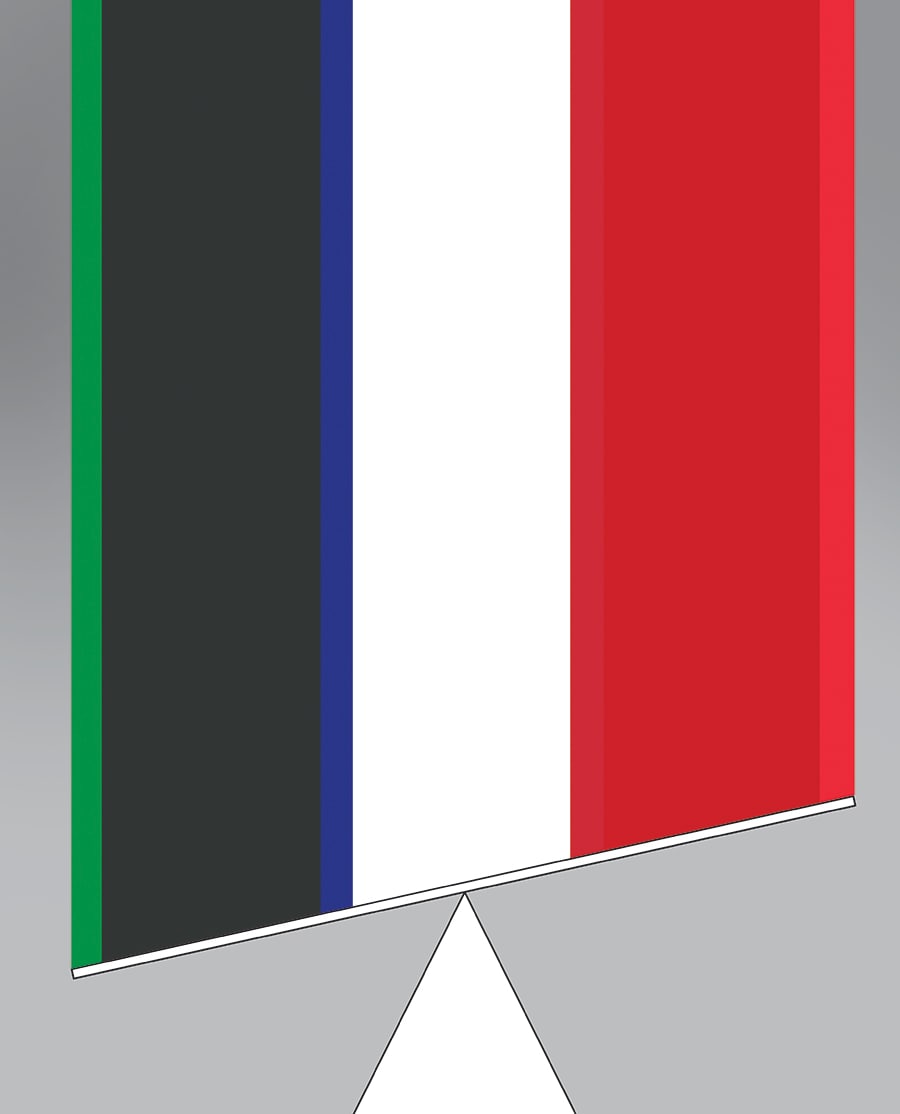

Obstacles to reforms in Italy and France threaten Europe and the world

The appetite for reforms is limited in both countries and they have relied on debt-funded public spending to maintain living standards

Italy and France found it difficult to implement reforms in the past and now face an increasingly difficult political environment. A combination of weak economic activity and low inflation is causing Italy’s debt to spiral upwards, despite austerity and a primary surplus of 2 percent of GDP. In France, on the other hand, there is no sign that the budget is likely to be in surplus in the near future.

The real problem here is the lack of competitiveness and underlying many of these problems is the single currency. Before the 2015 fall in the euro, after the European Central Bank introduced negative interest rates and quantitative easing, Italy and France were faced with a 15-25 percent overvalued currency, compounded by the high leverage to the exchange rate for export competitiveness. Italy has a gearing of over 60 percent to the exchange rate due to the nature of its exports, compared with around 40 percent for Germany.

Denied the option of devaluation, both countries have relied increasingly on debt-funded public spending to maintain economic activity and living standards.

In the absence of a favourable exchange rate, Italy and France face the difficult task of large internal cost reductions to regain competitiveness. Both nations have promoted structural reforms, to increase growth and competitiveness.

Former Italian Prime Minister Matteo Renzi belatedly introduced labour market reforms, including reduced employment security. But generous benefits were not eliminated, with entitlements and job protections increasing gradually with seniority. The change will affect only new workers and not public sector employees.

Political and constitutional reforms would increase the ability of future governments to act. But the rejection of constitutional changes in the December 2016 referendum in Italy—triggering the resignation of Renzi and ushering in a new period of political uncertainty—suggests that the appetite for reform is limited.

In France, the François Hollande government introduced cuts in employers’ payroll charges on low-paid workers and made modest reforms to pensions.

The reforms, while welcome, create a two-tier labour market. Established workers enjoy traditional employment benefits. New contract workers receive lower wages and have minimal job security, decreasing the effect on economic activity. It also creates an industrial sub-class of a new working poor with attendant social problems.

In both Italy and France, minimum wage levels, working hours, major entitlement programmes and reforms of the public sector remain largely taboo.

French liberalisation measures have been minor, focussed on extended retail trading hours, deregulation of intercity coach travel, procedural changes to labour tribunals to speed up proceedings and reduced protection for some professions.

Privatisations face opposition. Deregulation of controlled industries, from pharmaceuticals to podiatry and telecommunication to taxis, is resisted by incumbents. The required changes are well known. A 1959 report, commissioned by then French President Charles de Gaulle, recommended deregulation of many industries to remove obstacles to economic expansion, which have been ignored by subsequent governments.

Change is also slow. The Italian government took three months to legislate the new rules allowing employers to keep temporary workers for up to three years before putting them on permanent contracts. In the process, Renzi alienated trade unions and left-of-centre parties, including his own supporters.

In France, labour laws originally introduced by the 1936 Popular Front government of Léon Blum require consensus between employers, employees, unions and the government.

There is little appetite for confrontation on the scale of the UK miners’ strike of 1984-85. If the economy improves or deteriorates, reforms are frequently shelved as the time is not propitious.

Ordinary Italians are suspicious of deeply entrenched business oligarchies. Only around 30 percent of the French population believe in the superiority of the free market system.

Mistrust of market solutions is shared by major French political parties. Gaullist Prime Minister Édouard Balladur once defined civilisation as the struggle against the market. In his 2012 election campaign, French President Francois Hollande declared that his “main opponent is the world of finance”. He was recycling both President de Gaulle who stated that “my only enemy, and that of France, has never ceased to be money” and Socialist President Francois Mitterrand who denounced “the power of money”.

Discontent

A lack of appetite for political risk also impedes change. Italy’s legendary political dysfunction led dictator Benito Mussolini to state: “Governing the Italians is not impossible, it is merely useless.” Recent political events suggest that he may have been correct.

France’s political leadership believes that the economic and social model does not require radical change. Elected on a reform model, the government of Nicolas Sarkozy failed to implement changes as economic conditions deteriorated. The Hollande government has sent mixed messages. After initial backtracking on reforms, it shifted to policies favouring businesses, reminiscent of President Mitterrand’s 1983 change of strategy. But reforms are small. There is a lack of urgency. Both sides are wary of the electorate’s appetite for change. Gaullist Prime Minister Alain Juppé failed in his 1995 attempts to alter France’s welfare and pensions. Labour unrest forced a humiliating back down and led to an election defeat.

In both Italy and France, the priority is to defend the already-protected at the expense of the rising number of excluded. In Italy, 15 million people out of a population of 60 million now live in some form of deprivation, including over 8 million in a condition of serious economic hardship. In France, millions of long-term unemployed and young people, especially those without qualifications, face little prospects of employment.

These pressures manifest themselves in different ways. Politically, smaller parties like Italy’s Five Star Party and France’s National Front have gained at the expense of traditional holders of power. Parts of their agenda—anti-euro, anti-immigration—are now firmly on the political agenda. Social conflict is also evident. In Italy, anti-immigrant sentiments are rife. In France, discontent at discrimination and lack of prospects are radicalising the sizeable Muslim minority.

Borrowed Time

In 2015, in an interview on the Italian state TV network RAI, then Greek Finance Minister Yanis Varoufakis argued that the euro was fragile like a house of cards. It would collapse if Greece withdrew or was forced out on the single currency. He told his hosts: “Italy also risks bankruptcy.” His observation that Italy’s debt levels were unsustainable drew a response from Italian Economy Minister Pier Carlo Padoan, who tweeted that Varoufakis’s remarks were “out of place”. Italy’s debt was “solid and sustainable”.

The response was characteristic of Italian and French denial of the precariousness of their position. There is no acknowledgement of poor economic performance, high and rising debt levels, unacceptable fiscal outlook, and the need for far-reaching structural reforms. There is no willingness to address the problems of the euro and the incompatibility of the monetary union and a single currency with national fiscal management and sovereign independence among Eurozone members.

For the last 15-20 years, Italy and France have been promising reform and improvement. Unfortunately, time is now running out, with potentially disastrous consequences for the nations themselves as well as Europe and the world.

(This is the second in a two-part series)

Satyajit Das is a former banker. His latest book is Age of Stagnation. He is also the author of Traders, Guns and Money and Extreme Money.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)